- The Pulse Newsletter

- Posts

- Weak jobs data pushes BoC closer to action

Weak jobs data pushes BoC closer to action

EV Targets Pushed Back, Trump Jobs Miss, Wealthsimple Faces Breach Fallout

The Week in Review

Weekly Market Recap: U.S. and Canada

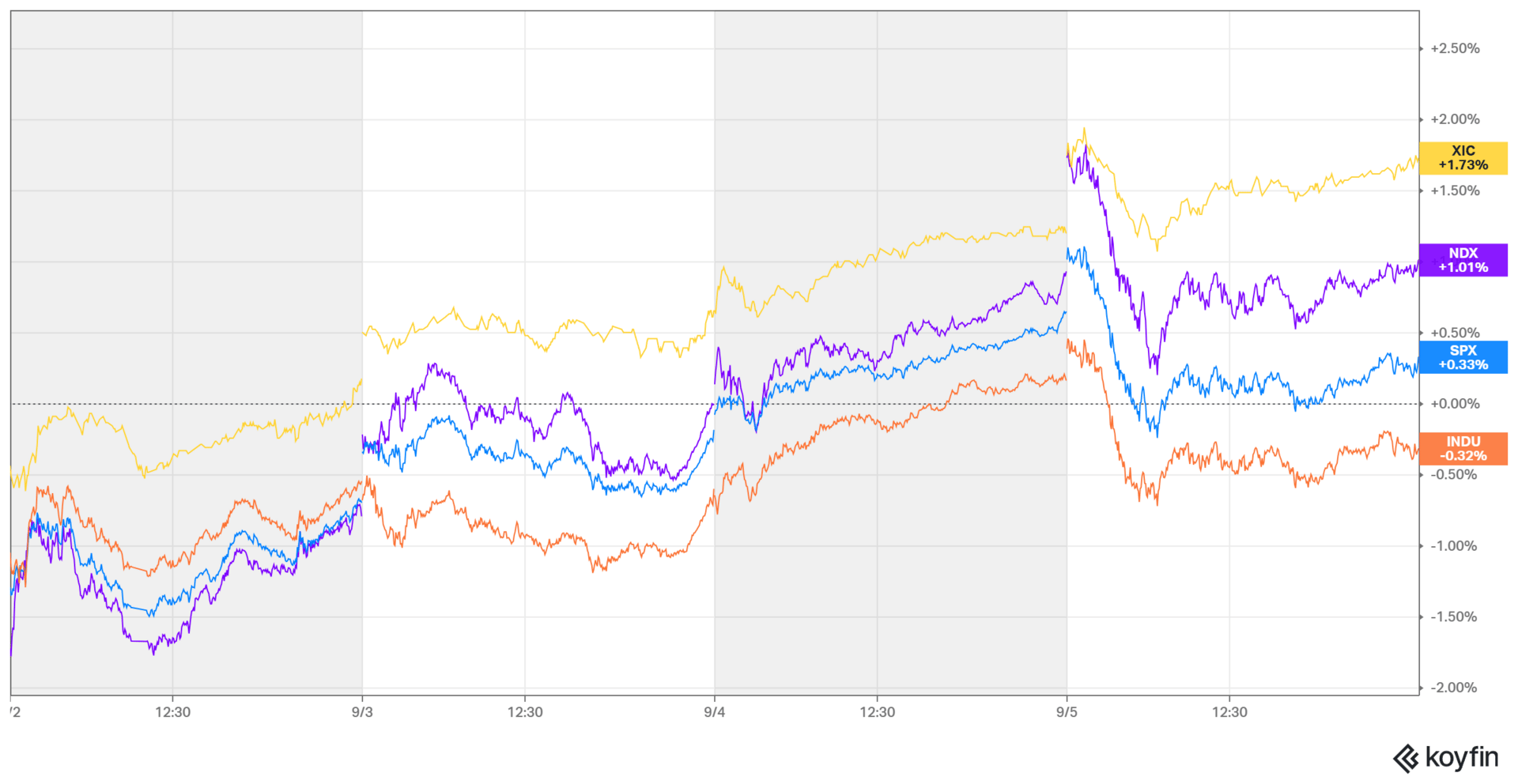

It was a shortened, four-day week in the markets with Labour Day closures, and investors looked a bit cautious. Momentum was a bit choppy midweek, and we saw a steep dip out of the gate Friday, then a steady rebound to end the week.

Looking at the numbers, the TSX led the pack, climbing +1.73%, while the Nasdaq 100 followed with a solid +1.01% gain. The S&P 500 eked out a modest +0.33% gain, but the Dow Jones lagged, slipping -0.32%.

Week ending September 5, 2025

Major Economic Stories

Recap of the Week

It’s that time again, when the most important jobs numbers are released. In summary, there wasn’t much good news coming out of either Canada or the U.S. I’ll cover it all off here.

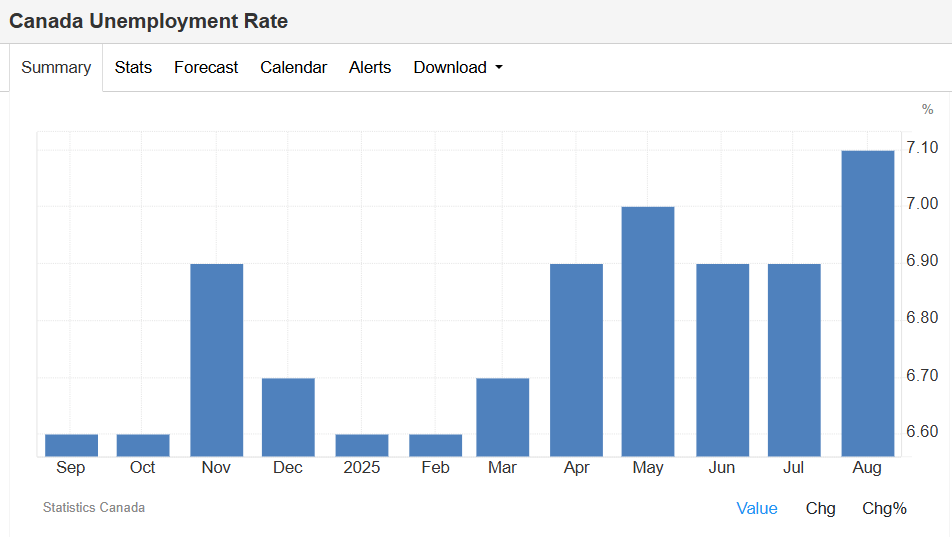

Canada Jobless Rate Hits 4-Year High

Canada’s unemployment rate climbed in August, a sign of a weakening labour market.

The rate rose to 7.1%, the highest since 2021, and job losses totaled 66,000, extending July’s decline in employment. Youth joblessness held steady at a troubling 14.5% level, while participation slipped slightly, again a sign of growing discouragement among job seekers. Overall, the labour backdrop continues to soften, aligning with the Bank of Canada’s recent warnings.

Weak job market raises pressure on Bank of Canada

Slower hiring could weigh on consumer spending

Tariffs add uncertainty to labour outlook

Rising unemployment risks further economic slowdown

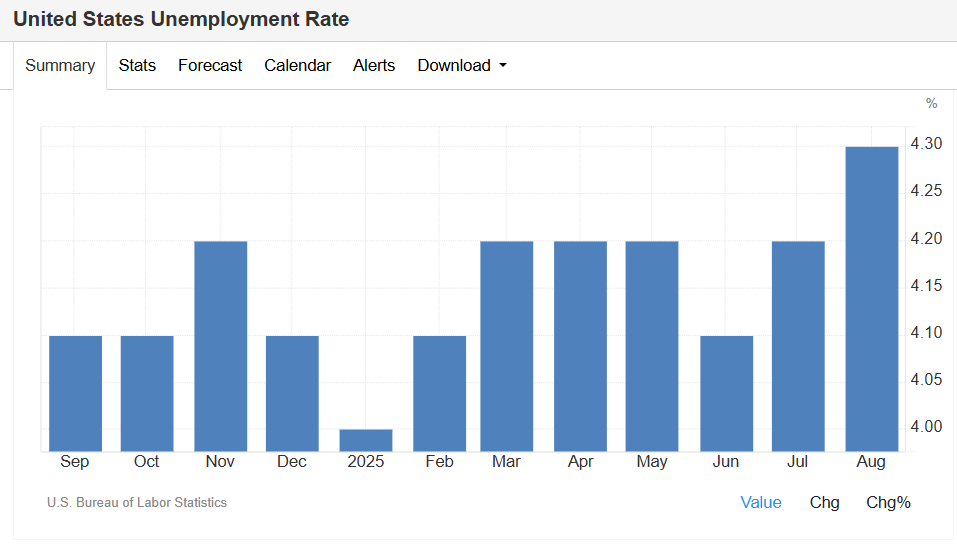

U.S. Unemployment Rises Again

The U.S. jobless rate edged higher in August, in line with expectations.

Unemployment rose to 4.3%, the highest since late 2021. The number of unemployed climbed by 148,000 to 7.38 million, but participation ticked up slightly, offering a partial offset. The broader U-6 unemployment measure also increased, reaching 8.1% as more discouraged and part-time workers were counted. Overall, the data reinforced a gradual cooling of the labour market.

Job market cooling could support Fed policy shifts

Rising unemployment may pressure consumer sentiment

Participation gains suggest workers returning to job hunt

Broader weakness points to slowing momentum in hiring

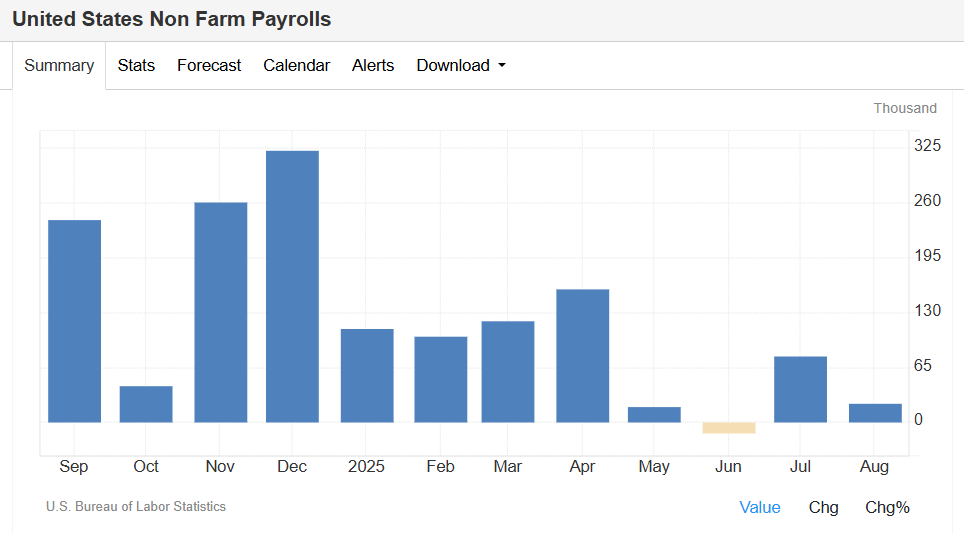

Payroll Growth Nearly Stalls in U.S.

August payrolls showed minimal hiring, confirming the trend of cooling labour demand.

Employers added just 22,000 jobs, far below forecasts and a steep drop from July. Health care and social assistance remained the strongest contributors, but job cuts hit government, energy, trade, and manufacturing. Revisions to June and July made the picture look even worse, leaving overall momentum fragile. All in, the data suggest that hiring is slowing at a faster pace than expected.

Weak hiring signals fragile labour momentum

Government spending cuts now visible in job numbers

Energy downturn weighing on employment outlook

Lower revisions reinforce softening trend

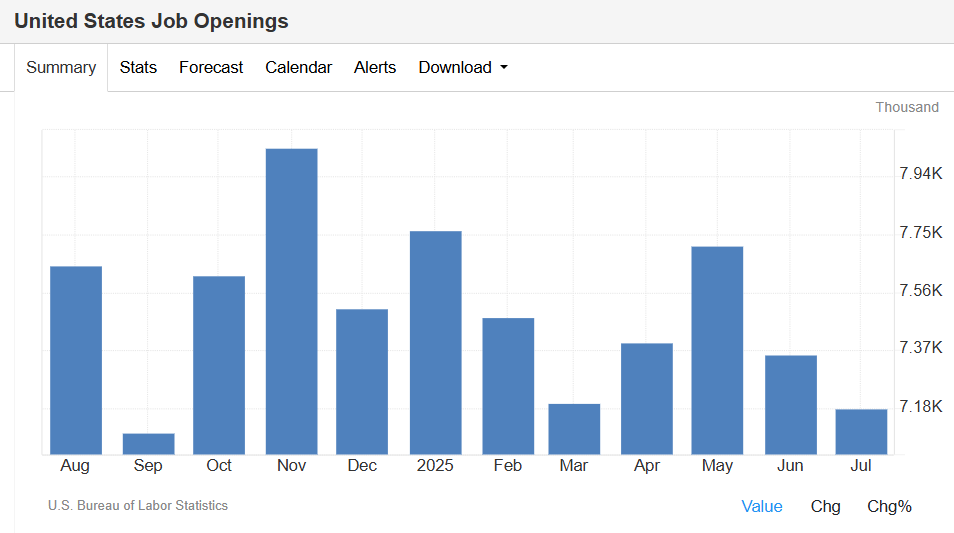

U.S. Job Openings Drop to 11-Month Low

The JOLTs report out Wednesday showed that openings fell sharply and that demand for workers is fading.

Vacancies dropped by 176,000 to 7.18 million in July, well below forecasts. Health care and recreation posted the largest declines, with mining also contributing to losses. Regionally, the South saw the sharpest pullback, while the West was the only bright spot. Overall, openings now sit at their lowest level since September 2024.

Hiring demand slowing across multiple industries

Regional job losses show uneven economic backdrop

Declining openings confirm cooling trend in labour market

Fewer vacancies may limit wage growth pressures

Key Takeaways

Canada’s Labour Market is Clearly Cracking

Let’s start right here at home. I think the rise in Canada’s unemployment rate to 7.1% is one of the clearest signs yet that the labour market is no longer resilient. For months, the Bank of Canada has been warning that high borrowing costs and trade tensions would filter through to employment, and now we’re seeing it happen. The combination of outright job losses and elevated youth unemployment paints a picture of weaker demand and fading confidence among employers.

This could mean the BoC faces even more pressure to cut rates soon, especially with consumer spending likely to soften as people tighten budgets. I’ll be watching closely how policymakers balance rate relief with inflation concerns, but it’s hard to see them ignoring the fastest deterioration in the labour market in years. If rate cuts come quicker, the loonie could weaken further, and that would boost exports but raise import costs for households.

U.S. Jobs Data Shows a Slow Grind Downward

The U.S. labour market hasn’t collapsed, but it’s clearly losing steam. A rise in unemployment to 4.3% might not sound alarming in and of itself, but when you pair that with payroll growth of just 22,000, I don’t see how we can ignore the signal that hiring demand is fading. Even worse, the revisions to previous months tell us the slowdown has been happening longer than initially thought.

So, as has long been the case now, this puts the Federal Reserve in a tricky spot. The slowdown supports the case for policy easing, but inflation risks haven’t disappeared, which makes timing delicate. I do fully expect a rate cut when the Fed next announces on Sep 17th, but I wonder whether it will lean more dovish in the coming months if unemployment keeps inching up? The markets may be underestimating how cautious the central bank will stay. For investors, volatility will remain elevated around every jobs release.

Job Openings Confirm Hiring Momentum Is Fading

Sticking with the labour theme, if there was any doubt about labour market cooling, the drop in U.S. job openings to the lowest level in nearly a year should clear it up. Employers are clearly pulling back on new postings, especially in industries like health care and recreation where demand had been strong. That tells me businesses aren’t just struggling to fill roles — they’re deliberately scaling back hiring plans.

This is important because job openings are often seen as a forward-looking indicator. Fewer postings now mean slower payroll growth later, and that fits with the broader slowdown we’re already seeing. I think this could eventually relieve wage pressure, which in turn helps inflation, but the trade-off is weaker consumer spending power.

A North American Labour Market Turning Point

I’ll try to sum up my thoughts on the overall jobs picture. When we take everything I’ve written about so far this week in total, the Canadian and U.S. jobs reports send a clear warning: North America’s labour market is no longer the economic engine it was. Canada’s unemployment rate is at a four-year high, U.S. payroll growth is barely positive, and job openings are sliding to multi-month lows. And, these aren’t isolated signals, but actually they’re pieces of a broader picture of cooling demand, cautious employers, and households are about to feel the squeeze.

From an economic perspective, this convergence is worrying because it threatens both growth and confidence at the same time. In Canada, the danger is compounded by trade tensions and domestic weakness, which will up the pressure on the Bank of Canada to act. In the U.S., the Federal Reserve may have slightly more breathing room, but it faces the same challenge: how to balance rate cuts with lingering inflation risks. I think what we’re seeing is the early stage of a shift where the “strong labour market” narrative can no longer hold up, and that means policymakers, investors, and consumers all have to adjust the expectations. I’m not wanting to be overly pessimistic here, but that’s a true, from-the-heart look at what I’m seeing.

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

The Bank of Canada is backed into a corner. Rising unemployment argues for relief, but inflation hasn’t fully cooled. Markets are betting heavily on a cut this month, but the bigger question is, should they?

Please weigh in on this week’s question:

Odds are 90% the Bank of Canada cuts rates this month. But with inflation still sticky, the question isn’t if they WILL, it’s whether they SHOULD. What do you think?" |

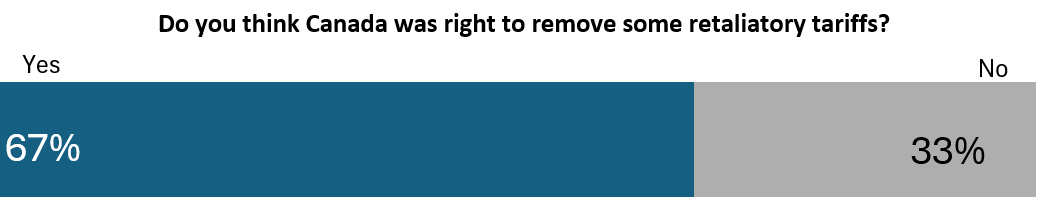

LAST WEEK’S POLL RESULTS

Last week we asked whether Canada was right to lift some of its retaliatory tariffs. The results were clear: 67% of you said yes, supporting the move, with about a third feeling it wasn’t the right step. A solid majority in favour of PM Carney’s decision.

Reader Comments

Yes, It Helps

"Although most of us are avoiding purchasing US made stuff, sometimes it can’t be avoided. Tariffs are taxes, and Canadians suffer if they have to buy US made and pay those tariffs. So I can see why Carney took them down. For one it will restart talks and Two to reduce the taxes on Canadians as we have enough taxes." — monicaambs18

"As much as I'd like to be difficult with the Trump administration (Elbows Up), the tariffs only hurt Canadians because we would pay the tax. I think it's a good concession, making Trump feel like he won, and meanwhile we are just abiding by CUSMA which we should be doing legally anyhow. I agree with keeping tariffs on aluminum, steel, etc so we match the US. What I hope is that Canadians pay attention and try to buy Canadian and non-American as much as possible in the meantime. We don't need government rules to get us to do this!" — syoungconsultinginc

"Its a very reasonable response when dealing with a leader and government as disjointed as the US. Canada has taken control of the direction of the conversation and made it their own and can now point the direction. The US leader is now making nice with Canada & sending out all sorts of friendly statements while we are in Europe negotiating trade, security, & closer ties without the US. The Canadian position is much stronger now than if we had followed the Conservative dance card. The cuts have come on goods covered by the new US, CANADA, MEXICO free trade no real pain for us. Thumbs up to Mr Carney." — entender1012

"The tariffs removed were for goods and services covered under CUSMA, and is similar to the US. It will also benefit Canadian consumers, who admittedly were not being crippled by the tariffs, still a benefit. It is a show of good faith, and not a capitulation on Canada’s part." — rcbent

"These two persons are business persons, not politicians. They are negotiating. Saying very little about their hidden agenda. Everything they say or do or signal are all intended to influence the other and ultimately get them their goal. Both are experienced, I do not think anyone knows what is going on in their heads. The things we see and hear are strategic to the negotiations and must be taken with many grains of salt. As we know, the end result could be some big surprise, not yet thought of by the mud slingers or general population." — bill.geneau

"Ultimately, tariffs or no tariffs, Canadians will still boycott American goods. As far as the Canadian consumer goes, removing some tariffs mean nothing. If it helps with negotiation, then great." — philip.swan

No, It Weakens Our Position

"We have nothing that Trump needs to negotiate with, Carney was elected on promises he cannot deliver, and promises he doesn’t respect like stop sending money to Ucraina, which he continue contrary to what people want." — maddiett305

"I believe we should approach this move with a long-term perspective, viewing it as a strategy to buy time and gain ground while securing new agreements with other nations. Our economy remains closely tied to the U.S., and restructuring supply chains will inevitably take time. The retaliatory tariffs Canada is lifting are those that remain compliant with CUSMA. This is a chess game—every move matters, and when played behind the scenes, the outcomes are often far more effective," — luismo

"I don't think it will help anything because at the end of the day Trump is only going to do what is best for him and not for the United States. It may alleviate the pressure a little bit on the Republican states because they are the ones who are really feeling the pressure. I can agree Canadian manufacturing was feeling the pinch too but by reducing our tariffs without them doing so first is definitely a weak move and goes to show we need them more then they need us even though in some cases it is the opposite. Which gives Trump more leeway to increase tariffs whenever he feels like it. " — edwardmawusi

INTEREST RATE DECISION

BoC Rate Cut Odds Surge to 90%

Traders see a BoC rate cut as almost guaranteed

Weak jobs numbers are forcing the bank’s hand

Markets now expect deeper cuts by year-end

The loonie slid as rate bets picked up

The Bank of Canada looks pretty much locked into cutting rates this month, at least if markets are right. After that ugly jobs report showing rising unemployment and big net job losses, traders quickly pushed the odds of a September cut to around 90%. The loonie slipped and bond yields dropped as investors bet that easier money is coming fast.

Weak Jobs, Stronger Case for Easing

With unemployment hitting a four-year high, it feels like the central bank doesn’t have much wiggle room left. Economists are saying the data basically made the decision for them — and at this point, it’s about damage control more than anything. The BoC had been cautious over the summer, but that stance is starting to look out of step with reality.

Looking Ahead: Risks and Reactions

Of course, cutting rates comes with its own headaches. A weaker dollar could make imports pricier and feed back into inflation, which the bank still has to worry about. Plus, Canada’s not operating in a vacuum, and U.S. trade moves and global uncertainty will shape how far and fast the BoC can really go. But for now, markets are betting on a clear pivot toward looser policy.

Read More Here

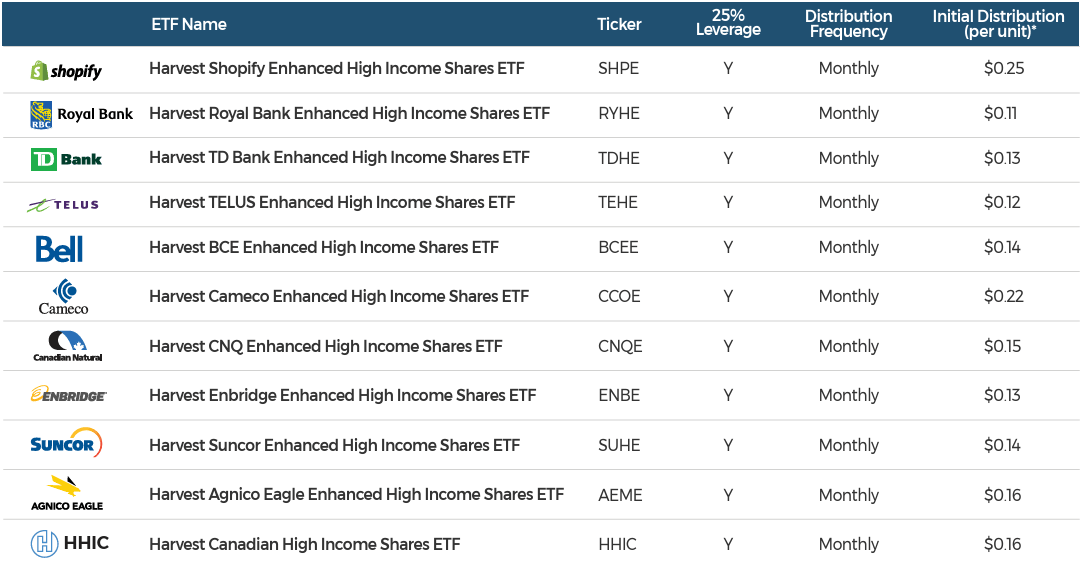

IN PARTNERSHIP WITH HARVEST ETFS

Invest in Canada’s Best | Built for High Yield, Every Month

Harvest High Income Shares™ just celebrated their one-year anniversary. Over 12 months, High Income Shares™, including the Harvest Diversified High Income Shares ETF (TSX:HHIS) and the Harvest MicroStrategy Enhanced High Income Shares ETF (MSTE:TSX), have made waves among investors with a compelling combination of growth access and high monthly income.

This week, we have introduced the next line in this innovative suite: Harvest Canadian High Income Shares!

10 of Canada’s best companies in single stock ETFs, overlayed with covered calls and modest leverage at approximately 25%.

A one ticket solution – the Harvest Canadian High Income Shares ETF (TSX:HHIC) – a portfolio of TSX-listed equities reflecting Canadian High Income Shares. Designed to generate high monthly income from covered calls and modest leverage.

Learn more about the Harvest High Income Shares here.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A units of the Fund. If a Fund earns less than the amounts distributed, the difference is a return of capital.

ELECTRONIC VEHICLES

Ottawa Delays EV Mandate

Canada pushes back EV sales targets by two years

Move meant to support automakers hit by tariffs

Carney signals flexibility to balance climate goals and industry needs

Policy shift could complicate Canada’s climate credibility abroad

Ottawa is giving automakers a bit of extra breathing room by delaying its electric vehicle mandate, in light of tariff pressures and slowing demand. The plan had originally required EVs to hit certain sales targets by mid-decade, but that timeline has now been pushed back. Finance Minister Mark Carney framed it as a “practical adjustment” to keep the industry competitive while trade tensions with the U.S. continue to weigh on margins.

Tariffs Bite, Policy Shifts

This move shows just how much tariffs are starting to reshape Canada’s economic playbook. Automakers already face higher costs on imports and uncertainty around supply chains, so forcing a rapid EV rollout was becoming unrealistic. By easing up, Ottawa is hoping to keep production stable and jobs intact. It’s also a signal that economic resilience is taking priority over hitting every climate milestone on time.

The Road Ahead for EVs

This delay doesn’t mean the EV push is dead, just slower. The government still says it’s committed to electrification, but the timeline may get fuzzier if trade issues drag on. For now, the auto sector gets a bit of a reprieve.

Read More Here

BLOSSOM SOCIAL

2025 BLOSSOM INVESTOR TOUR

Calgary and Vancouver SOLD OUT. There are a few tickets still left for Toronto, Montreal and the U.S. Tour Stops.

Don’t miss out!

🎟️ Tickets are limited, and last year’s events sold out FAST…

👀Don’t miss your chance to be part of Blossom’s biggest in-person tour yet.

More Information Here

THE LABOUR MARKET

Trump’s Jobs Promises Face Harsh Reality

Trump promised big job gains, but data shows slowdown

Payrolls missed forecasts badly in August

Cuts in government and manufacturing show economic headwinds

Confidence gap grows between campaign messaging and labour market data

President Trump has been, in his usual boisterous way, bragging about his record on jobs, but the latest numbers don’t match his optimism. As I noted above, payroll growth nearly stalled in August, rising just 22,000, far below expectations. Job losses in government and manufacturing added to the drag, while only healthcare and social assistance showed meaningful strength. It’s becoming harder for Trump to square his promises with the data, not that it really matters.

Promises vs. Performance

Trump has argued that his economic policies are reviving hiring, but cuts tied to White House spending decisions are actually now showing up in the employment numbers. Manufacturing weakness is another political liability, especially in swing states. He may be talking a big talk, but the numbers say that the labour market is struggling.

Mid-Terms and Market Watch

Heading into the next election cycle, this disconnect could matter. At crunch time, markets tend to care more about the Fed than political rhetoric, and consumer sentiment can swing quickly if confidence erodes. If job growth keeps disappointing, both households and investors may grow skeptical of Trump’s economic message, and that will surely shape both political momentum and policy debates in the months ahead.

Read the full story here.

CYBER SECURITY

Wealthsimple Hit by Data Breach

Wealthsimple reports security breach impacting customer data

Company says funds remain safe, but trust shaken

Regulators expected to probe incident closely

Raises questions about fintech security standards

Wealthsimple confirmed a data breach this week, and the concern is that the breach may rattle the confidence among its users. The company says no client funds were stolen but does acknowledge sensitive information was accessed. Millions of Canadians rely on Wealthsimple for investing and banking, and the breach is a big reputational hit in a sector where trust is so important.

What Happened and Why It Matters

Details are still thin at the time of this writing, but early reports suggest hackers exploited a third-party vendor vulnerability. Wealthsimple moved quickly to contain the breach, but regulators are already focussing in on the event, and the incident will likely raise the bar for security protocols across the industry.

Looking Forward: Trust and Oversight

Wealthsimple now has two big challenges: reassuring its customers and keeping regulators satisfied. The company is promising stronger protections, but once trust is shaken, it’s hard to win back. For now, Wealthsimple is in damage-control mode.

Read the full Story Here

OTHER NEWS FROM THE PAST WEEK

Tech Megacaps Now Worth $15 Trillion

Big Tech is now worth a mind-blowing $15 trillion combined. It’s a huge milestone, but it also raises the question: are these stocks unstoppable, or is the concentration getting risky?

Former Fed Governor’s Mysterious Resignation

A former Fed Governor just quit suddenly, and nobody’s sure why. With zero details given, Wall Street is buzzing with theories, from quiet disagreements to possible bigger tensions inside the Fed.

Investors Pile Into Gold at Record Highs

Gold is on a tear, hitting record highs as investors rush in. Some call it a safe-haven trade, others say it’s starting to look like a bubble. Take your pick.

Nestlé CEO Scandal Erupts Over Affair

Nestlé just ousted its CEO after revelations of a messy workplace affair. Beyond the drama, it’s a big reminder that corporate culture and executive behavior can quickly turn into business risks.

EU Fines Google in Antitrust Case

Google’s been slapped with another hefty fine in Europe over antitrust violations. Regulators are making it clear they’re not letting Big Tech run the table without checks, especially in the EU.

Anthropic Reaches AI Copyright Settlement

Anthropic has cut a deal to settle an AI copyright dispute. It’s a big signal for the whole industry: lawsuits are coming, and how companies handle them could shape the rules.

CIBC Says Immigration Boosting Canada’s Economy

CIBC says newcomers are giving Canada’s economy more bang for the buck than expected. They’re not just filling job gaps, but also lifting productivity and helping with long-term growth. Pretty bullish take.

World’s Oldest Drive-In Sold After Romantic Road Trip

A couple went on a road trip and somehow ended up buying the world’s oldest drive-in theater. It’s a quirky, nostalgic story, and proof love can lead to unusual investments.

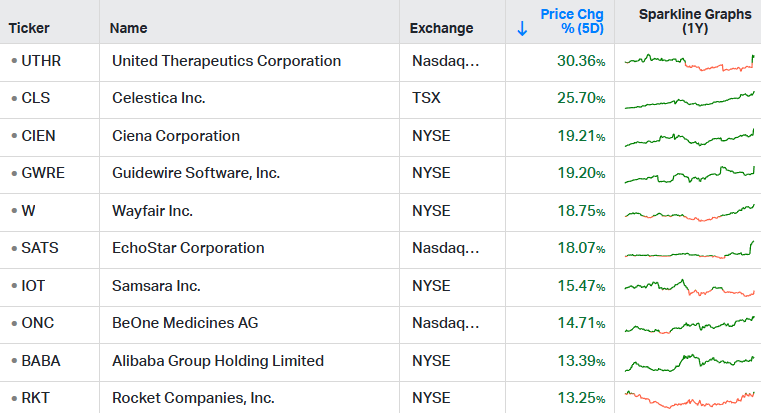

Market Movers

Top 10 Weekly Gainers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending September 5, 2025

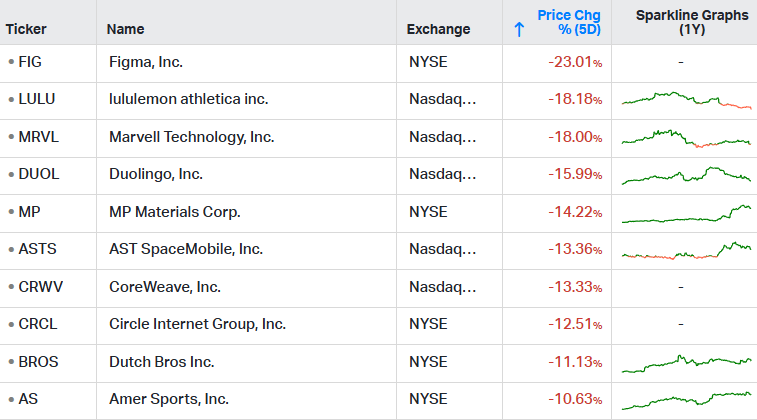

Top 10 Weekly Losers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending September 5, 2025

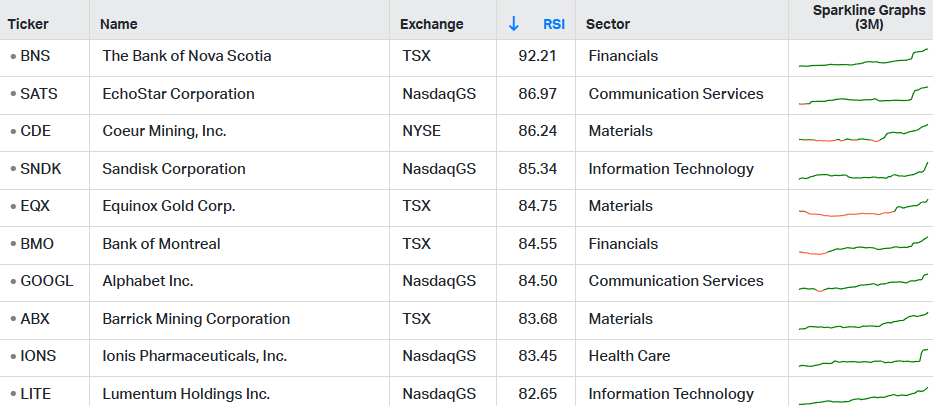

10 Most Overbought Stocks

Week ending September 5, 2025 | Most Overbought Stocks, based on 14-Day RSI

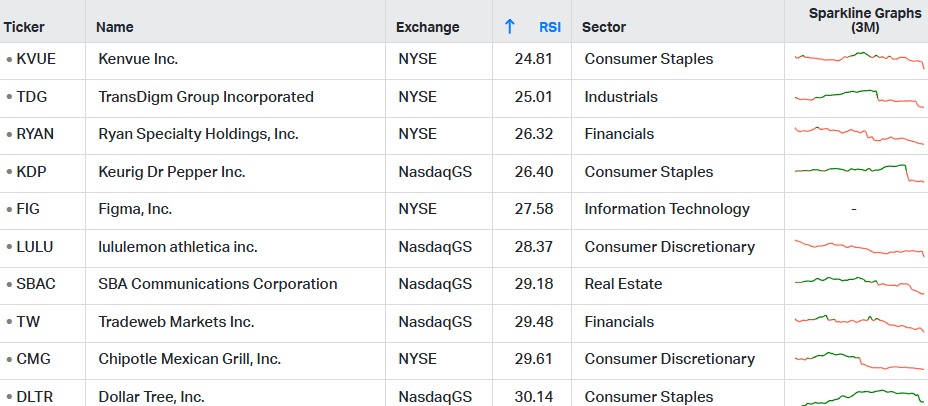

10 Most Oversold Stocks

Week ending September 5, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply