- The Pulse Newsletter

- Posts

- The AI Boom: Smart Bets or Speculative Bubble?

The AI Boom: Smart Bets or Speculative Bubble?

Investors Shift to Advisors, Dotcom-era Strategies Resurface, StatsCan delay

Personal Note

If you’re anything like me, you probably enjoy traveling and exploring new parts of the world, but it always feels great to come home and settle back into a normal routine. We thoroughly enjoyed our time in Poland, Czechia and Austria, but yes, it’s back to home sweet home now.

Warsaw, Poland |  Traditional Polish Meal |  Auschwitz-Birkenau |

I’ve missed digging into the markets each week and putting this newsletter together. So, as we head into the last part of 2025, it’s back to work.

The Week in Review

Weekly Market Recap: U.S. and Canada

It was another interesting week for equities, with all major North American indices posting solid gains. U.S. markets saw broad-based strength across sectors, led by a resurgence in investor confidence mid-week. You can see the indecisiveness Wednesday, but everything pushed through to finish the week on a high note. Overall, sentiment seemed to be steady.

Looking at the numbers, the Dow Jones led with a 2.20% gain, just edging out the Nasdaq 100, which rose 2.18%. The S&P 500 posted a respectable 1.92% increase. Meanwhile, Canada’s TSX underperformed relative to its U.S. peers, rising only 0.85% for the week.

Week ending October 24, 2025

Major Economic Stories

Recap of the Week

The dominant theme this week was inflation, both in Canada and the U.S. New data showed pricing pressures creeping higher again and the markets were watching closely for signs of stickiness in core inflation that could complicate central bank policy paths.

Here’s the bottom line on the latest inflation numbers.

Canada Inflation Rises in September

Inflation in Canada jumped above the BoC's 2% target for the first time in half a year.

Headline inflation came in hotter than expected, driven by rising food and transportation costs. Base effects played a role in the energy rebound, but underlying price pressures remained firm.

Gasoline deflation eased significantly to , 4.1% from , 12.7%

Grocery inflation climbed to 4% from 3.5% in August

Sugar and confectionery prices rose 9.2%, up from 5.8%

Core inflation remained at 3.2%, higher than the 3% forecast

U.S. Inflation Edges Higher

U.S. inflation also ticked up slightly, but core readings came in softer than expected.

Overall, the CPI print showed a modest uptick, but markets took comfort in the continued cooling of core inflation components.

Headline inflation rose to 3%, slightly below 3.1% forecasts

Gasoline prices spiked 4.1% month-over-month

Core CPI rose just 0.2%, slower than the prior 0.3%

Used car inflation slowed to 5.1% from 6%

Top Insights

Inflation: Turning Point or Temporary Bump?

Canada’s inflation came in at 2.4%, above expectations and the BoC’s target. This was the first time inflation crossed the 2% mark in six months, and while some of it was driven by base effects and seasonal food price rebounds, the sustained rise in core inflation is where it gets concerning. A 3.2% core reading, sitting at a one-year high, says there are underlying pressures that haven’t gone away.

The question now is whether this moves the needle for the Bank of Canada. I’m under no illusion we’ll see a hawkish pivot, but this new data could make rate cuts harder to justify, especially if the labor market remains stable. Investors expecting rate relief may need to adjust their timelines. One thing to watch for is energy prices; if they keep edging up, we could see inflation remain elevated into early 2026.

U.S. Core Inflation Relief Could Support Soft Landing

In the U.S., the story was different. Headline CPI moved slightly higher to 3%, but core inflation actually eased. That’s a crucial point, because the Fed cares more about underlying trends than the fuel-driven volatility that shows up in the headline number. With core CPI slipping to 3% and monthly core prints cooling to 0.2%, markets got the reassurance they needed that inflation isn’t reaccelerating in a meaningful way.

The main takeaway here is that this opens the door (just a crack) for a “wait and see” Fed, especially with economic growth showing signs of softening. It’s too early to declare victory, but this week’s data may offer support to the soft-landing narrative that markets have been clinging to. If this trend continues, we could see risk assets continue to rally into year-end.

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

In this week’s lead story, I dig into why the AI trade is starting to look a little too hot for some. The long-term promise is still compelling, but a lot of what’s driving prices right now feels more like momentum than fundamentals. Some investors are trimming exposure, others are rotating into safer names, but the hype is definitely being questioned.

Curious where you stand—cast your vote below.

What’s the biggest risk for AI stocks now? |

LAST WEEK’S POLL RESULTS

Last poll, I asked: “With everything going on, how are you feeling about the outlook right now?” The results were clear: most of you are feeling the weight of uncertainty.

58% said you're concerned

30% are neutral

Just 12% said you're feeling optimistic

This pretty much aligns with what we’re seeing in the broader markets; volatility, mixed economic signals, and political noise are making it harder to stay confident. Thanks to everyone who took the time to share your thoughts.

Reader Comments

Neutral

“A lot of 20 somethings are unemployed. My son graduated with an engineering degree and he is picking up odd jobs unrelated to his field. Very similar to many of his friends.” - cperera

“It’s important to understand the times we’re in. There’s no clear path forward until the US stabilizes. I feel cautious optimism for Canada but fear for our southern neighbours. Let’s not kid ourselves as Canadians; we’re vulnerable to the whims of Washington.” - jaci63

“The fact that Canada is now facing challenges that have never been experienced before and how best they can be handled in a world of trying times.” - jodorj

Concerned

“An increasingly challenging jobs market & inflation that's not under control (at least IMHO) is a very bad combination... Add in ever-growing policy induced uncertainties from America's leadership and I'm very concerned to say the least...

It's unfortunate, but America's mistakes will impact economies around much of the world, especially those of its closest neighbors (sorry to my Canadian friends).

There's one likely benefactor tho'... China! America's missteps and downright idiocy have pushed our once closet allies into the arms of Xi Jinping. China's businesses and economy will benefit hugely IMHO.

The budding bromance between Jinping, Putin and Modi is especially concerning... Can't help but wonder who will join their hand holding party next?

As I've said in the past, I'm really hoping to be proven wrong on this one. Time will tell...” - callawayguy

“I think all this uncertainty is definitely weighing in my decision.” - annsheena111

“The USA economy is starting to show some cracks. I'm concerned that a market reset is coming early next year. I'm pivoting out of US stocks, to Canadian defensive stock over the next few months.” - ardenb8

“They can pick whatever numbers they want but the fact is living is crazy expensive and the future for the teens and young adults today doesn't look bright. Sure they will survive but to be in a position to raise a family in a decent house and save for retirement doesn't seem to be in the cards.” - storierod

“Trump is more and more going full authoritarian, controlling and looks like McCarthyism is back!! :, ( “ - jaime2001sastre

Optimistic

“At the begining of 2025 I was concerned about the effect of events on my pensions & investments but over the months those concerns have dissipated. Following the outflow & inflow numbers have been a great help and assisted me in moving my portfolios. I decided to move my money out of US investments and revamped to have more Europe and Emerging markets along with my Canadian Holdings. In doing so I have seen an increase in my portfolio values of 15% since early 2025, and the solid passive income has held strong for 2 years now. I am regularly checking to see where is the best places to invest and so far (knock on wood) I will continue to stay away from the crazy areas and stick with the more balanced & productive areas. My feeling is that in 2026 we will see even more instability inthe US, Russia, N.Korea and Iran. Canadians must continue to rebuild our ecconomy with partners & friends and leave the unstable markets to their own demise. It ill take the US at least 20 to 25 years to recover from the government & the Supreme Court.” - entender1012

INVESTING

AI Boom Feels Frothy, Investors Playing It Safer

AI valuations drawing comparisons to dotcom bubble

Investors shifting to “old tech” with real cash flow

Risk management now part of the bullish thesis

Bubble talk growing louder in fund strategy notes

AI continues to dominate markets, but there’s a bit of a change in tone this week. We’re not seeing a broad sell-off, but we are seeing signs that investors are getting defensive, rotating into more mature names, trimming their exposure to high-flyers, and even dusting off some early-2000s risk management tactics. I’m not hearing too much “it’s over,” sentiment, but it’s more like “let’s not get caught flat, footed.” Followers of our YouTube channel will recognize this message.

Smart Money Getting More Selective

Without getting overly hysterical, the parallels to the dotcom era are hard to ignore, but there’s nuance here. Unlike back then, a lot of the leading AI companies today are actually profitable. Still though, the pace of gains has people nervous. I've noticed more funds talking about hedging and layering in value tech. It’s like there’s still optimism, but we’re seeing a growing sign of skepticism being added to the mix. And honestly, that might be what keeps this from turning into a true bubble.

Why This Pullback Could Be Healthy

Personally, although I remain cautious, I’m not saying that a bubble is necessarily about to burst. It looks like some seasoned investors are reminding themselves that trees don’t grow to the sky. If anything, this cooling-off could be a positive. Less speculative mania means a stronger foundation. So, while I wouldn’t call the AI trade “done,” I reiterate my thoughts that the easy money phase is likely behind us. It’s entering its prove-it stage.

Read the Full Story Here

IN PARTNERSHIP WITH HARVEST ETFS

Invest in Canada’s Best | Built for High Yield, Every Month

Harvest High Income Shares™ recently celebrated their one-year anniversary. Over 12 months, High Income Shares™, including the Harvest Diversified High Income Shares ETF (TSX:HHIS) and the Harvest MicroStrategy Enhanced High Income Shares ETF (MSTE:TSX), have made waves among investors with a compelling combination of growth access and high monthly income.

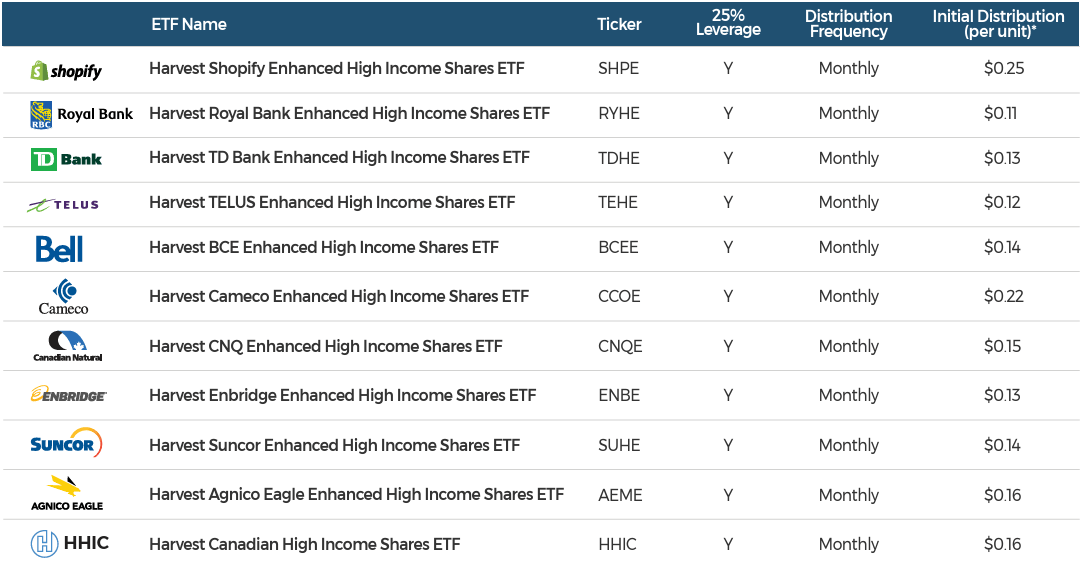

Harvest has also introduced the next line in this innovative suite: Harvest Canadian High Income Shares!

10 of Canada’s best companies in single stock ETFs, overlayed with covered calls and modest leverage at approximately 25%.

A one ticket solution – the Harvest Canadian High Income Shares ETF (TSX:HHIC) – a portfolio of TSX-listed equities reflecting Canadian High Income Shares. Designed to generate high monthly income from covered calls and modest leverage.

Learn more about the Harvest High Income Shares here.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A units of the Fund. If a Fund earns less than the amounts distributed, the difference is a return of capital.

INVESTING & FINANCIAL PLANNING

Volatile Headlines Pushing Investors to Seek Advice

More Canadians turning to advisors amid market stress

Trade, inflation, and recession risk top investor concerns

DIY investing losing ground to professional planning

Retirement goals now driving investment decisions

As a retired financial planner and portfolio manager, I read this next story with great interest. There’s a growing trend I’ve been seeing and hearing about, and now the data seems to back it up: more Canadians are leaning on financial advisors. A new survey shows that uncertainty, whether from inflation, geopolitics, or Trump’s trade threats, is pushing people to look for more structure and less guesswork in their portfolios. The hyper-focus on chasing returns is shifting to more about building a strategy that can weather surprises. For the record, I say that’s a smart move.

Fear Is Shifting the Conversation

It seems like investors are becoming a bit more wary of navigating it alone. What used to feel empowering (DIY investing, meme stocks, Reddit threads) is now taking on a sense of more risk and some are becoming worn out from managing their portfolios in isolation. According to BNN’s report, capital preservation and retirement stability are now leading investor goals. Honestly, that doesn’t surprise me. When politics, inflation, central banks and all-time highs are all wild cards, even seasoned investors want a sounding board.

Planning Beats Predicting

I take this as a positive trend. When people shift from reacting to planning, portfolios tend to benefit in the long run. Don’t get me wrong; advisors aren’t magic, but in many cases they do provide emotional guardrails, and right now, that might be the most valuable asset. I believe that when I was still working with clients, the value I added from the psychological side was just as important as how we structured their portfolio. Especially with Trump ramping up rhetoric and inflation sending mixed signals, it’s not a bad time to have a professional on your team.

Read More Here

STATISTICS CANADA

StatsCan Delay Sparks Credibility Questions

September trade data delayed without advance notice

Technical issue blamed, not data accuracy

Economists caught off guard by timing

Markets shrugged it off, for now

StatsCan has announced it will delay its September trade release, scheduled for November 4 , and while it might not sound like a huge deal, the optics aren’t great. The agency cited the lack of information from the U.S. Census Bureau as the cause, but with so much riding on accurate economic signals right now, the delay caught some attention. The markets themselves mostly brushed it off, but I think it’s worth paying attention to.

Why It Matters More Than It Seems

Trade figures help shape rate expectations, budget planning, and even how we as investors position our portfolios. When those numbers are late, or unexplained, it chips away at confidence. In light of the ongoing issues with Trump questioning the validity of numbers in the U.S., some have become more concerned than they might otherwise have been. I’m not buying into any conspiracy theories here, but if we are entirely honest, transparency matters more than ever in today’s economic climate.

A One, Off, or a Pattern?

Time will tell, but this may very well be a one-time hiccup. That said, if delays like this start piling up, or if clarity continues to lag, it could create credibility issues for one of the most important data sources in the country. I’m not concerned yet that this will mushroom into a big deal, but I will be watching with interest, for sure.

Read the full story here.

OTHER NEWS FROM THE PAST WEEK

15% of Canadians Over 65 Still Working

More seniors are staying in the workforce as retirement plans falter. Rising living costs and uncertain pensions are forcing Canadians to rethink traditional timelines.

Canada Post Workers Lose Back, to, Work Challenge

A federal court upheld legislation forcing Canada Post workers back on the job. The union argued constitutional violations, but the judge disagreed, citing economic disruption.

B.C. Billionaire Loses Hudson's Bay Property Fight

The courts ruled against a B.C. investor attempting to acquire a Hudson’s Bay building. The failed bid ends a high, profile battle over prime downtown real estate.

Manitoba Farmer’s Invention Recognized by TIME

A Manitoba man’s new farming tool just made TIME’s innovation list. The device improves crop yields while reducing chemical runoff, earning global attention from agritech leaders.

AI Spending Lifts Economy, But Not All Businesses

AI investment is fueling growth in some sectors, but many firms are still in survival mode. The gap between tech adoption and small business realities is widening.

Cookie Start, up Goes Viral With $2M Goal

Two siblings started a cookie giveaway as a side project, and turned it into a $2 million venture. Their story is a masterclass in grassroots marketing and timing.

U.S. Beef Prices Surge Amid Policy Uncertainty

Beef prices are spiking across the U.S., adding pressure to household budgets. Trump’s tariff plans are stirring debate over whether supply chains will worsen or stabilize.

JPMorgan Wants Relief From Fraud Legal Costs

JPMorgan Chase is seeking to limit its liability in covering legal bills tied to convicted fraudsters. The case could set new precedents on corporate responsibility.

U.S. Food Banks Brace for Surge

American food banks are preparing for a potential flood of need if federal benefits lapse. A looming government shutdown could hit low, income families hardest.

Charlie Javice Sentenced in $175M Fraud Case

Charlie Javice, founder of Frank, was sentenced to seven years for defrauding JPMorgan. The case highlighted due diligence failures in high, growth fintech deals.

Six Flags America to Close Permanently

Six Flags America is shutting down for good after years of financial instability. The closure reflects deeper challenges in regional entertainment and consumer confidence.

Market Movers

Top 10 Weekly Gainers

Week ending October 24, 2025 | Biggest Gainers

Top 10 Weekly Losers

Week ending October 24, 2025 | Biggest Losers

10 Most Overbought Stocks

Week ending October 24, 2025 | Most Overbought Stocks, based on 14-Day RSI

10 Most Oversold Stocks

Week ending October 24, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply