- The Pulse Newsletter

- Posts

- TSX Crushed Housing: Here's the Math

TSX Crushed Housing: Here's the Math

Stocks beat real estate, dividends bounce back, ETF portfolios examined

The Week in Review

Weekly Market Recap: U.S. and Canada

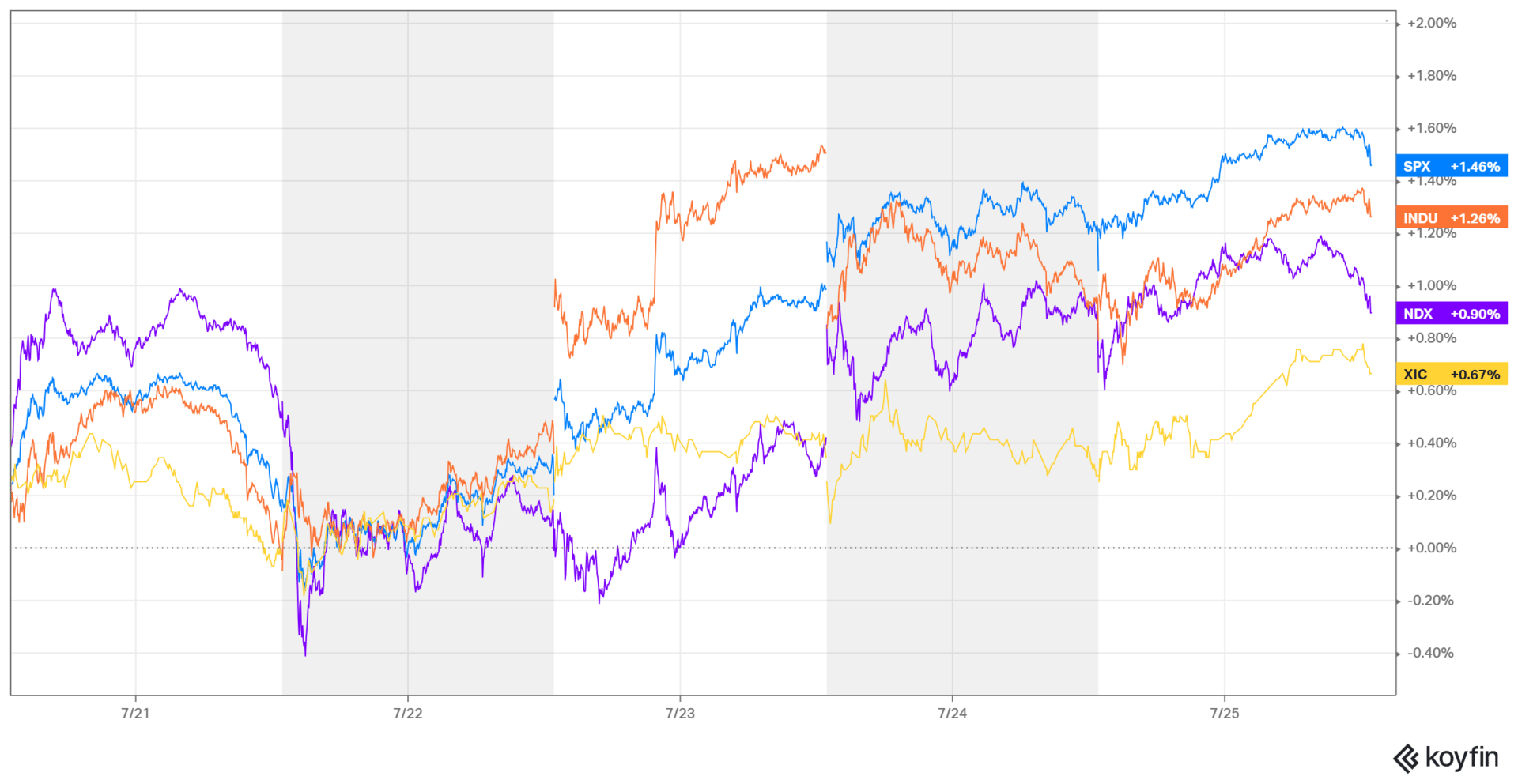

I’m not sure I’d go so far as to call it steady, but the markets did post gains across the board this week, with the broader U.S. indices showing particularly strong performance. The Dow Jones and S&P 500 moved up on positive corporate earnings and durable goods strength, and it was nice to see the Nasdaq 100 recover following the tech-led dip early in the week. The TSX also ended in the green, but trailed its U.S. peers.

In terms of performance, the S&P 500 led the way with a 1.46% gain, followed closely by the Dow Jones, which climbed 1.26%. The Nasdaq 100 added 0.90%, while the TSX lagged but still rose 0.67% for the week.

Week ending July 25, 2025

Major Economic Stories

Recap of the Week

We heard from both the Bank of Canada and the Fed this week, and the economic narrative centered on uncertainty, both in monetary policy direction and the broader trade landscape. Conflicting signals are still hanging around, but markets held steady and business sentiment showed cautious signs of recovery.

Here’s what you need to know.

Fed Signals Possible Rate Cut This Year

Fed minutes reveal officials are leaning toward a cut later in 2025.

The Fed kept rates steady for a fourth straight meeting, but the tone in June’s FOMC minutes shifted subtly. Policymakers pointed to easing inflationary pressures and anchored expectations as rationale for a potential rate cut. That said, opinions varied, with some advocating for no change this year due to geopolitical and trade-related uncertainty.

Fed funds rate held at 4.25%–4.50% in June

Some officials see weakening labor and economic activity

Trade and tariff risks remain elevated but improving

Inflation expectations still viewed as well anchored

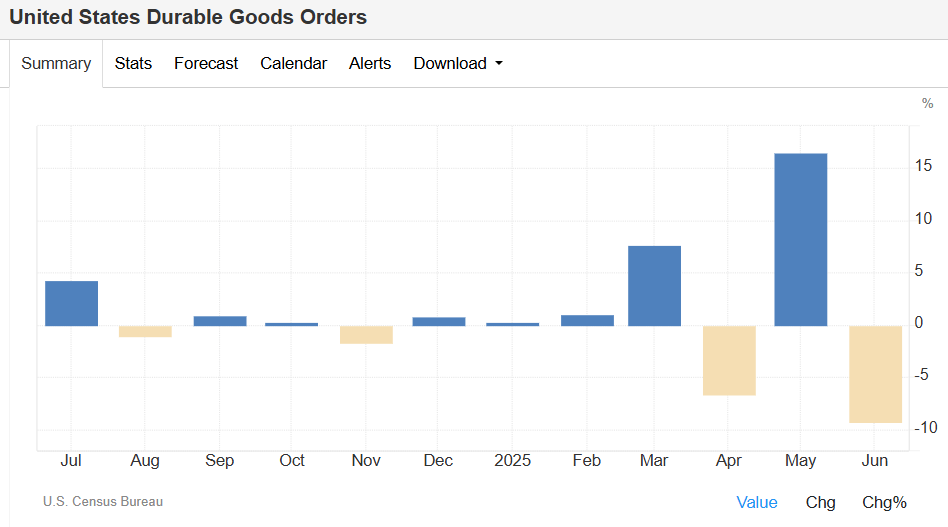

U.S. Durable Goods Orders Slide 9.3%

Transportation dragged down the headline number; core data steadier.

Durable goods orders fell 9.3% in June, a complete reversal of last month’s impressive gain. The headline drop came largely from nondefense aircraft orders, which fell over 50%. Core orders excluding defense and aircraft slipped 0.7%, another sign that business investment remains cautious.

Orders fell to $311.84 billion in June

Transport equipment orders dropped 22.4%

Core capital goods down 0.7% vs. 0.2% gain expected

Machinery and metals posted modest monthly increases

Business Sentiment Improves, But Uncertainty Lingers

Canadian firms see less risk of a worst-case trade outcome.

The Bank of Canada’s Business Outlook Survey showed improving sentiment after a gloomy Q1, although overall, firms remain cautious. We’re starting to see tariff-related cost pressures materialize, but the expected future impacts have eased. Hiring and investment remain quiet with soft demand and unpredictable policy shifts.

Share of firms expecting recession dropped from 32% to 28%

Labour shortages and capacity constraints have eased

Investment focused mostly on maintenance, not expansion

Wage and input cost expectations are moderating

Key Takeaways From this Week’s Economic News

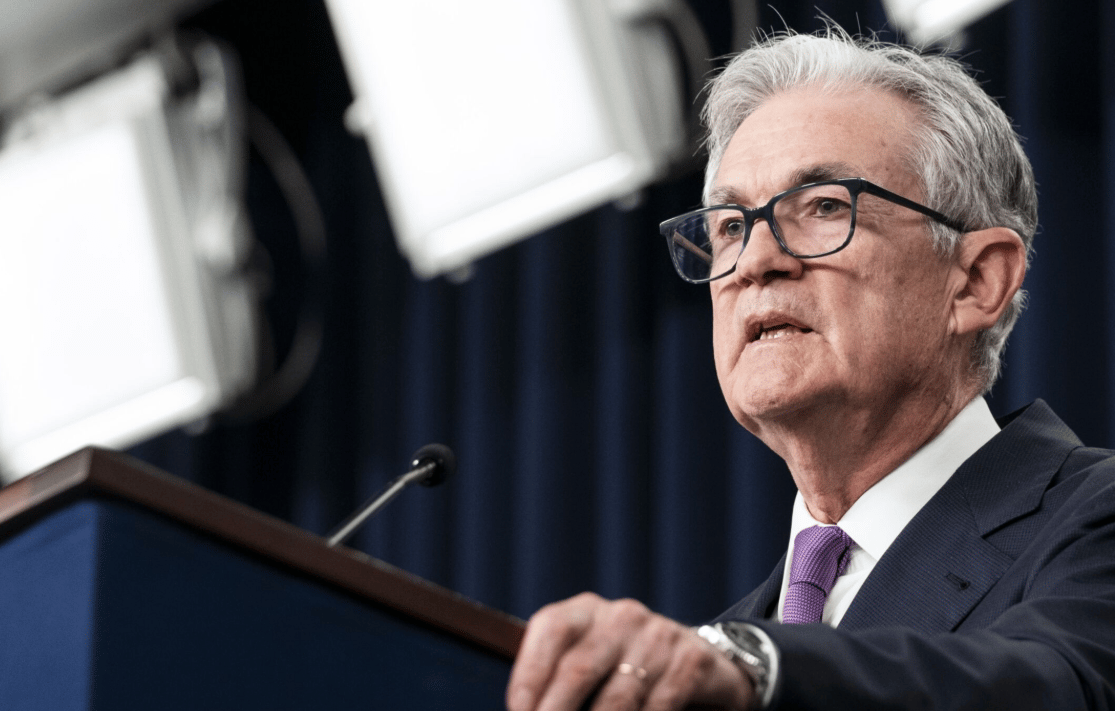

The Fed’s Mixed Messaging on Rate Cuts

Fed Chair Powell’s speech this week left little doubt that the committee is very much still in search of consensus. Most members are leaning toward a rate cut sometime this year, but there’s clearly no urgency. Some policymakers are still focused on lingering inflation risks, especially from tariffs and geopolitical disruptions, while at the same time others are becoming more concerned about economic softening and weakening labor conditions.

What stands out to me is the Fed’s acknowledgment that upward pressure on inflation from tariffs may be “temporary or modest.” That is a shift in tone from previous meetings where inflation was public enemy number one. But the divide among policymakers makes it hard to know if we’ll get a cut in September or be stuck in limbo until year-end. Either way, markets are clearly hoping for a dovish pivot soon. As I’ve said so often over the past few months, uncertainty is still the key.

Canada’s Business Outlook: Better, But Still Wary

Here in Canada, you’d be hard pressed to call the Bank of Canada’s latest Business Outlook Survey “optimistic,” but there are clear signs of improvement. The worst-case scenarios around trade tensions have faded somewhat, and some exporters are actually regaining confidence. But still, what we’re seeing is a business environment where firms are cautious, defensive, and reluctant to commit, especially when it comes to hiring or expanding.

This kind of sentiment speaks volumes about the broader state of the Canadian economy. Even though labor shortages have eased and tariff costs are less severe than originally feared, weak demand and elevated uncertainty are keeping firms on their heels. It’s not panic mode, but it’s not growth mode either. The recovery in sentiment is welcome, but it’s certainly fragile.

Durable Goods Reveal a Split Economy

The sharp drop in U.S. durable goods orders, down 9.3% in June, is a bit jarring at first glance, but as is usually the case, the story beneath the surface is more nuanced. Transportation orders, especially aircraft, were the major drag, while core orders excluding defense and aircraft were only slightly negative. That says that business investment is pausing, but not collapsing.

The key takeaway for me is the reminder that big-ticket sectors like aviation can swing the data, but the real economy may be on steadier footing than the headline implies. That said, a 0.7% decline in core capital goods isn’t a nothing burger (can I still use that term? It was the first thing that came to mind so I went with it 😊), and it points to hesitation among firms that may be waiting for more clarity on rates and demand before making commitments. No different that what we’re seeing here in Canada. I think we’re going to need to see a turnaround in these indicators before confidence fully returns to the corporate sector.

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

I’m keeping it sweet and simple this week. After you’ve read the first story below, and the report in the link, if you had to choose only one investment for the next two decades would go pick real estate or stocks? This should be a good one.

If you had to lock in for 20 years, which would you choose? |

LAST WEEK’S POLL RESULTS

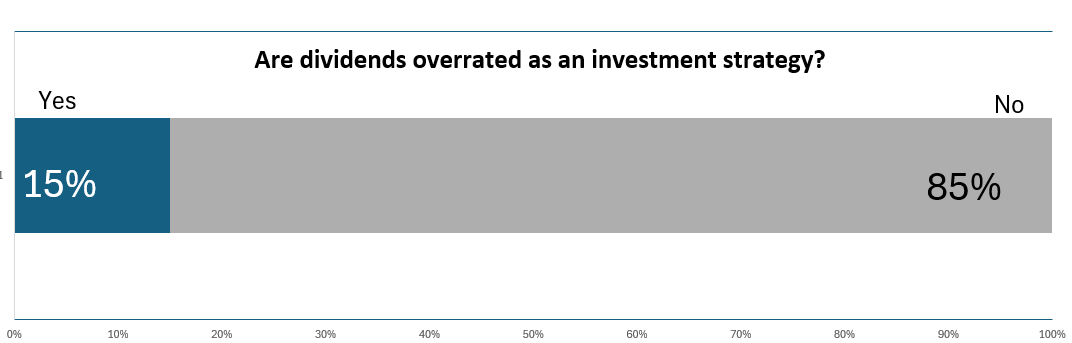

I figured the No’s would win this one, but I had no idea the results would be so overwhelming. If you’re among the 85% who said dividends are not overrated, you’ll probably enjoy this week’s story, showing a counterpoint to last week’s report questioning dividend investing.

Reader Comments

They Provide Essential Stability

“I've made over $800 in 6 months in dividends. Big part of my investment strategy!!!” — michelle

“Dividend Investing To Be or Not To Be! I do not invest in individual stocks anymore, but invest in ETF's with good dividend yield. Our portfolio of Dividend Yield ETF's have supported myself & my wife for many years. These ETF's holding a basket of stocks have returned 40% on our portfolio investment and a monthly income of dividends to support our travels and our day to day living expenses. Our dividends have given us a great deal of freedom in our 15 years of retirement. It helps residing in a country that costs one third of the costs in Canada, so our monthly income goes even further.“ — entender1012

“Dividends are found alongside steady stable performers. That's what you need in this volatile environment” — karen.egan.2013

“For me they help promote the emotional stability that aids with investing. I usually reinvest dividends on whatever stocks are the best value in my portfolio at the time they are paid. It feels good to have my investments paying more into my portfolio than I can. Yield on cost also helps me not to sell out of good performers. I imagine everything will balance out in the end. “ — mjwebstuff

“I am not fully invested in dividend paying stocks, but they serve a purpose in my portfolio. The dividends that pay out provide cash flow in retirement prior to collecting OAS/CPP. Although not guaranteed, solid Canadian dividend payers are pretty reliable. It means I don't have to sell shares during a downturn and have enough to ride out the market until it rebounds. Better than selling stocks at a serious low. I know it's possible to generate my own dividends by selling shares of any stock or ETF, but it's psychological to avoid selling at a loss and just spending the dividends. This way I can keep a smaller proportion of my portfolio in income (GICs, money market etc) generating a higher return overall and I stay invested without panicking.” — syoungconsultinginc

“Income investment is key for wealth and stable, as long as we have the correct security in our portfolio, and have the right knowledge to rebalance our portfolio. We can follow good YouTube Chanels with good information for reference, but the most we learn the most we gain!! “ — luismo

“Pick a stock with a solid dividend record , set up a DRIP and check back 3-4 times a year. Yes, it's that simple. “ — alcook481

“While I never buy a stock simply because it distributes dividends, I'm always happy to own those stocks assuming the dividends are well covered by cash flow and R&D isn't being crimped.

As for being overrated? I think a big part of some saying they're “overrated” is due to the high (if not irrational) sentiment around high growth (i.e. AI, etc) and speculative stuff (i.e. crypto, quantum computing, etc.) at the moment. It's hard to like 2-5% dividend yields when some stocks and virtual coins are doubling within weeks.

With that said, dividend stocks will have their moment again at some point. The majority of dividend names will likely outperform the currently high flying names once things cool off and especially when we enter another bear market, which we will. I even expect the 'better' ones will get re-rated and trade at higher multiples again. The old 'revert to median' scenario playing out yet again. When? No idea! In the meantime, I'll continue buying the dividend names I feel are overvalued and happily wait until their time comes... Cheers Marc!“ — callawayguy"

INVESTING STRATEGIES, Pt. 1

Real Estate vs. Stocks; Not What You Might Think

Housing underperforms TSX index over long-term horizons

Average home prices are down 15% from peak levels

Condo sales slump in key markets like Toronto and Vancouver

Real estate carries emotional benefits, but shaky investment math

The Canadian housing market isn’t in crisis, but it’s definitely lost some of its shine recently. Prices are slipping in major markets, especially for condos, and the assumption that real estate is a no-brainer investment is being tested. For decades, people treated their homes like guaranteed retirement plans. But now, that mindset feels more and more fragile.

The Risk Canadians Forgot

For a lot of current homeowners, this is the first real “housing wake-up call.” We’ve had nearly two decades of near-constant price gains, and a whole generation believed real estate only moves one way; up. But like economist Mike Moffatt said, “every generation has to put their hand on the stove.” The speculative mentality is now colliding with real-world market pressures.

Reality Check: Stocks Win the Long Game

Here’s a stat worth contemplating: since 1980, Canadian home prices have returned 5.5% annually. The TSX? 8.9%, including dividends. That’s a material gap, especially when you factor in real estate transaction costs and lack of liquidity. Don’t get me wrong, owning a home still makes sense for a lot of reasons, but if your reason is because you’re counting on it outperforming the market, you may want to reconsider.

Emotions vs. Returns

Of course people don’t just buy homes for money; they buy for stability, security, and for some, even a sense of price. And those are valid. But the danger is when those emotions cloud investment decisions. If expectations don’t adjust, a lot of Canadians could find themselves short on retirement capital. It’s not about turning their backs on real estate, it’s about not overcommitting to a story that seems to be evolving.

Read More Here

IN PARTNERSHIP WITH HARVEST ETFS

Harvest Global Utilities ETFs | Income, Stability, and Growth Potential

Markets have rebounded in the summer season after the bout of volatility in the spring, but uncertainties remain. Harvest global utilities ETFs – HUTL & HUTE – provide a mix of stability, monthly income, and growth opportunities through exposure to a diversified portfolio overlayed with an active covered call strategy.

Why Utilities?

Utilities produce and deliver basic essential services that we take for granted everyday:

Water

Natural Gas

Electricity

Pipelines

Etc.

Global Utilities Advantage | Stability from Diversification

HUTL & HUTE’s global utilities portfolio provides added benefits:

Reduces geographic risk

Lower regulatory risk

Diversified exposure

AI Power Demand | Growth Potential for Utilities

ChatGPT and AI-powered searches consume many times more energy than a traditional google search. Utilities must work to meet the demand of rising generative AI usage. MIT estimates that data centers could account for 21% of global energy demand by 2030.

Large-cap global utility stocks with long-term sustainable cash flows

Defensive position with monthly income

Covered calls generate cashflow and lower volatility

Access to global utilities portfolio

Employs modest leverage to HUTL to enhance cashflow and growth potential

Learn more about HUTL and HUTE here.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A units of the Fund. If a Fund earns less than the amounts distributed, the difference is a return of capital.

INVESTING STRATEGIES Pt. 2

Counterpoint: Why Dividend Investing Still Works

Dividend ETFs outperformed broader TSX index over the past year

Critics say dividends don’t generate real wealth or cause tax drag

Psychological benefits of regular income help investors stay invested

Dividends historically offer lower volatility and inflation protection

As I noted in last week’s Pulse, dividend investing has been catching some heat lately, and a lot of investors are souring on dividend investing. (The poll results from our readers, however, clearly disagree.) Some say it’s outdated, overly conservative, or inefficient from a tax perspective. But dividends do still work, especially for investors looking for stability and income. In years where rates stop rising and markets start to wobble, dividend-focused strategies often quietly outperform.

It’s Not a Cult, It’s a Discipline

It’s true that people poke fun at dividend investors, calling them stuck in the past and out of touch with modern trends. But the reality is that most of us aren’t all-in on one strategy. We hold ETFs, growth stocks, even cash when it makes sense. (As I mentioned last week, if you do want to see what I’m currently holding in my portfolio, be sure to download the blossom social app and look up my user profile “MarcB”.) The point is, dividends aren’t about hype. They’re about cash flow, discipline, and staying invested through the chaos. I’ve personally held a number of dividend stocks for decades and when I assess my progress, I have no regrets.

Performance Tells a Different Story

If we look back over the past three years, dividend ETFs like XDV trailed broader TSX trackers like XIC. But zoom in on the past year, and the picture flips. XDV returned almost 30% versus 25% for XIC. When rate hikes stopped, dividend stocks rallied hard. And we’ve seen this before; dividends often lead when the market shifts from aggressive growth to defensive quality.

More Than Just Yield

And perhaps most importantly, dividends keep investors calm. That regular income helps avoid panic-selling when markets get choppy. This cannot be overlooked. And yes, there are tax considerations, but they’re often offset by the dividend tax credit. Bottom line, whether reinvested or cashed out, dividends are a proven tool for long-term investing, both emotionally and financially.

Read More Here

BLOSSOM SOCIAL

2025 BLOSSOM INVESTOR TOUR

✈️ What is the Blossom Investor Tour?

The Blossom Investor Tour is the traveling edition of Canada’s largest retail investing event, bringing the energy of the Blossom Investor Tour to cities across North America!

With stops in Toronto, Vancouver, Calgary, Montreal, New York, Los Angeles, Chicago, and Las Vegas, the Tour connects hundreds of investors in each city for an intimate and high-impact experience designed to inspire, educate, and empower.

Hosted by Blossom, the investing social network where over 300,000 retail investors are sharing their portfolios, trades, and investing ideas, the Blossom Investor Tour is a live extension of the meaningful conversations we see happening every day in-app.

Whether you're a seasoned DIY investor or just starting out, the Blossom Investor Tour is your chance to plug into the investing community that's changing the game, and meet the people behind the portfolios.

Marc Beavis, Harvest ETF President and CEO Michael Kovacs, and blossom co-Founder Maxwell NIcholson present at the 2024 Blossom Social event in Toronto

What to Expect

🎤 Live panel talks featuring some of your favourite creators and finance pros. Stay tuned as we announce the full lineup!

🤝 Connect IRL with hundreds of fellow DIY investors, creators, and brand partners

🍸 Food, drinks, and light bites served throughout the night, all included with your ticket

🛍️ Blossom t-shirt, tote bag, lanyard, and other exclusive Investor Tour swag drops!

💸 Face time with the largest financial institutions across North America

Take a look at what 2024's Toronto Blossom Investor Social looked like: |

Don’t miss out!

🎟️ Tickets are limited, and last year’s events sold out FAST…

👀Don’t miss your chance to be part of Blossom’s biggest in-person tour yet.

More Information Here

INVESTING STRATEGIES Pt. 3

The Hidden Risks of ETF Overload

ETF-only portfolios can accidentally overweight sectors or geographies

Asset allocation ETFs help—but may cause overlap

Diversification requires more than just adding funds

Time horizon and style exposure matter more than ever

ETFs have made investing easier than ever in recent years, but they’ve also introduced a different kind of risk: over-diversification. A lot of investors think they’re spreading out their risk by adding more ETFs, but without checking under the hood, they might be doing the opposite. What looks like balance could actually be exposure stacking in disguise. When I was working as an advisor and reviewing portfolios, I’d see this all the time.

It’s About What You Own—Not How Many

You could have five ETFs and still be overly concentrated in Canadian bank stocks. Prerna Mathews of Mackenzie Investments warns that it’s easy to have too much product if you’re not careful.

“There’s a risk of having too much product in your portfolio.”

As a common example, if you own a TSX ETF and a banks ETF, you’ve just doubled down. That’s why knowing what’s inside your funds is essential, especially in a market like Canada’s, where sectors like financials dominate.

Asset Allocation ETFs Are Helpful—but Not a Shortcut

These bundled products are gaining traction for good reason, they’re simple, they’re diversified, and they are generally very low maintenance. But they aren’t foolproof. If you already own similar underlying ETFs, you may be adding complexity, when in fact you think you’re adding clarity. I’m not saying there’s anything inherently wrong with using them, but just don’t forget to zoom out and assess your entire portfolio.

The Right Kind of Diversification

Actual diversification isn’t just about adding asset classes. It’s about mixing styles, sectors, durations, and strategies that behave differently under pressure. ETF investors need to think beyond labels and into strategy.

Read the full story here.

AUTONOMOUS VEHICLES

Tesla’s Robotaxi Plans Aren’t What They Seem

Tesla lacks permits for autonomous ride-hailing in California

Upcoming service will use human drivers, not true robotaxis

Waymo spent years testing before getting full approval

Tesla’s regulatory path remains long and uncertain

On April 22, 2019, Elon Musk claimed Tesla would have a fleet of one million fully autonomous cares operating robotaxis by the end of… wait for it…. 2020. Not sure about you, but I am growing very weary of this story.

Finally, after years of delays, Tesla launched its robotaxi service in a limited pilot on June 22, 2025, in Austin, Texas, operating Model Y vehicles, BUT, with human safety monitors.

Hype vs. Reality in the Bay Area

Now, Tesla is planning to offer ‘chauffer-style’ services in California, but for now regulators confirmed that Tesla doesn’t have the permits to run autonomous vehicles. So the new service in the Bay Area? It’s just a chauffeured ride with a human behind the wheel.

Tesla plans to launch rides for “friends and family of employees” using supervised Full Self-Driving software, but that still requires the driver’s hands and attention. That’s not autonomy, it’s assisted driving. The California Public Utilities Commission was clear: Tesla can’t test or transport the public in autonomous vehicles.

The Long Road to Robotaxis

When we compare this to Waymo’s journey, its true robotaxi service took over nine years, seven permits, and millions of test miles. Tesla hasn’t even applied for most of those approvals. So while the headlines might suggest robotaxis are here, the reality is that Tesla’s playing catch-up and regulators are in no rush to speed them through.

Read the full Story Here

OTHER NEWS FROM THE PAST WEEK

Inside the Fed's Historic Renovation Project

New images show extensive renovations underway at the Federal Reserve's Depression-era headquarters. The updates—spanning boardrooms, atriums, and rooftop views—coincide with President Trump’s symbolic visit amid continued pressure on central bank policy.

Domestic Travel in Canada Feels Out of Reach

More Canadians are staying local this summer—but many are shocked by the cost. Sky-high hotel prices, limited availability, and rising demand are making cross-country travel feel less affordable than ever.

NFL to Fine Over 100 Players for Ticket Scalping

The NFL is penalizing over 100 players and dozens of staff for reselling Super Bowl tickets above face value. Future offenders face steeper fines and potential loss of ticket privileges altogether.

Mail Scams Are Evolving—and Targeting Canadians

A new wave of convincing mail scams is catching Canadians off guard. Fraudsters now impersonate companies like Ledger, preying on urgency and using personalized letters to bypass digital defenses.

Caitlin Clark Rookie Card Shatters Records

A rare rookie card signed by WNBA star Caitlin Clark sold for $660,000, setting a new record in women’s sports memorabilia. Her fan base and historic performance continue to drive auction interest.

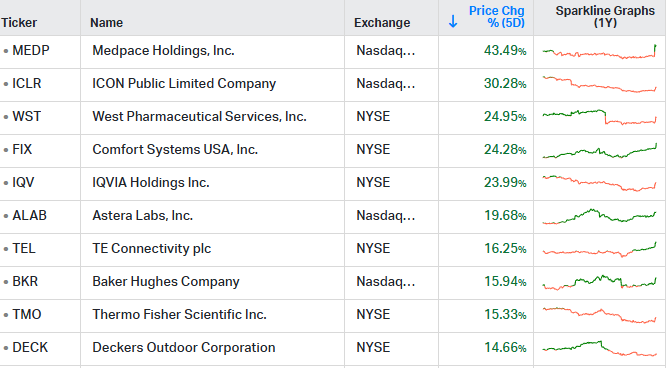

Market Movers

Top 10 Weekly Gainers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending July 25, 2025

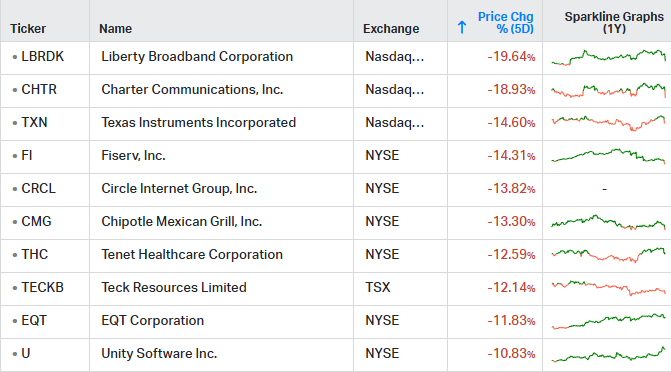

Top 10 Weekly Losers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending July 25, 2025

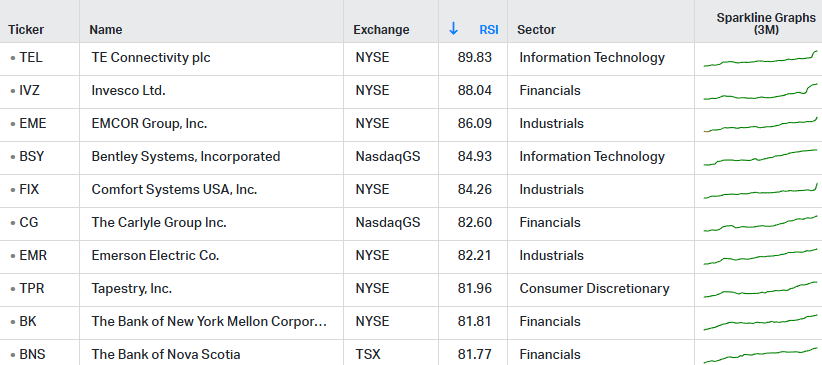

10 Most Overbought Stocks

Week ending July 25, 2025 | Most Overbought Stocks, based on 14-Day RSI

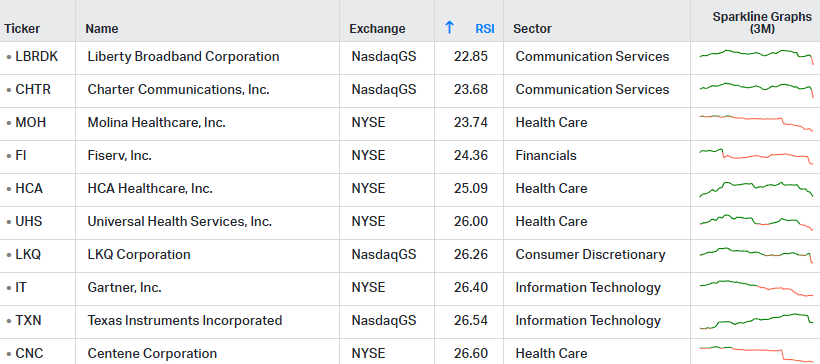

10 Most Oversold Stocks

Week ending July 25, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply