- The Pulse Newsletter

- Posts

- Big Six banks signal a slow path into 2026

Big Six banks signal a slow path into 2026

Plus, EU fines X, Canadian Housing Charges Jump, Blockbuster Netflix Deal

The Week in Review

Weekly Market Recap: U.S. and Canada

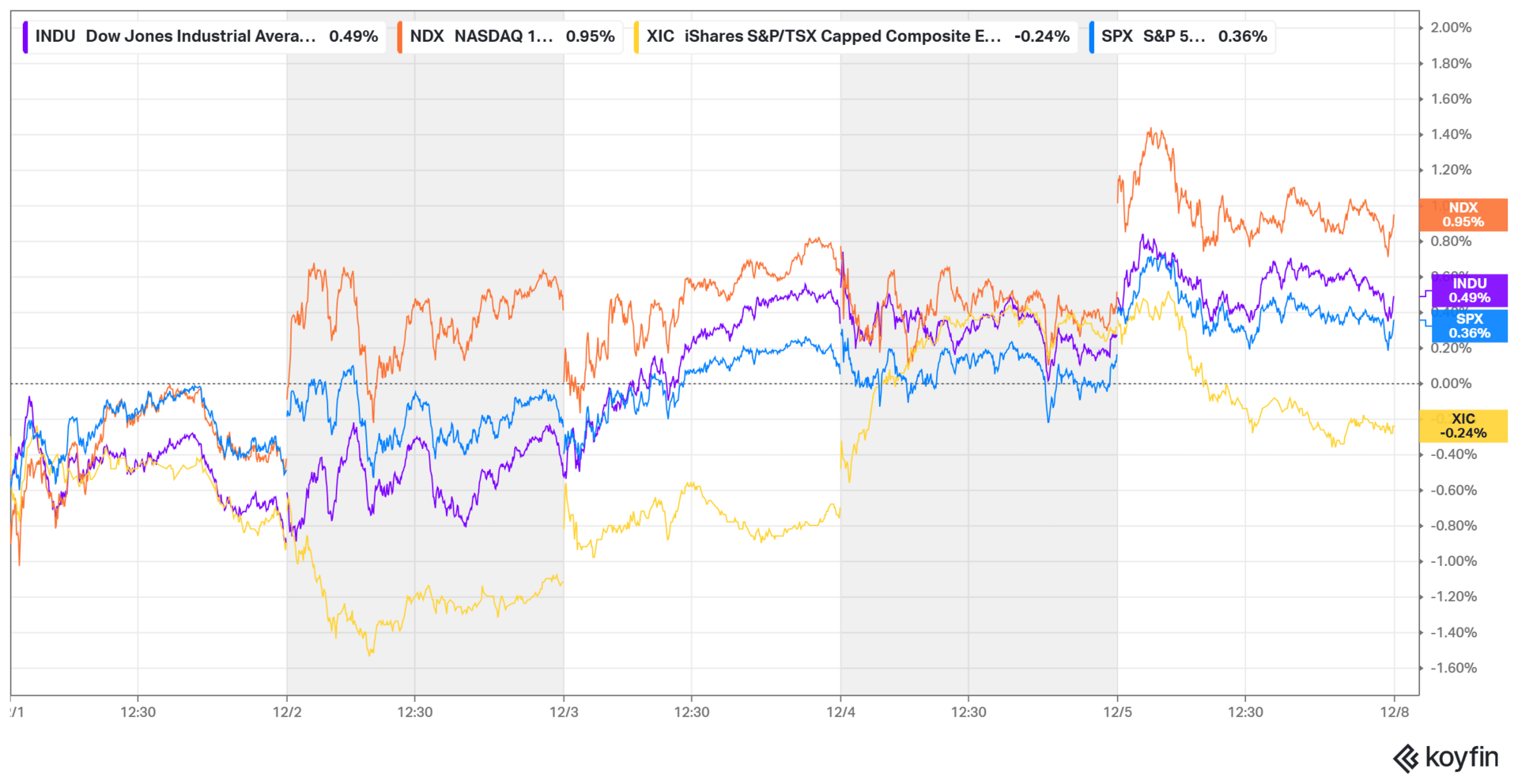

For the most part, I’m going to call it a cautiously-positive week in the markets, with most major indices slowly grinding higher. Tech outperformed again, helping to lift overall sentiment, but the market here at home stayed under pressure as commodity-linked names lagged. The general tone felt steady rather than enthusiastic, and the markets held on quite well.

For the week, the Nasdaq 100 led with a 0.95% gain, the Dow rose 0.49% and the S&P 500 added 0.36%. The TSX slipped 0.24%, which lines up with the softer mood in Canadian resources and interest-sensitive sectors.

Week ending December 5, 2025

Major Economic Stories

Recap of the Week

The economic focus this week was on the latest unemployment report in Canada and fresh inflation numbers out in the U.S. We also got the latest consumer sentiment report.

Here’s how things played out this week.

Canada’s Unemployment Rate Shows a Sharp Improvement

The latest jobs report brought a notable shift in Canada’s labour market.

The unemployment rate in Canada fell to 6.5% in November, helped by an 80,000 drop in the number of unemployed. Net employment rose by 54,000 in November, and that’s now the third straight month of improvement and pushing total employment to 21.14 million. Part-time work drove the gains, with 63,000 new positions and nearly 18% of workers saying they accepted those roles involuntarily. That’s a pretty high chunk. The labour force edged slightly lower, taking the participation rate down to 65.1%. Looking at the job creation numbers, it just might be a sign of a market that is gradually healing after a year of rising joblessness.

Unemployed population declined sharply from October levels

Part-time hiring accounted for most of November’s job gains

Participation rate slipped as labour force contracted modestly

Involuntary part-time share held steady near last year’s trend

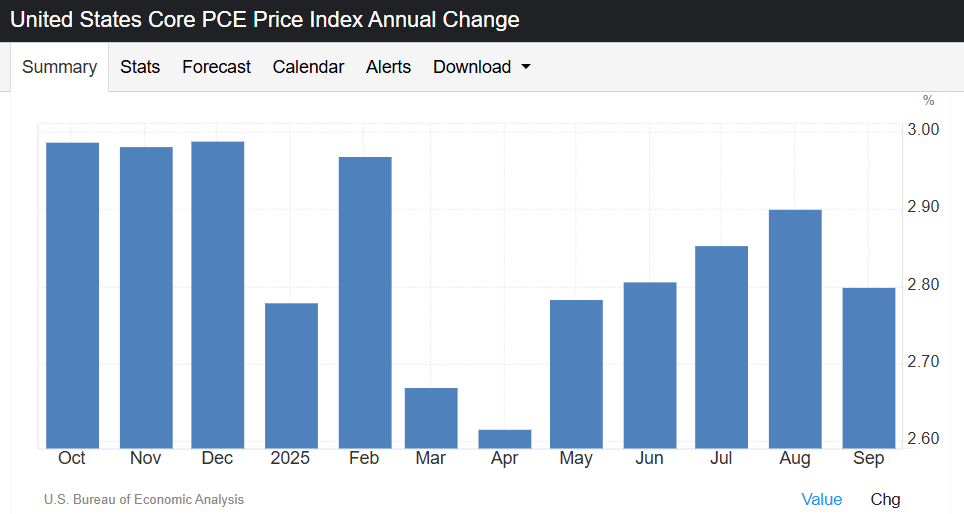

US Core PCE Inflation Holds Steady in September

A key measure of US inflation delivered a familiar reading, once again.

Core PCE in the U.S. increased 0.2% month over month, matching July and August and landing exactly where markets expected. On a yearly basis, the index rose 2.8%, keeping inflation above the Federal Reserve’s comfort zone. The consistency of the Core PCE will give policymakers a bit more confidence that underlying price pressures are slowly normalizing, but services inflation remains sticky enough to prevent any firm conclusions about the timing of rate cuts.

Monthly core PCE maintained a stable three-month pattern

Annual inflation stayed above the Fed’s preferred target

Services costs continued to hold inflation elevated

Market expectations aligned closely with September’s reading

US Manufacturing PMI Signals Deeper Contraction

The US factory sector weakened again as new data pointed to ongoing stress.

The ISM Manufacturing PMI fell to 48.2 in November, its lowest in four months and the ninth straight month in contraction territory. New orders, employment and supplier deliveries all softened, with most firms still prioritizing head count management over hiring. Inflation pressures intensified as the prices index rose, while backlogs shrank further. The one bright spot came from a rebound in production, though not strong enough to offset broader weakness. ISM noted that 58% of the sector’s GDP contracted during the month, with a slightly smaller share in deep contraction.

New orders and employment fell further from October levels

Price pressures firmed as production staged a mild rebound

Manufacturing logged a ninth month of contraction in November

Backlogs weakened again, pointing to soft demand conditions

The PMI number is important to understand, and it’s largely underappreciated by most investors. I posted a more comprehensive YouTube video this week speaking to this metric, and you can watch it here. |  |

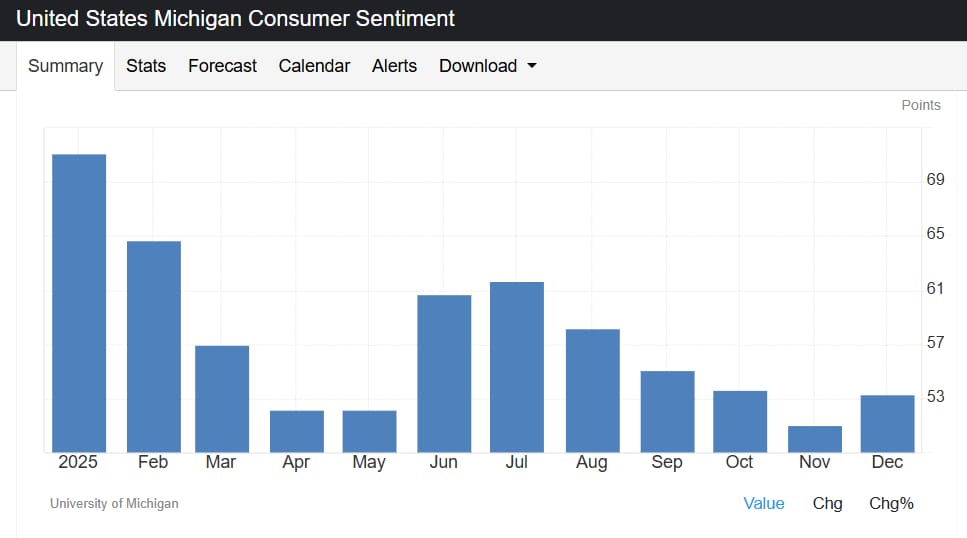

Consumer Sentiment in the US Shows a Rare Uptick

A closely watched confidence gauge delivered its first improvement in months.

The University of Michigan index rose to 53.3 in December from 51, breaking a five-month slide and surprising forecasters. Expectations strengthened noticeably, helped by a 13% jump in anticipated personal finances among younger consumers. Inflation expectations eased as concerns about tariff-driven price spikes failed to materialize. One-year expectations fell to 4.1% and five-year expectations eased to 3.2%. Even with the improvement, respondents remained historically pessimistic about labour conditions, and uncertainty around price trends stayed elevated.

Consumers reported better financial expectations for the year ahead

Short- and long-term inflation outlooks softened in December

Confidence improved for the first time in five months

Sentiment readings remained low relative to historical norms

Top Insights

A Turning Point in Canada’s Labour Market?

I can’t help but wonder (ok, maybe ‘hope’ is the better word) if the drop in Canada’s unemployment rate is more meaningful than just a single-month blip. The drop in the number of unemployed Canadians was far larger than the small pullback in the labour force, and that tells me real hiring momentum is picking up. Three months of consistent employment gains is a pattern you want to see when trying to figure out whether the labour market is stabilizing after such a long cooling phase.

What I’m watching now is the quality of those jobs. Part-time roles drove the gains, and nearly one in five workers said they were taking those positions involuntarily. That combination tells me that employers are still cautious about long-term commitments, even if short-term demand is improving.

Inflation Progress in the US Remains Uneven

The rock-solid steadiness of core PCE at 0.2% for the third straight month tells me inflation progress is real, but not yet decisive. It’s encouraging to see that dip in the Core PCE annual change, but services inflation is still the sticky part of the story. The Fed is still going to want several more months of this clean, low-volatility data before they signal stronger confidence that inflation is on a sustainable downtrend.

From a market perspective, investors are going to have to square two things: inflation that is moving in the right direction and growth data that is softening around the edges. That mix will keep rate-cut expectations alive, but not on a fixed schedule.

Manufacturing Weakness Is Becoming Harder to Ignore

The latest ISM report is another reminder that the US manufacturing sector is still under strain. Nine straight months in contraction territory is not something markets should easily brush off. You add to that the declines in new orders, employment and supplier deliveries, and it points to deeper demand issues. Also, the shrinking backlog is likely due to firms working through past orders without replenishing pipelines.

What stands out to me is the widening contrast between manufacturing and services. A mild rebound in production isn’t enough to counterbalance the broader deterioration. If this trend persists into the first quarter of 2026, it could influence both earnings expectations and how the Federal Reserve evaluates downside risks to the economy. My last point on this is that we should be watching for any sign that the slowdown spills into other sectors.

TOP STORY

Big Six Banks Post Mixed Year-End Results

Net interest income slipped as loan growth cooled again

Capital markets bounced back but still felt inconsistent

Banks tightened costs with more visible staff reductions

Credit loss provisions stayed high as households felt the strain

I thought I’d have a look at this week’s earnings reports of Canada’s biggest banks, which all reported during the week. A summary or recap, you might say. Overall, The Big 6 wrapped up the quarter with results that felt a bit uneven, which pretty much lines up with how the whole year has gone. Loan growth was soft almost across the board, so net interest income didn’t have much room to run. Capital markets were better, but not in a way that makes you think the wind is fully at their backs yet. And the cost cutting is now hard to miss. Several banks trimmed staff as they try to keep margins from slipping further. Credit conditions haven’t eased either, and the elevated provisions show that households are still having a tough time absorbing higher borrowing costs.

Earnings Diverge Across Business Lines

Business remained tricky on the consumer side of things, since anything tied to higher rates is still dragging. Some banks made up ground through wealth and insurance, while others leaned on fee income to balance out tighter spreads. Deal flow improved a touch, though nowhere near the busy years before 2022. A lot of banks talked about digital upgrades as a way to keep long-term costs in check, which feels like the direction the whole sector keeps inching toward.

Looking Ahead to 2026

A common theme this quarter is that executives are sounding cautious about next year, and I don’t think that’s overly surprising. Loan growth will likely stay sluggish and credit risk will hang around the edges. Capital markets might get a bit more lift if issuance improves, but that’s hardly guaranteed. Cost restructuring looks set to continue into 2026 as banks try to protect profitability in a slow-growth environment.

Read the Globe & Mail full breakdown here.

As I covered in this week’s top story, Canadian bank earnings have been choppy this year, and a lot of the big themes heading into 2026 feel unsettled. Loan growth is still soft, credit losses are hanging around, and cost cutting has become a clear priority for the sector. With so many moving parts, investor sentiment is split on whether next year brings relief or just more of the same. Please vote on this week’s question:

How do you think 2026 will turn out for Investors in the Big 6 Canadian Banks? |

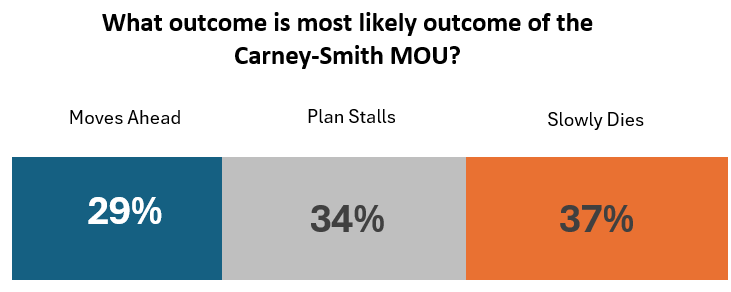

LAST WEEK’S POLL RESULTS

In last week’s poll, I asked what readers thought was the most likely outcome of the Carney Smith MOU. The top pick was that the plan would slowly die, with 37 percent choosing that option. Thirty four percent said the plan would stall, while 29 percent expected it to move ahead. Thanks to everyone who voted.

Reader Comments

Ok, so this is strange. Last week, I noted that a technical glitch didn’t allow user comments after their votes. I thought we had that fixed, but this week there were no votes, again. So…. somebody, anybody, please comment with your vote so I’ll know what’s going on! Maybe it was just a busy week and nobody had time to share their thoughts? Thank you, and I will report back. 😳

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

CANADA’S HOUSING MARKET

CMHC Flags Developer Fees as a Growing Cost Driver

Municipal fees can add over $100,000 to new homes

Charges vary widely and often feel disconnected from costs

Builders say rising fees leave little room to price affordably

CMHC warns current system could make affordability worse

I try and mix it up here in The Pulse, but it seems as though I could cover a housing story every single week. I am going to stick with the topic for at least this week, and I note that the CMHC has taken a hard look at development fees and basically confirmed what a lot of people in the industry have been saying for years. In some cities, the fees alone can push a project more than $100,000 higher, which makes it incredibly tough to build anything aimed at the middle of the market.

One thing that jumps out is how inconsistent the costs are from one municipality to another. That creates uncertainty even before a shovel hits the ground. Builders say they just do not have the margins to absorb these increases any more, so the costs end up with the buyer. CMHC didn’t mince words: if governments are serious about affordability, the fee structure cannot be left as is.

What’s Inside the Cost Breakdown

A chunk of the fees come from things like servicing, parkland and infrastructure charges, and many of these have risen faster than actual construction costs. Municipalities lean on them to keep their budgets together, which makes meaningful reform politically tough. Developers also said the unpredictability of fees makes early-stage planning far more complicated than it needs to be.

Where This Could Go Next

CMHC hinted pretty strongly that provinces may have to step in if municipalities will not revisit their frameworks. The broader risk is that high fees push developers toward higher end builds where the math works better, and that again leaves the attainable segment even further behind. The big debate points now are everything from fee caps to targeted exemptions, and we’ll have to see if any changes in those areas can nudge more mid-priced housing into reality.

Read the full story here.

MERGERS AND ACQUISITIONS

Netflix Moves to Acquire Warner Bros Discovery

Deal would combine two huge entertainment catalogues

Regulators already signaling they’re uncomfortable with the scale

Creators worry about bargaining power concentrating again

Viewers could see another major reshuffling of content

If you’re following the big news in the media space this week, you might have noted the crazy culmination of what turns out to be the myopic remark by Jeff Bewkes, then CEO of Time Warner. Fifteen years ago this month, he said: “It’s a little bit like, is the Albanian army going to take over the world? … I don’t think so.”

“It’s a little bit like, is the Albanian army going to take over the world? … I don’t think so.”

Bewkes was commenting on the potential ‘threat’ of the DVD-by-Mail company, Netflix. How quant.

Well, fast forward those 15 years and we get to this week’s announcement that Netflix is buying Warner Bros Discovery for USD $75 Billion. If the deal goes through, Netflix will control an enormous amount of the film and TV landscape. Regulators are already looking at it with skepticism though, which doesn’t seem unreasonable given how much influence the combined company would have. Creators and studios are also uneasy because consolidation usually means fewer negotiating options. For viewers, it probably means another round of guessing where your favourite shows end up as everything gets re-bundled and re-licensed.

How the Market Is Reacting

Analysts are split on the deal. Some see this as Netflix locking in its long-term dominance now that subscriber growth is harder to come by. Others think it shows just how tough the streaming economics have become, especially for a company like Warner Bros Discovery that has been wrestling with debt. A big unanswered question is what happens to iconic franchises and whether theatrical windows get squeezed even tighter.

What to Watch Going Forward

The regulatory review is going to be the main event, and it could drag on for a long, long time. Even if the deal does eventually clear, merging two enormous creative operations is not simple. There’s also a decent chance regulators attach conditions that reshape how licensing or exclusivity works. One way or another, this deal is going to change the streaming landscape for years.

Learn more here.

INTERNATIONAL TRADE & REGULATION

Europe Pushes Ahead With Big Tech Crackdown

EU leans into stricter rules even as US backs away

X gets hit with a major fine under new digital rules

Regulators say platforms still nowhere near full compliance

US–EU tension rising over tech governance priorities

lower prices and more choice if rules change

I’ve always noted how aggressive the EU is when it comes to regulation. This week, we hear that Europe is doubling down on its Big Tech crackdown, and it isn’t doesn’t seem to care much about Washington reacts or at least isn’t waiting to find out. The latest move is a hefty €120 million (CAD $195M) fine against X for falling short of the Digital Services Act, which the EU considers its baseline for responsible platform management. European regulators say the big platforms just aren’t meeting the transparency and enforcement standards they’re supposed to, and they seem pretty comfortable escalating. The US administration, on the other hand, is signalling that the EU may be going too far, and that sets up a messy argument about who gets to shape the rules of the internet.

Why This Matters for the Industry

The DSA has some real teeth, from algorithmic disclosures to strict takedown requirements, and many companies have been struggling to keep up. A few have warned that compliance changes could be costly enough to alter how they operate in Europe altogether. The EU, though, appears ready to prioritize regulation over industry frustration.

How Splintered Might Things Become?

The risk here is a more fractured digital landscape where companies have to maintain one compliance playbook for Europe and a completely different one for the US. It kind of reminds me a lot of the global banking rules that came about after 2008, where every region built its own framework. For now, the EU is pressing ahead even if it means a diplomatic standoff.

Read the full story here.

OTHER NEWS FROM THE PAST WEEK

Food price report says grocery inflation may ease in 2025

Canada’s latest food price outlook suggests grocery inflation could cool next year as supply chains stabilize, though higher labour and transportation costs may still keep some categories elevated for households already stretched.

Laurentian Bank announces sale to Fairstone and National Bank

Laurentian Bank is set to be split between Fairstone and National Bank, ending months of uncertainty and raising questions about how the deal will reshape competition and customer experience in Canada’s mid-tier banking market.

Cow Shortage? Canadian butchers feel pressure as beef prices stay high

Independent butchers say historically low cattle herds are keeping beef prices high, squeezing margins and forcing some shops to rethink product mixes as customers shift toward cheaper cuts and alternative proteins.

New York Times sues Perplexity AI for illegal content copying

The New York Times is taking Perplexity AI to court over allegations of large-scale content copying, raising fresh questions about data use, copyright boundaries and how newsrooms navigate rapidly evolving generative AI tools.

Coffee prices climb as supply issues ripple through global markets

Coffee drinkers are seeing higher prices as poor harvests and weather-related disruptions tighten supply, leaving cafés and roasters with little choice but to pass increased costs on to consumers already noticing pricier cups.

Michael Jordan set to testify in NASCAR antitrust trial

Michael Jordan is expected to testify in a major NASCAR antitrust trial involving race charter rules, adding star-power and sharper scrutiny to a case that could reshape how teams negotiate revenue and competitive access.

CIBC flags stretched sentiment as investors worry about stocks

CIBC says investor sentiment looks increasingly fragile, with worries about valuations and slowing growth pushing more people toward defensive positioning as markets wait for clearer signals on rates, earnings and economic direction.

Airbus shares fall on reported A320 quality issue

Airbus shares slipped after reports of a potential quality concern involving A320 aircraft components, prompting questions about inspection timelines and whether any manufacturing adjustments will be needed to prevent delivery delays.

US to charge $45 fee to airline passengers without Real ID

Air travellers without Real ID credentials will face a new $45 fee at security, a move officials say will streamline screening but may frustrate passengers still navigating the long lead-up to nationwide compliance.

Taiwan bans China’s Xiaohongshu over national security concerns

Taiwan has banned the Chinese social app Xiaohongshu, citing national security risks and data access concerns, marking another escalation in digital governance tensions between Taipei and Beijing as elections approach.

Market Movers

Top 10 Weekly Gainers

Week ending December 5, 2025 | Biggest Gainers

Top 10 Weekly Losers

Week ending December 5, 2025 | Biggest Losers

10 Most Overbought Stocks

Week ending December 5, 2025 | Most Overbought Stocks, based on 14-Day RSI

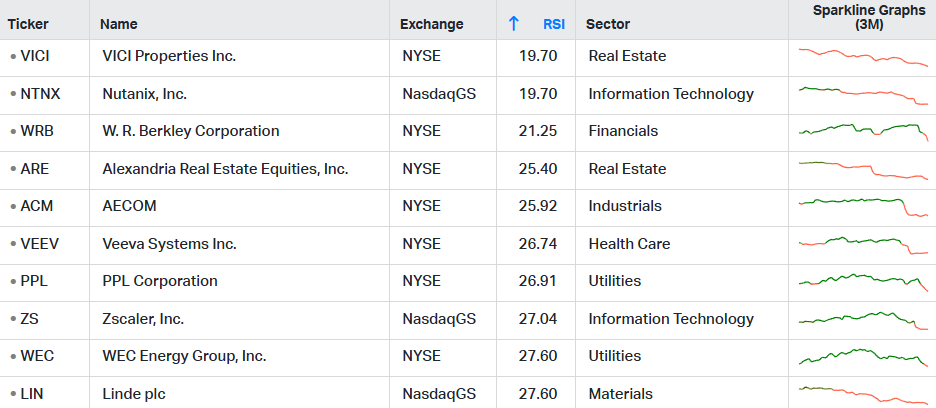

10 Most Oversold Stocks

Week ending December 5, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply