- The Pulse Newsletter

- Posts

- Betting Markets or Insider Trading?

Betting Markets or Insider Trading?

WestJet Seat Controversy, GTA Home Sales Slide, , Micron Supply Squeeze, Trump Courts Oil

It’ Saturday, January 10, 2026. A single trade turned $30,000 into $400,000, AI servers are eating the world’s memory supply, and Westjet is testing how little legroom passengers will tolerate.

Those are just a few of the stories I’m covering this week. I’m also looking at why GTA home sales stayed weak even as prices fell, and why oil executives aren’t lining up to invest in Venezuela even after a dramatic political shift.

If you’re a new reader to The Pulse, welcome! If you’re a long-time reader, thanks for sticking around. I trust you’ll enjoy this week’s edition.

Market Recap: U.S. and Canada

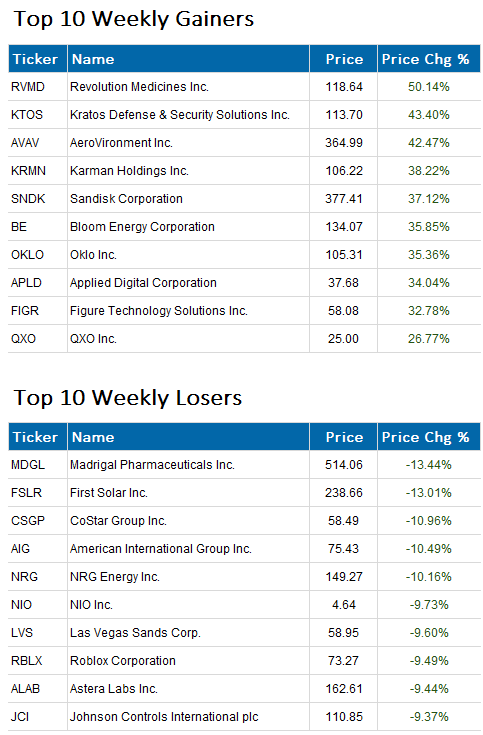

As we ease our way into 2026, we enjoyed a week of strong markets, with a pretty clear risk-on tone across North American equities. As usual, we had to endure the requisite volatility (that’s obvious by the chart), but we did see strong leadership in both growth and momentum areas, and the broader benchmarks all moved higher.

As for the numbers, the TSX led the way, up 2.34% on the week, the S&P 500 gained 1.57%, the Dow Jones added 2.32%, and the Nasdaq 100 climbed 2.29%. That’s a nice mix of broad strength, which usually signals investors are feeling a bit more comfortable leaning back into upside.

Week ending January 9, 2026

Major Economic Stories

Economic Recap

It was all about jobs this week, both in Canada and the U.S., as the economic data gave us more signs that labour markets are cooling even as job growth keeps grinding along.

Here’s how things played out this week.

Canada’s Job Market Lost Traction

Canada’s unemployment rate rose to 6.8% in December 2025, up from 6.5% in November.

It looks like supply is part of the story as more people stepped back into the labour force. The number of unemployed increased by 73,000 to 1.6 million, while the labour force grew by 81,000 and pushed the participation rate up to 65.4%. Net employment still eked out a gain of 8,200, which extends a four-month run of improvements. Full-time jobs rose by 50,200 while part-time work fell by 42,000, which is a cleaner mix than the headline might suggest. The market is still adding jobs, but not fast enough to absorb everyone who wants one.

Labour force growth is now lifting unemployment mechanically.

Full-time gains help, but hiring momentum looks uneven.

Higher participation suggests confidence, not just joblessness.

Watch wage growth next for inflation pressure clues.

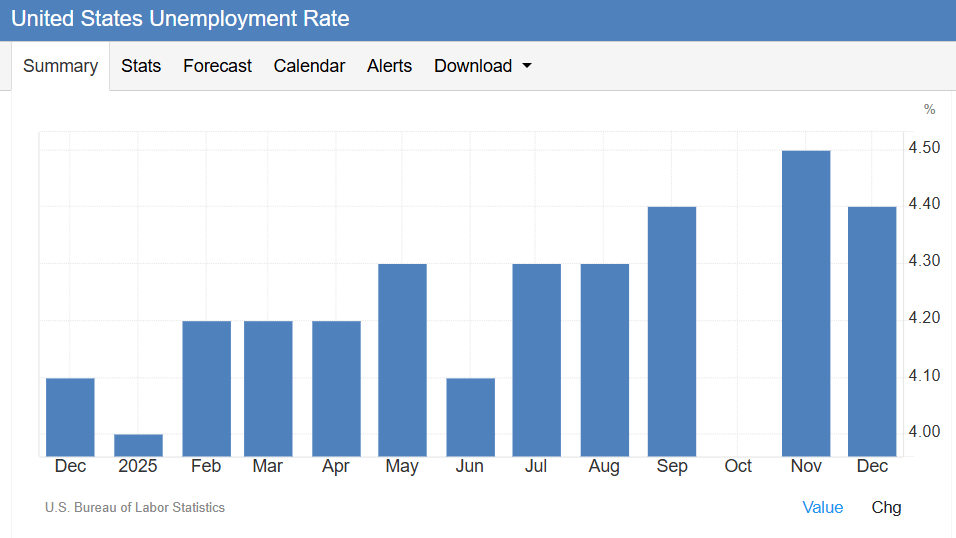

U.S. Unemployment Rate Ticked Lowed

The U.S. unemployment rate edged down to 4.4% in December 2025 from 4.5%

Details hint at a labour market that’s cooling, not re-accelerating. The number of unemployed fell by 278,000 to 7.50 million, while employment rose by 232,000 to 163.99 million. At the same time, the labour force shrank by 46,000, and that nudged the participation rate down to 62.4%. The broader U-6 measure (which measures the share of people who are unemployed, discouraged from looking for work, or stuck working part-time when they want full-time jobs) eased to 8.4%. That’s encouraging, but it still points to a fair bit of slack under the surface. The net effect is the headline improved, but the participation dip is something I wouldn’t ignore

A lower participation rate can flatter unemployment readings.

U-6 easing says underemployment pressures are slowly fading.

Hiring is still positive, just less uniformly strong.

Issues under the surface are still lingering.

Payroll Growth Is Slowing, and Revisions Aren’t Helping

The U.S. added 50,000 payrolls in December 2025, below 56,000 in November and under the 60,000 expectation, and the bigger story may be how much the past few months were marked down. October was revised down by 68,000 to -173,000, and November was revised down by 8,000 to +56,000, leaving the two-month total 76,000 lower than previously reported.

Gains clustered in food services and drinking places (27,000), health care (21,000), and social assistance (17,000), while retail trade cut 25,000 jobs. Over full-year 2025, payrolls rose by 584,000, averaging 49,000 per month, a big step down from 2024’s pace.

Downward revisions change the narrative more than headlines.

Services are carrying growth while retail sheds workers.

2025 hiring pace looks meaningfully slower than 2024.

Net effect points to a slowing labour market.

Job Openings Keep Falling, Bargaining Power Wains

U.S. job openings dropped to 7.146 million in November 2025, down 303,000.

The biggest declines came in accommodation and food services (-148,000), transportation and warehousing (-108,000), and wholesale trade (-63,000), while construction bucked the trend with a 90,000 increase. Hires and total separations held steady at 5.1 million, and quits were little changed at 3.2 million, which suggests the cooling is happening more through fewer new postings than outright job losses. Regionally, openings fell across the Northeast, South, Midwest, and West, so it was broad.

Fewer openings usually means slower wage growth later.

Cooling is broad across regions, not just one sector.

Stable quits suggest workers still feel relatively secure.

Construction strength may reflect backlog, not fresh demand.

TOP INSIGHTS

A Cooler Labour Market Changes The Whole Rate Story

I think the most important shift in the news this week is that the labour market is cooling in a way that tends to show up first in openings and hiring momentum, not in big layoff headlines. (Although we’ve seen plenty of those.) When openings slide and payroll growth settles into a lower gear, which is what we’re seeing, inflation pressure from wages usually eases next. That matters for markets because it changes how investors price the path of interest rates, and it matters for households because borrowing costs and mortgage renewals are basically downstream of that rate path.

From a real-world perspective, this looks like fewer “easy” job switches and less negotiating leverage, even if people are still employed. It can mean longer job searches for anyone re-entering the workforce, and slower wage gains for people hoping to catch up to higher everyday costs. What I’m watching next is whether participation stabilizes and whether wage growth cools without unemployment jumping sharply, because that’s the line between a soft landing and something not so soft, I guess you could say.

Canada’s Unemployment Uptick Looks Supply-Driven

Canada’s unemployment rate moved higher at the same time employment still grew, and that combination is a classic reminder that labour supply can swing the headline. More people looking for work is not inherently a bad thing, and it often reflects confidence, immigration flows, students, or people re-entering after time away. But it does create a tougher near-term reality: even with job gains, not everyone finds a spot right away.

For households, this is the environment where competition for roles feels a bit sharper, especially in entry-level and mid-career positions. It can also influence consumer confidence, which then feeds into spending and the housing market. What we should be watching for next is whether full-time growth continues and whether we see signs of wage pressure cooling, because that’s where the Bank of Canada’s reaction function tends to show up in a very real way.

Revisions Are The Quiet Headlines

They’re not as sexy as the headlines, but I pay a lot of attention to revisions because they change the story investors thought they were trading. When prior months get marked down, it often means the economy had less momentum than originally assumed, and that can shift expectations for earnings, credit conditions, rate policy, etc. Even if the current month looks “fine,” a weaker trend line can reprice risk pretty quickly.

Slower trend tends to hit the most rate-sensitive corners first, like hiring plans and retail staffing. It also changes how confident consumers feel about taking on new payments, whether that’s a car loan or a home upgrade. The next big question is whether job losses stay contained in the coming reports, because slowing hiring is manageable, but rising layoffs is where sentiment can turn quickly.

TOP STORY

Prediction Markets: The Biggest Scam?

A single Venezuela bet turned $30,000 into $400,000.

These platforms let people trade yes or no outcomes.

In the U.S., they’re regulated like financial derivatives.

Canada bans binary options, yet access remains patchy.

I’ll going to level with you right up front here: I don’t like the growing Prediction Market craze. I think it’s interesting, modern, progressive, intriguing… but in its current form, it’s dangerous.

If you’re not familiar with them, prediction markets are basically betting exchanges for real-world events, where you buy and sell “yes” or “no” shares on outcomes ranging from Oscar nominations to geopolitics. This week, they were front and center after heavy wagering followed the U.S. military operation in Venezuela that removed President Nicolás Maduro. One anonymous trader put more than $30,000 US on Maduro being ousted by the end of January, right before the operation, and later walked away with over $400,000 US. That kind of timing has pushed the obvious question to the centre: are these markets just a fun forecasting tool, or a new place for privileged information to get monetized? Or as I’d call it; outright fraud.

From Sports Betting to “Financialize Everything”

Unlike sportsbooks, prediction markets generally don’t act as the house. Users are effectively trading against other users (or a market maker), while the platform takes small transaction fees. Supporters argue the prices reflect a “wisdom of crowds,” which is why media outlets have started integrating prediction-market odds into coverage. The space has also scaled quickly: one report cited by CBC says monthly bet volume across five major markets grew from about $100 million US in early 2024 to over $13 billion US.

The Insider-Trading Problem

In the U.S., these platforms are treated like financial products, overseen by the Commodity Futures Trading Commission, which has rules around fraud, manipulation, and insider trading. After the Venezuela wager, Rep. Ritchie Torres said he plans legislation to bar government officials from using privileged information to bet. But enforcement is tricky when users are anonymous and transactions run through cryptocurrency. In Canada, binary options have been banned nationwide since 2017, and regulators say prediction markets could still be considered securities or derivatives. Enforcement has been limited, though Ontario banned and fined Polymarket in 2025, and Canadians can still often access platforms outside Ontario.

I’d really like to hear your thoughts on these markets. Answer this week’s poll question and please take an extra minute to leave a comment and share your thoughts.

Full story here.

Prediction markets have moved quickly from niche platforms into mainstream headlines, especially as large sums of money flow into bets on elections, wars, and political outcomes. Supporters argue they surface useful signals, while critics (yours truly included) worry about insider information, manipulation, and weak oversight. Please vote on this week’s question:

Weigh in with your thoughts on this week’s question:

What should governments do about prediction markets overall? |

LAST WEEK’S POLL RESULTS

In last week’s poll, I asked what the biggest risk is to Canada and the U.S. reaching a fair CUSMA/USMCA agreement. Most of you picked one-sided concessions (53%), with political flair-ups next (37%) and talks dragging a distant third (10%). Thanks to everyone who voted.

READER’S COMMENTS

One-Sided Concessions

"I really hope this will not happen because President Trump is a taker. I hope Canada won’t offer anything nice to the U.S before the negotiation starts just to please Trump. He won’t give us anything in return. " — tochitocchi

"The US have the strength, they know it and are going to use it to their advantage. Also, Trump is unpredictable and I would guess he will get pissed at some point and negotiations could come to a screeching halt. We will blink and one sided concessions will be included in the new agreement." — thompsond1951

Political Flair-Ups

"Political flair-ups or to put in more simple terms, idiotic comments and demands from the president of my country, the U.S.. I hope Carney not only stands his ground with Trump, but makes him look petty and weak in the process.” — callawayguy

"The only thing stopping us from reaching a fair deal is Trump. He is completely unpredictable and a loose cannon. Would it make a difference if another Republican was leading the nation? Maybe, maybe not. The expectations are one-sided concessions, Canada to bend to all their demands. I don't see this ending well, whether we sign a deal or not." — syoungconsultinginc

REAL ESTATE

GTA Home Sales Slide as Listings Rise

GTA sales fell 11.2% in 2025 overall.

Inventory stayed high, giving buyers more leverage.

Average selling price dropped 4.7% year over year.

TRREB is calling for tax relief to help affordability.

Home sales in the Greater Toronto Area cooled a lot in 2025, with transactions down 11.2% from 2024. The Toronto Regional Real Estate Board (TRREB) says higher listing inventory helped push selling prices lower through negotiation, which improved affordability on paper. Realtors recorded 62,433 sales through the MLS system last year, while new listings climbed 10.1% to 186,753, a combination that tends to tilt the market toward buyers. As a result, the annual average selling price fell to $1,067,968, down 4.7% from $1,120,241 in 2024. The board’s take is that lower mortgage rates and softer prices set the stage for a recovery, but we’ll only see real results once households feel better about the economy and jobs, as I write about above.

Affordability Improved, But Confidence Is Still The Gatekeeper

TRREB president Daniel Steinfeld framed 2025 as a year where affordability improved as prices and mortgage rates moved lower, with “pent-up demand” ready to come back once households trust the labour market again. CEO John DiMichele pushed a more policy-focused angle, calling for tax relief to give families more breathing room for housing and basic needs. He argues that “fair and responsible” tax policy could help restore confidence.

December Showed The Same Pattern: Fewer Sales, More Supply

The latest numbers covering December 2025 show that sales were down 8.9% year over year to 3,697, while new listings rose 1.8% to 5,299. The average selling price that month was $1,006,735, down 5.1% from December 2024, and seasonally adjusted sales dipped slightly from November while listings increased. TRREB’s Jason Mercer also pointed to broader federal economic measures and big domestic projects as a potential tailwind for sales, but reiterated the key condition: buyers need to feel secure before taking on long-term mortgage payments.

Read the full story here.

THE ENERGY SECTOR

Trump Pushes Venezuela Oil, Industry Hesitates

Trump floated $100B target for Venezuela oil investment.

Exxon CEO calls Venezuela “uninvestable” right now.

Sanctions rollbacks could happen, but terms stay unclear.

Analysts doubt output jumps or quick price relief.

Following the invasion into Venezuela and the capture of Nicolas Maduro, President Trump is trying to turn Venezuela’s political reset into an energy win, and is pressing oil executives for at least $100B in spending to revive production which, in his framing, will help drive energy prices lower. The pitch came at a White House meeting where industry leaders agreed Venezuela’s reserves are tempting, but quickly shifted to the fine print: safety, legal certainty, and whether companies can trust they will not get burned again. Exxon CEO Darren Woods put it bluntly, saying the firm has had assets seized there twice and that Venezuela is “uninvestable” today without major changes. No one walked out with a solid commitment, and that speaks volumes about how wide the gap is between Trump’s political ambition and the boardroom reality.

Oil Majors Want Stability Before They Write Cheques

Venezuela’s output has been hammered by disinvestment, mismanagement, and sanctions, and sits around one million barrels per day, or less than 1% of global supply. Chevron, the last big American operator still on the ground, says it expects to boost production from its existing footprint. Exxon says it plans to send a technical team in the coming weeks, while Repsol, currently producing about 45,000 barrels per day, says it could triple output over the next few years under the right conditions. Trump also signalled a gatekeeper approach, telling firms they would deal with the U.S. directly, not Venezuela, as the administration weighs selectively rolling back sanctions and controlling the sales process.

Control Of Sales, Seized Tankers, And A Long Timeline

U.S. officials say they have seized multiple tankers carrying sanctioned crude and are working on a process that would funnel proceeds into U.S.-controlled accounts, partly to keep leverage over interim leadership under Vice-President Delcy Rodríguez. Analysts read the meeting as polite optimism with minimal dollars attached. David Goldwyn argued big players will not commit billions without security and a competitive fiscal framework, while Rystad Energy estimates it would take $8B to $9B per year in new investment for production to triple by 2040. My takeaway is simple: the headlines and videos have been sensational, but meaningful supply growth is a slow build. This will take a while.

Read the full story here.

Episode 12 of “Second Act” is now live. Think the Snowbird life is simple? It’s more than booking your flight and packing your suitcase. See the Tips & Traps here. |

TECHNOLOGY

AI Memory Is Sold Out and Prices Are Spiking

AI chip demand is swallowing the global memory supply.

HBM production crowds out regular DRAM for consumer devices.

TrendForce sees DRAM prices jumping 50%–55% this quarter.

Micron says it’s already sold out for 2026.

A major issue that’s been flying somewhat under the radar is that the AI buildout is running into a very unglamorous constraint: memory. Every device needs RAM, but AI servers need a lot more of it, and they need the fast, specialized kind, not the kind you run out to your local Staples store and grab off the shelf. That surge is overwhelming supply from the three companies that basically run the market, Micron, SK Hynix, and Samsung. Micron’s Sumit Sadana says demand has “far outpaced” what the industry can supply, and the knock-on effect is already showing up in pricing. TrendForce now expects average DRAM prices to jump 50% to 55% this quarter versus Q4 2025, a move its analyst called “unprecedented.”

HBM is the New Choke Point

For modern AI chips, the GPU is surrounded by high-bandwidth memory (HBM), which feeds data fast enough to keep those processors busy. Micron supplies Nvidia and AMD, and the scale is wild: Nvidia’s Rubin GPU can ship with up to 288GB of next-gen HBM4 per chip, and it’s packaged into massive systems like the NVL72 rack. The problem is HBM is hard to make, involving stacks of 12 to 16 layers built into a single “cube,” and it creates a brutal tradeoff. Sadana says every bit of HBM Micron makes effectively displaces three bits of conventional memory it could have made for other devices. Memory makers are prioritizing servers and HBM because cloud customers are less price-sensitive and the demand runway looks longer.

The “Memory Wall” is Becoming Everyone’s Problem

Inside AI, the industry calls it the “memory wall”. GPUs keep getting faster, but memory speed and capacity don’t keep up, so expensive processors end up waiting around for data. More and faster memory is what enables bigger models, more simultaneous users, and longer context windows that make chatbots feel more personalized. Meanwhile, the shortage is bleeding into consumer electronics. TrendForce’s Tom Hsu says memory has risen to about 20% of laptop hardware costs, up from 10%–18% earlier in 2025. Dell has already warned its cost basis is rising and said retail prices will likely feel it, and even Nvidia is getting questions about whether gamers will blame AI for higher prices.

Micron says it can only meet about two-thirds of some customers’ medium-term needs and is building new fabs in Boise for 2027 and 2028, with a New York fab targeted for 2030. But in the near term though, supply will be tight through 2026.

Read the full story here.

U.S. Mortgage Rates Crack a Key Threshold for Housing: Thirty-year mortgage rates slipped below 6% for the first time in years, giving buyers and refinancers a jolt of optimism. The key question is whether lower rates stick into spring.

Grok’s AI Images Trigger Regulatory Risk: Elon Musk’s Grok is under fire after users generated non-consensual sexualized images, including of minors. Regulators and politicians want tougher safeguards, while X has begun restricting image tools.

Telus Buyouts Point to Deeper Cost Cuts: Telus is offering buyouts to roughly 700 employees, according to the union, as it leans harder into self-serve operations. Workers have a short window to decide, raising fresh severance questions.

Pension Giant Loses High-Stakes Tax Fight: A Dutch tax court ruled an Ontario pension plan wrongly claimed about $346 million in dividend tax refunds, a setback in a long-running cross-border dispute. The fund is expected to challenge it.

RBC Flags Tech’s Next Market Rotation: RBC thinks Canadian tech could broaden in 2026, with the TSX info-tech group poised for healthier returns after a strong market year. Software names, not just the usual winners, may participate.

180! Darts Prodigy Turns Hype Into Cash Flow: Teen darts star Luke Littler signed a record sponsorship deal with Target Darts, reportedly worth up to £20m over 10 years. His rapid rise is turning tournament success into serious commercial clout.

Early Jobs Data Leak Raises Market Risk: Trump posted key U.S. jobs figures online before the official release, triggering criticism over market-sensitive data handling. The White House says procedures will be reviewed, even as the numbers lifted sentiment.

GM’s EV Strategy Comes With a $6B Bill: GM booked about $6B in charges after EV demand cooled, following reduced incentives and looser emissions standards in the U.S. It’s a reminder that electrification plans still hinge on policy and pricing.

Week ending January 9, 2026 | Market Cap > $10 Billion USD

Week ending January 9, 2026 | based on 14-Day RSI | Market Cap > $10 Billion USD

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply