- The Pulse Newsletter

- Posts

- Tariffs Push Allies to the Brink

Tariffs Push Allies to the Brink

EV Price Wars, Inflation Plateau, Beer Fatigue

Happy Sunday, and welcome to The Pulse.

As I was selecting this week’s stories, it was like a bit of déjà vu. I saw pressure building in familiar places. Trade is being used more aggressively (as in very aggressively), prices are staying stubborn (beyond the headlines, at least) and what was once a booming consumer trend is clearly losing momentum.

To quote Justice Brett Kavanaugh, "I drank beer with my friends. Almost everyone did. Sometimes I had too many beers. Sometimes others did.” That may have changed.

Enjoy the read.

Market Recap: U.S. and Canada

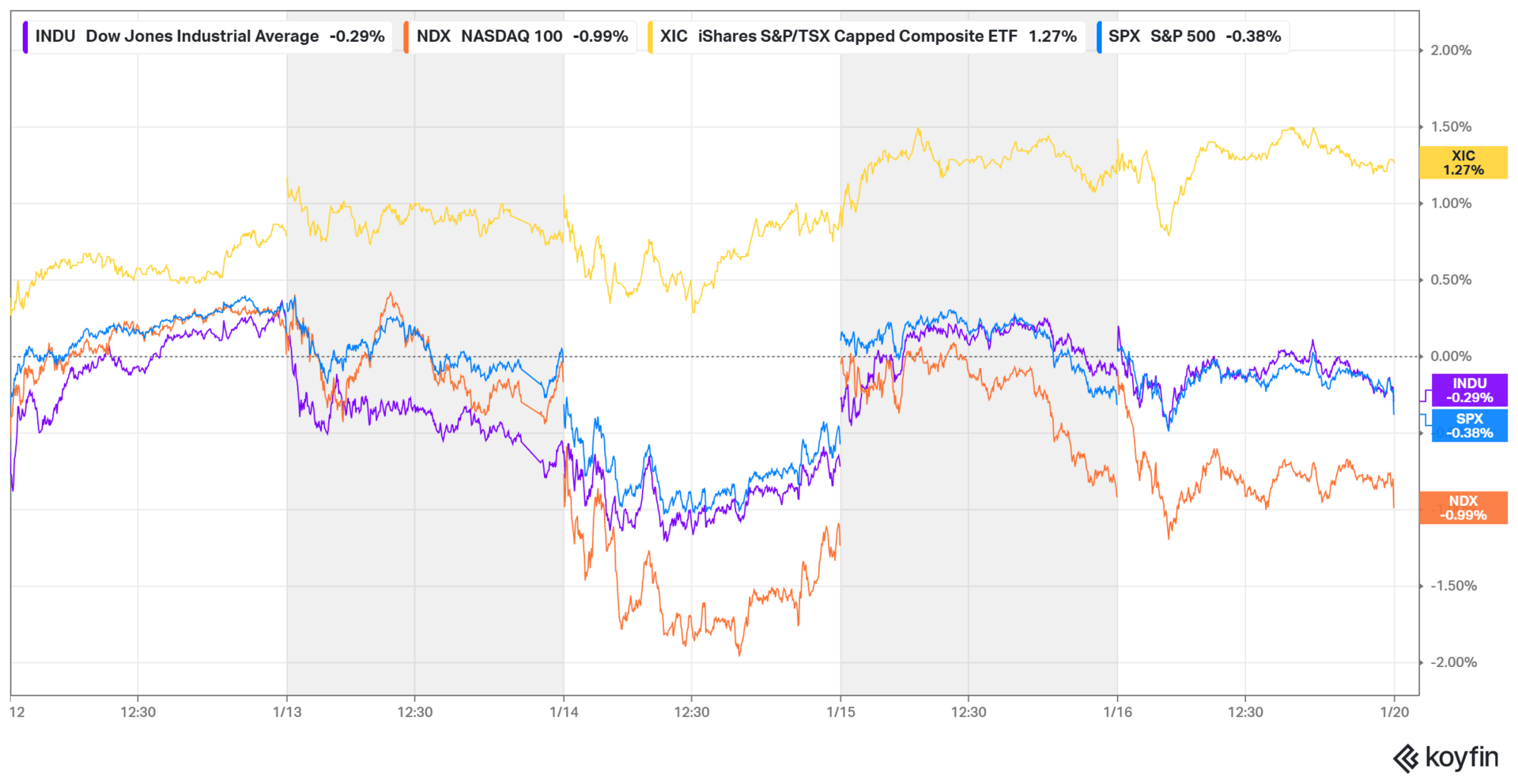

When I looked at the weekly markets chart below, I saw a flock of seagulls flying aimlessly about with no clear destination. (Is it just me, or does anyone else see that?) Canadian stocks kept grinding higher, but US markets had a harder time getting traction as volatility reappeared midweek.

As for the numbers, the TSX had a decent week, finishing up 1.27%, helped by strength in commodities and financials. The Dow Jones fell 0.29%, the S&P 500 slipped 0.38%, and the Nasdaq 100 lagged down almost a full percentage point.

Week ending January 16, 2026

Major Economic Stories

Economic Recap

The economic picture this week was all about prices in the U.S., and we saw inflation continuing to cool at the consumer level, with underlying cost pressures and consumer spending staying more resilient than many expected.

Here’s what we learned.

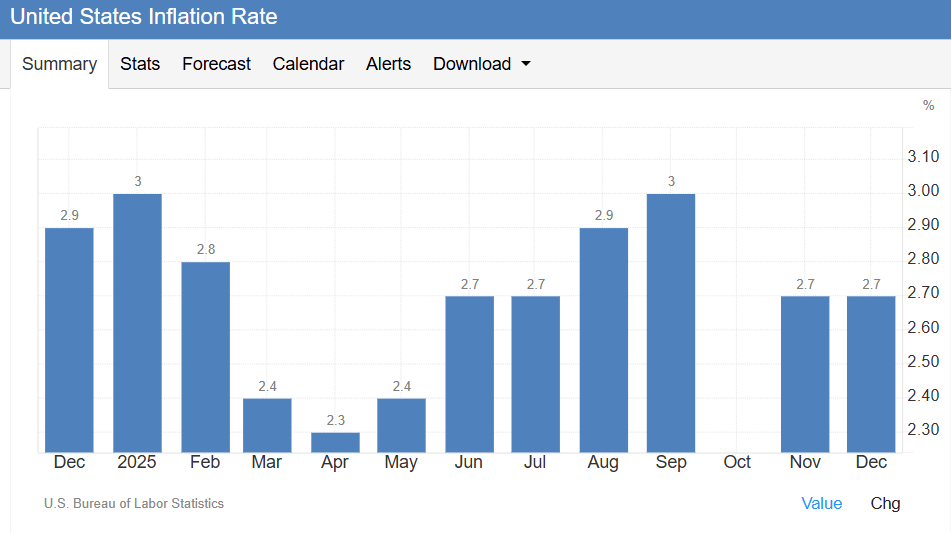

US Inflation Holds Steady in December

The annual inflation rate held at 2.7% in December, matching November and market expectations.

Energy prices provided some relief as gasoline prices fell 3.4% year over year and fuel oil inflation cooled sharply, even as natural gas costs moved higher. Used vehicle prices also continued to decelerate, and that helped offset faster gains in food and shelter. On a monthly basis, prices rose 0.3%, with shelter again the single biggest contributor.

Energy disinflation is doing more of the work

Shelter costs remain the dominant inflation driver

Goods prices are offering modest consumer relief

Inflation progress remains uneven across categories

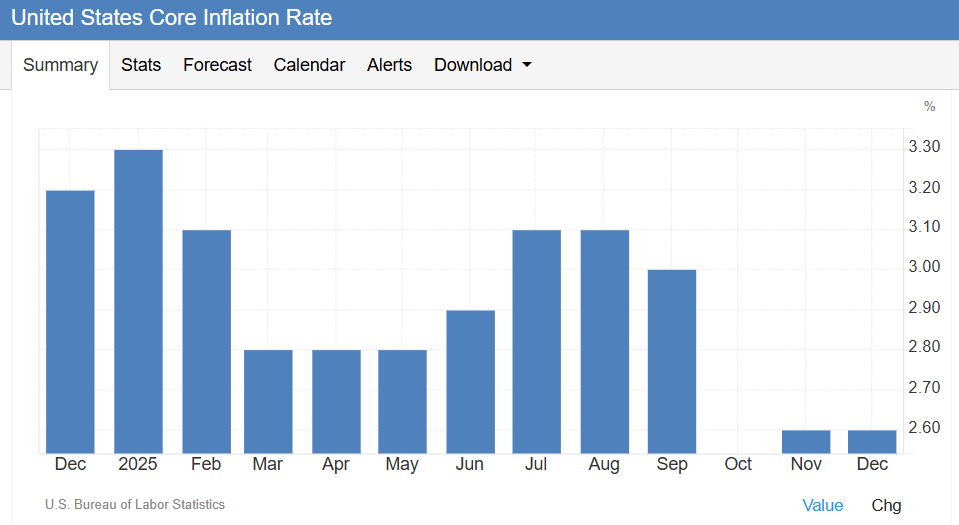

Core Inflation Signals Remains Sticky

Underlying core inflation came in at 2.60%, showing a continued plateau in prices.

Core consumer inflation, which strips out food and energy, remained at 2.6% in December, coming in below expectations of a slight uptick. Slowing price gains in used vehicles and household furnishings were key contributors to the softer reading. At the same time, shelter costs continued to rise at a 3.2% annual pace, highlighting how sticky housing-related inflation remains. Other service categories, including medical care, recreation, and personal care, also saw firmer price increases over the past year.

Core inflation remains flat

Housing inflation remains stubbornly elevated

Service costs continue to rise steadily

Goods deflation is easing overall pressure

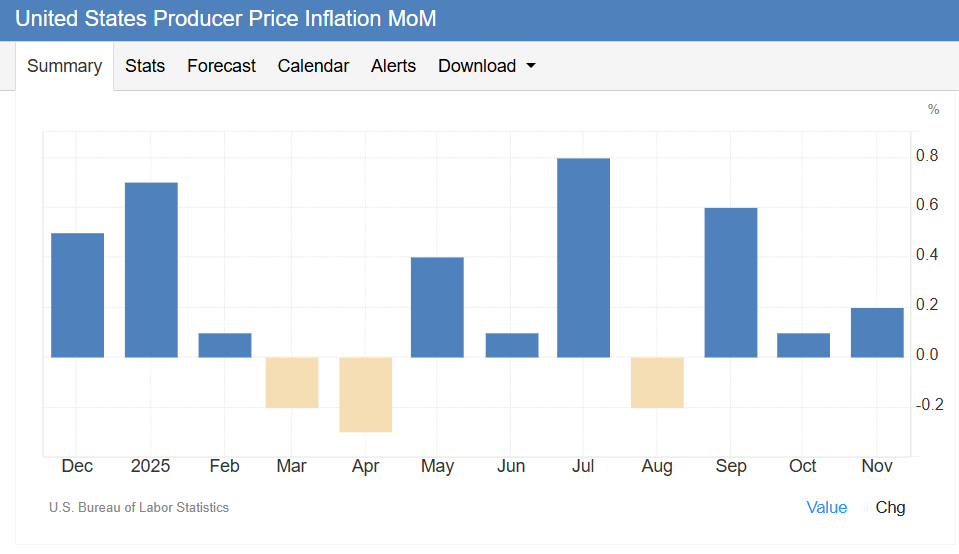

Producer Prices Reaccelerate

Upstream inflation pressures showed signs of firming again.

Producer prices rose 0.2% month over month in November, largely due to a sharp rebound in energy costs. Goods prices jumped 0.9%, the strongest increase since early 2024, while service prices were flat. Core producer prices were unchanged on the month, coming in below expectations and suggesting some cost pressures remain contained. On an annual basis, both headline and core producer inflation climbed to 3.0%, moving further above market forecasts.

Energy volatility is influencing producer costs

Annual producer inflation is creeping higher

Core pressures look less alarming month to month

Margin pressures may resurface for some firms

Consumers Show Resilience

Spending data pointed to a stronger-than-expected consumer backdrop.

Retail sales rose 0.6% in November, the strongest monthly gain since summer and easily beating forecasts. Auto sales rebounded following the expiry of electric vehicle tax incentives, while holiday shopping supported gains across discretionary categories. Spending was broad-based, with strength in sporting goods, clothing, restaurants, and building supplies. Sales used in GDP calculations also rose 0.4%, a sign of solid momentum heading into year-end.

Consumers are still opening their wallets

Auto sales bounced back sharply

Holiday spending delivered a meaningful lift

Growth-sensitive categories remain active

TOP INSIGHTS

Headline Inflation Is Falling, Core Is Catching Its Breath

What stands out to me in this data is the growing gap between headline inflation and the core trend. The overall inflation rate looks like it’s doing what policymakers want, helped along by energy and goods behaving better. That progress matters, because it shapes public perception and eases some immediate pressure on household budgets. On the surface, it feels like inflation is may be fading into the background.

But when I look under the hood, the core readings tell a different, more cautious story. Core inflation isn’t falling in any meaningful way; it’s levelling off. It’s that plateau that tells us that the easier part of the inflation fight may be under control, but we have less relief in the places that matter most month to month.

For markets and policy, I say this points to a holding pattern; certainly not a victory lap. Falling headline inflation buys time, but a plateauing core rate limits how quickly central banks can move. What I’m watching next is whether core inflation resumes its downward trend or settles into a range that forces policymakers to stay restrictive longer than investors currently expect.

For those of you who follow me on our YouTube channel, I will be posting a more detailed video on this topic this coming week. Hope to see you there.

Consumers Are Slowing Selectively, Not Broadly

The retail sales data tells me that consumers aren’t tapped out, but they are being more deliberate. Spending is still there, especially when it comes to experiences, autos, and seasonal shopping, but it’s showing up in bursts rather than a steady grind higher. That feels very different from the post-pandemic spending spree where everything went up at once.

From a real-world perspective, it looks like households are picking their spots. People are still going out, still buying, but they’re thinking harder about value. Price is what you pay, value is what you get, right? As for the markets, this selective strength favours companies that can justify pricing and deliver clear utility. It’ll be interesting to see whether this behaviour holds once credit conditions tighten further or if we finally see a broader pullback.

Upstream Costs Are a Risk Again

Producer prices don’t get the same attention as CPI, but IMHO, they matter more than most people realize. When we see energy-driven spikes at the producer level, they tend to show up later in margins, pricing decisions, or hiring plans. Even with core PPI looking contained month to month, the year-over-year numbers creeping higher are a reminder that cost pressures haven’t gone away.

For households, this often shows up indirectly through smaller things like product sizes (no pun intended), slower wage gains, or fewer promotions not necessarily outright price hikes. In markets, it raises questions about earnings durability if companies lose pricing power. We should keep an eye on whether energy volatility feeds through more aggressively in early 2026, because that’s where this story could reaccelerate.

TOP STORY

Trump Escalates Tariffs Over Greenland Push

Tariffs tied directly to Greenland purchase demands

Allies pulled into an unexpected trade standoff

Europe warns relations could sour quickly

Higher consumer prices loom in the background

President Donald Trump said this week he plans to impose new tariffs on Denmark and seven other European countries until an agreement is reached to buy Greenland, turning his overt and long-standing political fixation into a direct trade threat. The tariffs would start at 10% and jump to 25% if no deal is reached by June 1. Trump framed the move as a national and global security issue, arguing that European military activity around Greenland and interest from China and Russia leave the US no choice but to act forcefully.

Europe Draws a Line

We saw a quick response from leaders across Denmark, the UK, France, Germany, and the EU, including some unusually blunt language, warning that tariff threats against allies undermine trust and risk a downward spiral. They pushed back hard on Trump’s security claims, noting that joint exercises in Greenland are part of routine NATO cooperation. Some European officials went further, suggesting that existing trade agreements with the US could be paused or re-examined if the threats continue.

Why This Matters Economically

This standoff comes at an especially bad time for consumers (not that there would be a good time) already feeling stretched by high living costs. European officials warned that tariffs could ripple through prices on pharmaceuticals, aircraft parts, and industrial goods, particularly from Germany. There’s also legal uncertainty over how these tariffs would be imposed, with the Supreme Court set to weigh in any day now.

Full story here.

Trade policy was back front and center this week and, as I write in today’s top story, it’s increasingly being used for more than economics, with tariffs showing up as tools of diplomacy and political pressure. Supporters see leverage, critics see unintended fallout for consumers, allies, and markets. What do you see? Keep an open mind, and vote on this week’s question:

Using tariffs to achieve political goals as opposed to economic goals is: |

LAST WEEK’S POLL RESULTS

In last week’s poll, I asked what governments should do about prediction markets overall. A narrow majority favoured licensing and regulation over an outright ban, while nobody, not even one, supported leaving these markets unregulated. Thanks to everyone who voted.

READER’S COMMENTS

License & Regulate

"Prediction Markets are the same as online gambling sites, and should be regulated in the same way. There are to many people that once involved would not be able to control themselves - addiction is a terrible thing." — entender1012

Ban Outright

"So called "predictions markets" are quite simply, repackaged gambling IMO, which is why I voted for an outright ban?

Households with a gambling member have a 10x higher likelihood to have domestic violence and as addictions go, gambling has the highest suicide rate by far, with 20% of those addicted to gambling attempting suicide at least once. Those are reported #'s, so I'll assume the real # is even higher.

Digging a bit deeper, U.S. states that allow sports betting see a 28% jump in bankruptcies following legalization. Sure there are some winners, but the damage done on the whole isn't worth it.

Might not be popular with many reading this, but banning predictions markets outright is essentially protecting males from their prevalence of poor decision making (yes - it's almost always young males). I'd prefer we don't throw fuel on the fire of an already challenged generation of young men.

Over/Under on people hating my opinion: 75%

I'll take the over! Haha!!

Full Disclosure: The gambling and suicide statistics I used were borrowed from a ProfG G Markets newsletter I read a couple months back." — callawayguy

"These markets can be skewed by insiders so not a fair playing field" — realtymediaservices

IN PARTNERSHIP WITH HARVEST ETFS

SIX NEW Harvest High Income Shares ETFs Trading Now on the TSX

Harvest is excited to announce that it is expanding its High Income Shares™ lineup with SIX new Harvest High Income Shares ETFs!

These new single stock ETFs provide investors more opportunities to generate enhanced monthly distributions from some of the world’s most influential companies. Explore these new Harvest High Income Shares ETFs™:

BLKY | Harvest Block Enhanced High Income Shares ETF

CRWY | Harvest CrowdStrike Enhanced High Income Shares ETF

JNJY | Harvest JNJ Enhanced High Income Shares ETF

JPHE | Harvest JPHE Enhanced High Income Shares ETF

NOVY | Harvest Novo Enhanced High Income Shares ETF

ORCY | Harvest Oracle Enhanced High Income Shares ETF

Why own Harvest High Income Shares ETFs?

Own Top Stocks + High Monthly Income

High, Tax Efficient Income Available in USD/CAD

Available in Enhanced Series

Check out our full Harvest High Income Shares™ lineup.

*See Harvest ETFs Disclaimer at the end of the newsletter

AUTO INDUSTRY AND INTERNATIONAL TRADE

China EV Deal Could Shake Up Prices

Canada China auto deal reshapes Canada’s electric vehicle market

Dealers and manufacturers see very different outcomes

Consumers could gain access to cheaper EVs

Domestic job concerns remain front and center

Canadian Prime Minister Mark Carney announced a new Canada China electric vehicle deal this week, opening up a fresh divide in the auto sector. The agreement allows a limited number of lower tariff EV imports tied to China, and it immediately sparked debate over affordability, competition, and the even future of Canada’s domestic auto industry. Manufacturers are warning about job losses and supply chain risks, and car dealers are focusing on what this could mean for buyers.

Why Dealers See a Consumer Win

Several Canadian car dealers say the biggest impact will be price pressure across the market. After seeing Chinese EVs firsthand at global auto shows, they argue the technology, range, and build quality have advanced far faster than most consumers realize. Brands like BYD and Xiaomi are offering vehicles packed with features at prices well below comparable models from established automakers. Even shoppers who never consider a Chinese brand could benefit, because we can expect other manufacturers to respond by cutting prices or improving value. Some also believe brand new lower cost EVs could weaken demand for older used models.

Concerns From the Manufacturing Side

Auto manufacturers and industry groups remain skeptical. They argue Chinese EVs benefit from much lower labour and environmental standards, creating cost advantages that Canadian plants can’t hope to replicate. Critics also point to weaker economic spillovers if vehicles are built overseas rather than in Canadian communities. The federal government’s upcoming auto strategy is expected to prioritize domestic production while gradually opening the market. Whether that balance delivers affordability without hollowing out local manufacturing is the unresolved question.

Read the full story here.

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

“I LIKED BEER. I STILL LIKE BEER”

Turn Out the Lights, The Party’s Over?

Brewery closures signal industry turning point

Rising costs collide with changing drinking habits

Younger consumers drinking less overall

Survival now depends on adaptation

After more than a decade of rapid expansion, it looks like Canada’s craft beer industry is facing a clear slowdown. Beer sales are declining, brewery openings have stalled, and closures are becoming more common as higher costs butt up against unquestionably shifting consumer habits. What once felt like a growth story with tons of runway now looks more like a maturing industry going through a painful but expected correction.

The End of the Golden Age

The craft beer boom took off in the early 2010s, fuelled by supportive provincial policies, millennial demand, and a massive wave of enthusiasm from both entrepreneurs and local governments. Breweries became community hubs and economic development tools, especially in smaller towns and revitalized neighbourhoods. In my small city, we have only one micro-brewery and it’s on the ‘must-see’ list for every visitor. But that growth has run into reality. Sales have been falling roughly 2% per year for several years now, and the total number of breweries has started to shrink after peaking earlier in the decade. Industry observers say the days when opening a brewery almost guaranteed success are over.

Why the Market Is Tightening

Several forces are hitting at once. Consumers are drinking less overall, especially younger Canadians and new immigrants. Add to that the fact that affordability pressures are keeping people home more often, and alternatives like ready-to-drink cocktails, seltzers, and non-alcoholic options are stealing share. Breweries also face higher input costs and heavy taxation, squeezing margins even more. Some closures stem from bad timing and bad luck, but others reflect deeper shifts in how and why people drink.

How Breweries Are Adapting

Some good news and a glimmer of hope is that not everyone is struggling. Some breweries are broadening their identity beyond beer, adding full food menus, hosting events, and offering new products like hard iced tea, canned cocktails, and alcohol-free options. The craft beer scene won’t disappear entirely, obviously, but it is changing tone. Pushing back on my title for this story, one brewer put it this way: The party isn’t over, it’s just quieter, more selective, and a lot more competitive.

Read the full story here.

Were you caught up in the massive data leak from Canada’s securities regulator? See the full story here. |

WestJet Walks Back Seat Squeeze: WestJet is reversing planned changes to reduce economy legroom after customer backlash, highlighting how airlines are testing pricing power limits as travellers push back against tighter cabins and shrinking value.

Lab Diamonds Take On Natural Stones: Lab grown diamonds are reshaping the jewellery market by undercutting prices and challenging long held perceptions of value, raising questions about resale, long term pricing, and consumer trust.

Why Financial Resolutions Keep Failing: Most financial resolutions collapse quickly due to unrealistic goals and behavioural blind spots, leaving households stuck in cycles that undermine long term wealth building and financial confidence.

Silver Surges, Canada Holds Back: Silver prices are climbing, but Canada’s refusal to classify it as a critical mineral raises questions about policy priorities, industrial strategy, and missed opportunities in the clean technology supply chain.

Trump Targets Banks Over Debanking: Trump is escalating criticism of major banks over alleged debanking practices, putting political pressure on financial institutions and reopening debate around access, regulation, and corporate discretion.

MDA Space Stock Jumps on Upgrade: Shares of MDA Space surged after an analyst upgrade, reflecting renewed investor optimism around space infrastructure spending and Canada’s growing role in global satellite and defence programs.

Krispy Kreme for $1 a Dozen: Krispy Kreme is extending aggressive promotions to drive traffic, signaling how food chains are leaning on discounts to protect volume as consumers grow more price sensitive.

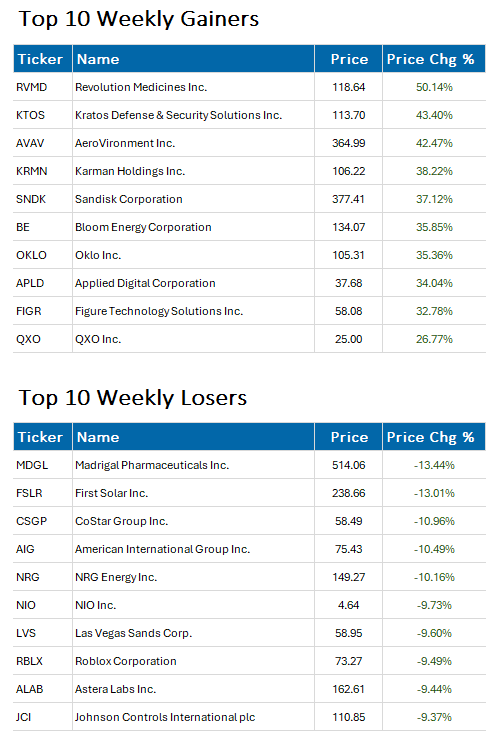

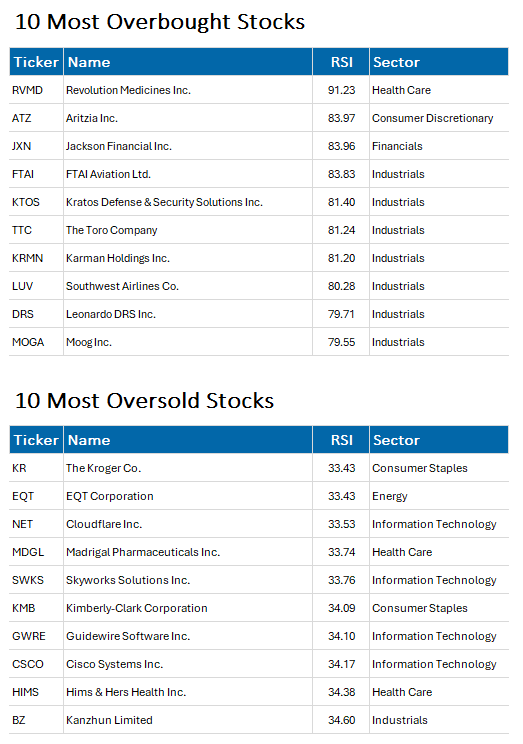

Week ending January 16, 2026 | Market Cap > $10 Billion USD

Week ending January 16, 2026 | based on 14-Day RSI | Market Cap > $10 Billion USD

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

*Harvest ETFs Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The Funds pay distributions to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested available Class units/shares of the Fund. If the Funds earn less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.

Reply