- The Pulse Newsletter

- Posts

- Fractured Fed Officials Clash Over How Fast To Ease

Fractured Fed Officials Clash Over How Fast To Ease

BoC surprise, US tech to China, social media ban, China surplus

The Week in Review

Weekly Market Recap: U.S. and Canada

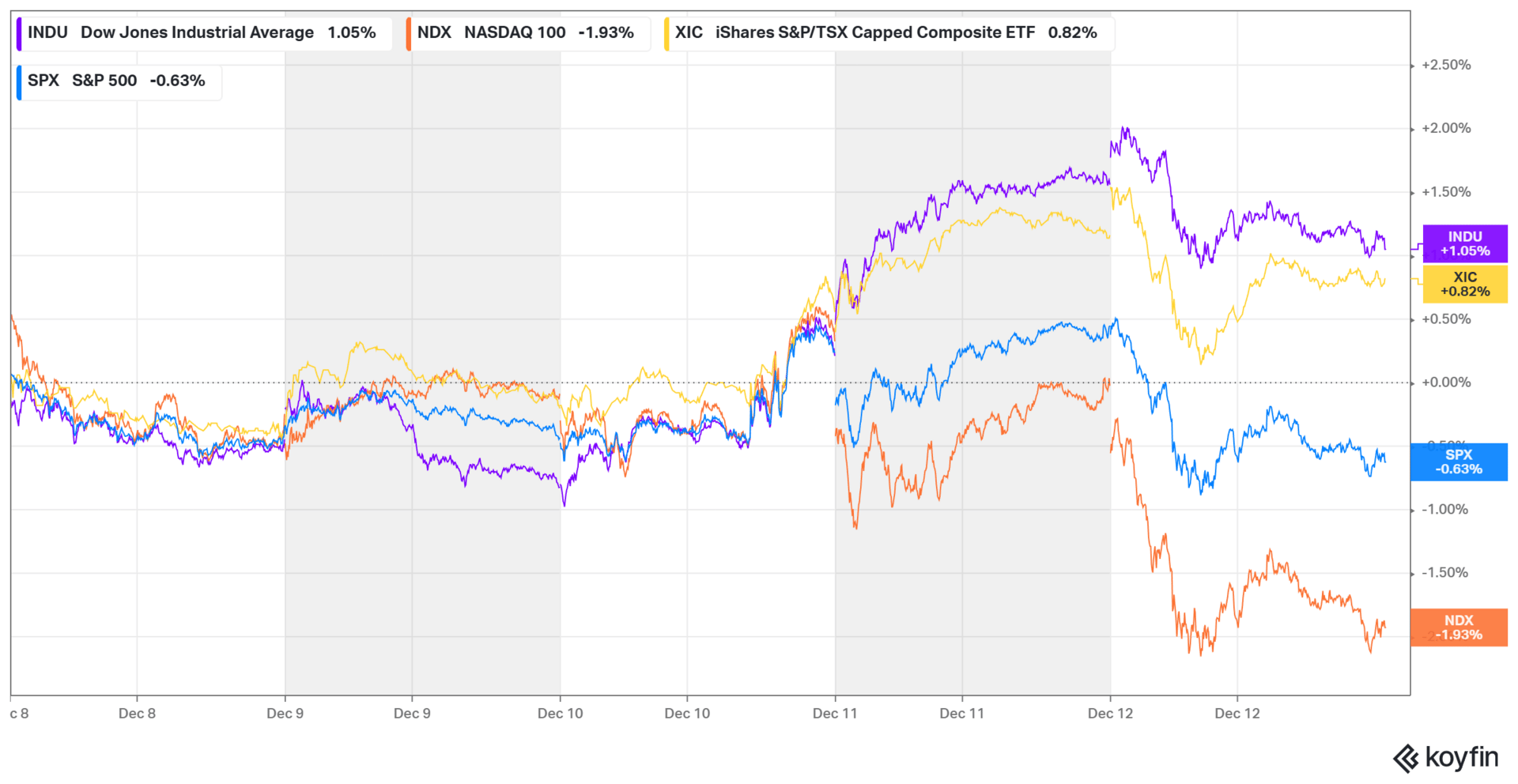

Markets were mixed in a week that offered up two central bank decisions. Things were pretty cautious leading up to Wednesday, but moved around quite a bit after the Bank of Canada and U.S. Fed rates were announced.

At the end of the day, the Dow Jones led the way finishing up just over 1%. The TSX fell 0.82%, the S&P 500 slipped 0.63% and the Nasdaq 100 trailed the field, falling 1.93%.

Week ending December 12, 2025

Major Economic Stories

Recap of the Week

The big economic news of the week is both the Bank of Canada and the U.S. Federal Reserve announcing their latest interest rate decisions. I’ll recap those here. Also, after the lengthy U.S. government shutdown delay, we finally got more insight into the U.S. jobs situation with the JOLT report coming out this week.

Here’s how everything played out.

Bank of Canada holds steady as inflation cools

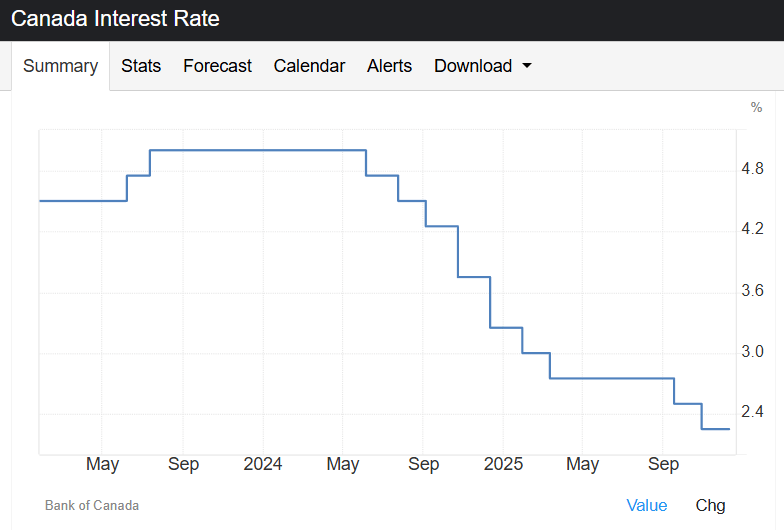

The Bank of Canada kept its overnight rate at 2.25%, a signal that it sees the current level as appropriate given how inflation and growth are evolving.

In support of its decision, the BoC noted that Canada’s third quarter GDP came in stronger than expected at 2.6%, giving the bank a bit more breathing room as it looks across a labour market that improved in November with unemployment easing to 6.5%. CPI slowed to 2.2% in October, and officials think core inflation is tracking between 2.5 and 3%, which keeps the overall trend moving in the right direction. There is still some concern around global risks, tariff related pressures and choppy trade flows that could swing quarterly growth, but the bank is signalling confidence that it is close to where it needs to be. Policymakers say they are ready to respond if the outlook shifts, but for now they feel the current rate is doing the job.

Inflation progress leaves rate path mostly stable

Growth beat gives BoC policymakers more room to wait

Labour market improvement supports the bank’s stance

Trade volatility still creates pockets of uncertainty

Fed cuts again while internal tensions grow

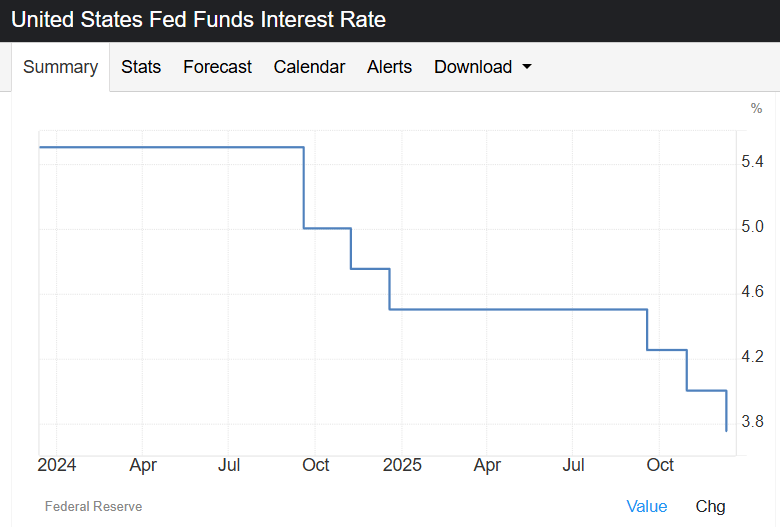

The Federal Reserve lowered the federal funds rate by another 25 basis points to 3.5 to 3.75%, its third cut in four months, bringing borrowing costs to their lowest level since 2022.

The cut was expected, but the big story was how messy the vote was. Three members dissented and pushed back against the move, confirming how split the committee has become on timing and risk. Stephen Miran wanted a deeper 50 basis point cut, while Austan Goolsbee and Jeffrey Schmid argued for staying on hold. Even with the back-and-forth, the Fed left its rate projections unchanged and signaled only one cut in 2026. Growth forecasts were nudged higher for both 2025 and 2026, and inflation expectations moved slightly lower, which helped justify the December cut. Unemployment projections stayed put, and the Fed feels it has enough stability to keep easing but not enough agreement to move quickly.

Dissent highlights widening gap in policy views

Growth upgrades suggest more confidence in momentum

Inflation projections inch lower across the board

Forward guidance points to a slower path in 2026

U.S. job openings rise in delayed JOLTS release

U.S. job openings increased to 7.67 million in October, inching higher from September’s revised 7.65 million in data delayed by the long government shutdown.

The September increase was unusually large at 431,000 and came in above expectations, mostly because of gains in trade, transportation and utilities, along with growth in health care and social assistance. Other sectors moved the opposite way, with declines in professional and business services, the federal government and leisure and hospitality. The regional picture also split, with the South and West seeing gains while the Midwest and Northeast softened. Because the shutdown pushed both months’ numbers into the same release, it will take a while for analysts to parse how much of the September jump came from late reporting. Even with the noise, the overall trend points to a labour market that is cooling but still flexible.

Trade and transportation drive most of the monthly gains

Shutdown timing adds noise to revised September data

Regional results show an uneven hiring landscape

Labour demand cools yet remains historically elevated

Like the PMI report I highlighted last week, the ISM Services report is another important signal most investors miss. I posted a quick breakdown this week on what the latest number means. Watch it here. |

Top Insights

The Fed’s divide is becoming the market story

I think the growing split inside the Fed actually matters more than the cut they delivered this month. Investors pay close attention to policy direction, and when the committee sends mixed signals, as it did this week, it raises the odds of sharp swings in pricing. The fact that three people voted against the move shows how unsure policymakers are about the next stretch of inflation data. No doubt that filters directly into market confidence.

What I will find interesting is how the Fed handles communication over the next few months. If the divide widens, we could see more moments where officials talk past each other and create confusion. A clear consensus would calm things down quickly, but it’s not obvious the committee is close to one. If I were a betting man, I’d bet against any significant consensus developing.

Canada’s economy looks sturdier than expected

It seems as though Canada’s recent growth surprise changed the tone around the Bank of Canada’s strategy. When the bank said the policy rate was about right (its code for patience) it was essentially saying that the third quarter GDP result gives it more cover to hold that line. This could help explain why policymakers sound comfortable staying put even as global risks continue to swing around.

The big thing for me is underlying inflation. If it keeps drifting toward the target range, the bank can extend this steady-hand approach longer than markets expected a few months ago. It sets up 2026 as a year where small shifts in consumer spending and labour conditions will matter a lot more than headline growth.

Labour demand in the U.S. still hasn’t cracked

Even with the noise from the shutdown, the JOLTS numbers tell a simple story: job openings are cooling, but not collapsing. This as a sign that the labour market is easing in a way the Fed probably likes, and it reduces wage pressure without signalling a major downturn.

What I’m watching next is whether the openings decline more consistently across regions rather than bouncing between them, as it has been doing lately. If things smooth out it would support the Fed’s case for further easing, but if we see a sudden drop, that could shift the conversation back toward recession risk.

TOP STORY

Fed Struggles To Find A Clear Path

A split committee leaves investors guessing on direction

Inflation outlooks vary widely across voting members

Growth concerns collide with lingering pricing pressure

Fed communication grows harder as divisions widen

We’ve seen no shortage of ink spilled over the Federal Reserve in 2025, and yes, I know I’m dating myself with that saying. It’s now heading into the new year without a shared view of where policy should go next, and the tension is showing. Some members want to ease sooner to protect softer growth, while others think inflation still has a bit too much energy left in it. The tone in the room has shifted from cautious agreement to something closer to open disagreement, and that makes it harder for anyone watching to get a clean read on what happens next. Instead of clarity, markets are getting mixed messages that reflect a committee that is simply not aligned.

Why The Debate Is Getting Louder

A big factor in the disagreement is that different regions are experiencing different economic rhythms, and that gap is feeding the internal friction. A few members worry that cutting too slowly will stall momentum, while others argue that moving too quickly risks undoing the progress made on inflation. It’s creating a tug-of-war where every comment lands with a bit more weight because it signals where each person stands rather than where the committee is heading as a whole.

What This Means For Early 2026

So where do we go from here? Well, I’m expecting more uneven communication until the data forces a clearer consensus. To make matters worse, if upcoming inflation readings land somewhere in the middle, the split could become even sharper. That might mean more back-and-forth in market pricing and more moments where the Fed feels the need to clarify what it actually meant. The next round of projections will be the first real test of whether this group can close the gap or has to navigate the year with an uncomfortable divide.

Read the full story here.

As I discuss in this week’s lead, the Fed’s internal split has become one of the biggest stories heading into the new year, and it’s creating a real gap in how people read the outlook. Some see inflation as the issue that still needs more work, while others think slowing growth deserves more attention. And the wildcard is that the Fed’s internals squabbles have been creating a buzz. What do you think? Vote on this week’s question.

What is the Fed’s biggest challenge right now? |

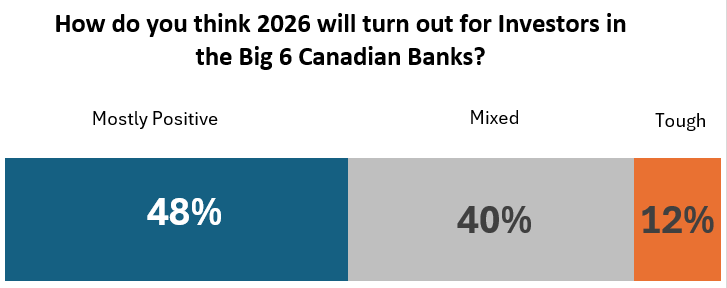

LAST WEEK’S POLL RESULTS

In last week’s poll, I asked how readers think 2026 will play out for investors in the Big 6 Canadian banks. Nearly half expected a mostly positive year, while 40% leaned toward a mixed outcome and a smaller group anticipated tougher conditions. It was a fairly balanced split, si it looks like most people see opportunity but still recognize the uncertainty ahead. Thanks to everyone who voted.

THE BANK OF CANADA

BoC Signals It May Hike Again

Inflation pressures still look too sticky for comfort

Growth remains soft but not weak enough for cuts

Officials hint the next move might be higher

Markets reassess expectations for early easing

A quick read of Bank of Canada Governor Tiff Macklem’s policy decision statement this week makes it clear the Bank is sounding less patient with stubborn inflation, and the tone is shifting toward the possibility of another hike. Policymakers are watching services prices that haven’t cooled as quickly as hoped, and they’re signalling that keeping rates steady is anything but guaranteed. The backdrop is tricky because growth has softened but not enough to convince the bank it can safely ease. That leaves the door open to a move that a lot of analysts thought was off the table a just few months ago.

Why A Hike Is Back On The Table

What we’re seeing is the underlying price pressures holding on longer than expected, especially in sectors tied to wages and housing. The bank is trying to balance that against consumers who are already stretched, but officials are worried that easing too early could reignite the problem. The message coming through is that inflation progress has not been smooth enough to rule out another push higher if the next few data points do not improve.

What To Watch Ahead Of The Next Meeting

The key question is whether incoming inflation readings show any real momentum downward. If they stall, the bank may feel it has limited room to wait. Even hinting at a hike is enough to shift market expectations, and investors are already starting to adjust their timelines for cuts. The next meeting, late next month, will hinge on whether the data finally breaks in the bank’s favour or forces a tougher call.

Read the full story here.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

TECHNOLOGY

Nvidia Finds A Way Back Into China

H200 chips return under revised export rules

Trump team signals a more flexible stance

China regains access to top tier AI hardware

Tech sector watches how far exemptions extend

Nvidia is getting a path back into China with H200 sales the company had previously been blocked from making, and the move gives us some insight into the Trump administration’s plans to handle tech exports. The change gives China access to high-end hardware again, although the final specs land slightly below the most advanced versions. For Nvidia, it reopens a massive revenue stream that had been effectively shut off, and for markets, it hints at a policy tone that could prioritize commercial interests over strict restrictions.

Why This Matters For The Tech Supply Chain

A partial reopening means Chinese buyers can rebuild AI capacity without relying entirely on local substitutes. That reduces pressure on domestic chip efforts and gives global suppliers more room to operate, and it also sets a precedent for other tech firms hoping for similar flexibility under the new rules. The open question is how tightly Washington plans to monitor performance thresholds so the policy doesn’t drift too far from national security goals.

What Investors Are Watching Next

The first sign of where this goes will be how quickly orders ramp up and whether competitors try to push for their own exemptions. For now, Nvidia’s ability to supply China without crossing red lines will shape how broad this easing becomes. The next few months will show whether this was a one-off adjustment or the beginning of a wider policy reset.

Read the full story here.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

INTERNATIONAL TRADE

IMF Pressures China To Fix Trade Imbalances

Fund warns surplus remains too large to ignore

Calls for stronger household demand and structural reform

Concerns rise over weak confidence and slowing investment

Global partners watch how Beijing responds next

The International Monetary Fund is urging China to address its widening trade surplus and the structural issues sitting underneath it, and the message is more pointed than we’re used to seeing. The fund wants Beijing to boost household demand, cut back on policies that favour export-heavy industries and address the imbalances that have been building for years. In China, confidence remains soft, private investment is lagging and the overall policy mix is still tilted toward production rather than consumption. What the IMF is essentially saying is that the current path isn’t sustainable, and the rest of the world is paying attention.

Why The IMF Is Turning Up The Heat

One of China’s mixed blessings is that its economy is large enough to have a huge influence on global trade patterns, but operating with a persistent surplus means other countries are feeling the pressure. The IMF argues that shifting toward consumption-led growth would stabilize demand internally while easing external tensions. The bigger concern is that households remain cautious, and stimulus aimed at industry hasn’t done much to change that. Without a pivot, the imbalance becomes harder to unwind later.

What This Means For Global Markets

Investors will be watching for signs that Beijing is ready to comply and broaden its toolkit, especially if confidence does not improve. A policy shift toward consumers could support global demand and reduce friction with trading partners, but if that doesn’t happen, the pressure for more trade actions from other countries may rise.

Read the full story here.

OTHER NEWS FROM THE PAST WEEK

Trump tariffs are killing farmers but new aid is on its way

The administration is weighing another round of farmer support as tariff tensions with China resurface, raising questions about how much aid producers may receive and whether the move signals a broader shift in trade strategy.

How many billions did you give away this year?

MacKenzie Scott announced another significant set of unrestricted donations aimed at community based groups, reinforcing her approach of fast, flexible philanthropy and adding fresh momentum to nonprofits preparing for a challenging year.

McDonald’s pulls Dutch AI powered Christmas ad after backlash

McDonald’s removed a Dutch Christmas ad created with AI following public criticism, prompting a wider conversation about brand authenticity, creative standards and how companies decide when automated campaigns cross a line.

How do get your sweat to smell like cookies

Dove and Crumbl introduced a holiday themed collaboration featuring skincare products and matching cookie flavours, blending two distinct brands in a campaign designed to spark seasonal buzz and attract cross category shoppers.

RBC sees rising entertainment spending across sports and concerts

New RBC data shows Canadians funnelling more discretionary spending toward sports, concerts and live entertainment, suggesting households are prioritising experiences even as broader budgets stay tight and overall consumer patterns remain uneven.

Mars prepares to close its $36 B Kellanova acquisition

Mars is set to finalize its massive Kellanova acquisition after securing EU approval, marking a major expansion in its snack portfolio and signalling continued consolidation momentum across global packaged food companies.

Market Movers

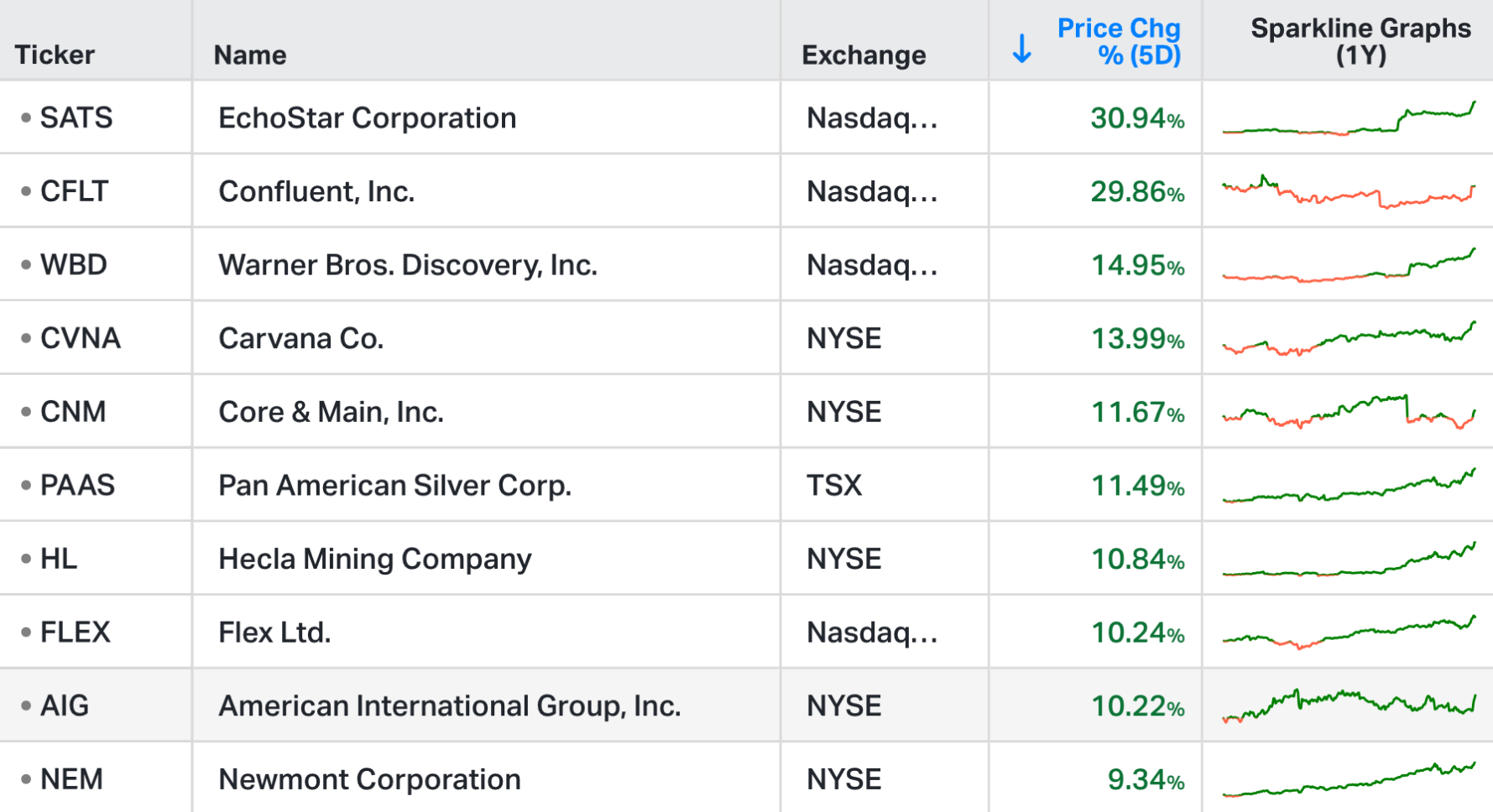

Top 10 Weekly Gainers

Week ending December 12, 2025 | Biggest Gainers

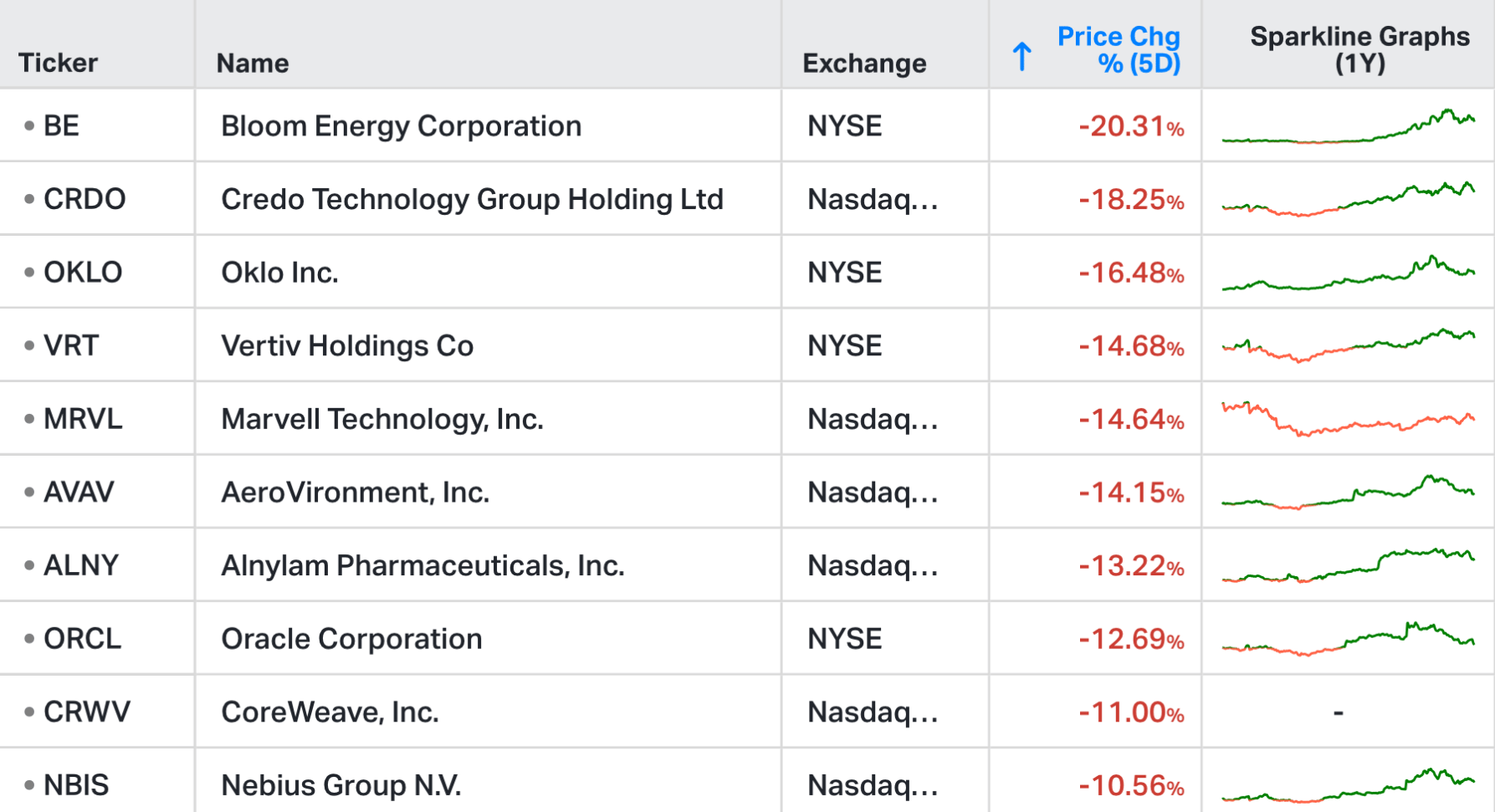

Top 10 Weekly Losers

Week ending December 12, 2025 | Biggest Losers

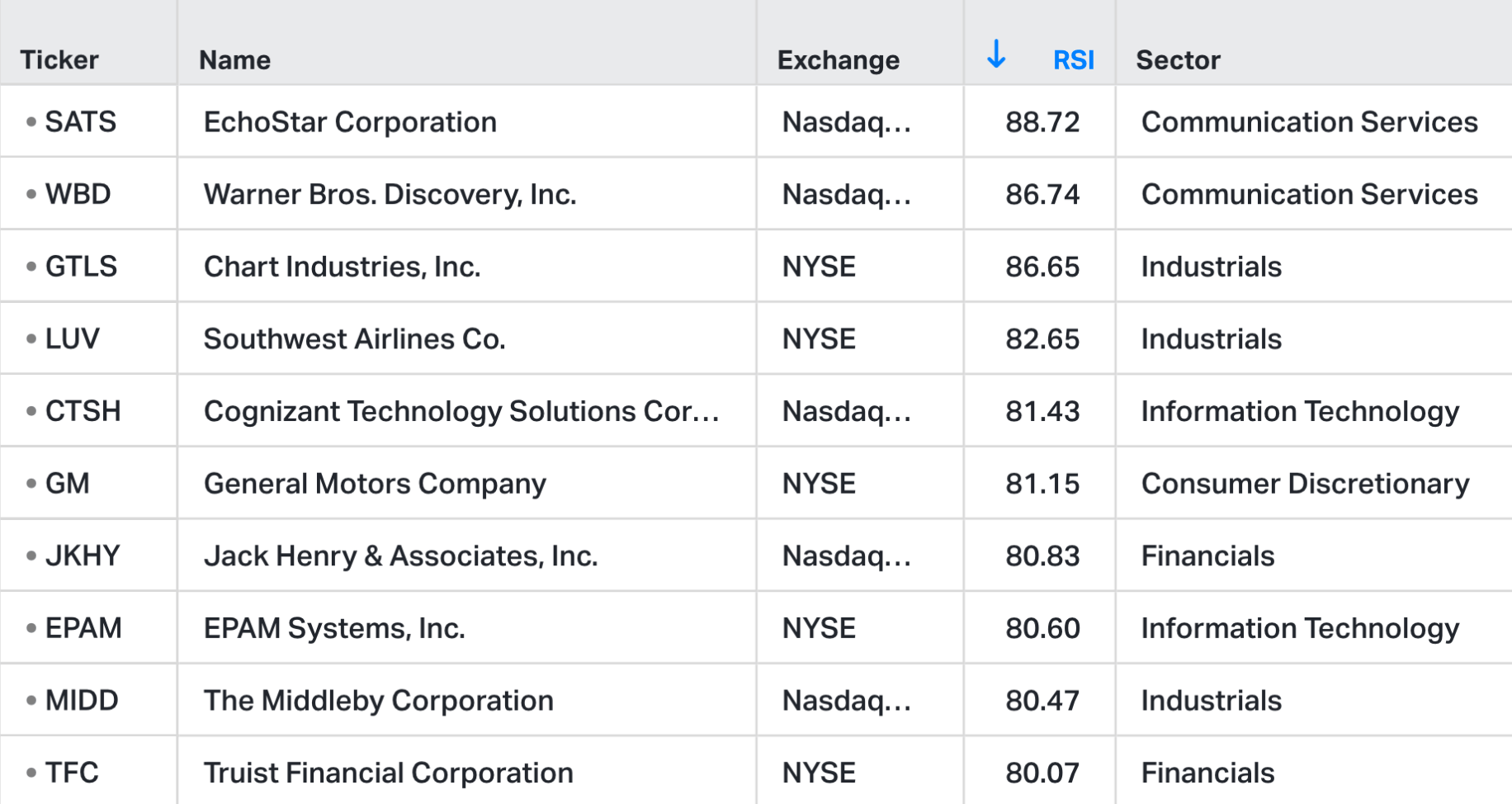

10 Most Overbought Stocks

Week ending December 12, 2025 | Most Overbought Stocks, based on 14-Day RSI

10 Most Oversold Stocks

Week ending December 12, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply