- The Pulse Newsletter

- Posts

- Are Dividends Dead?

Are Dividends Dead?

Also, Trump threatens Powell, Inflation Rises, Stablecoin Now Law

The Week in Review

Weekly Market Recap: U.S. and Canada

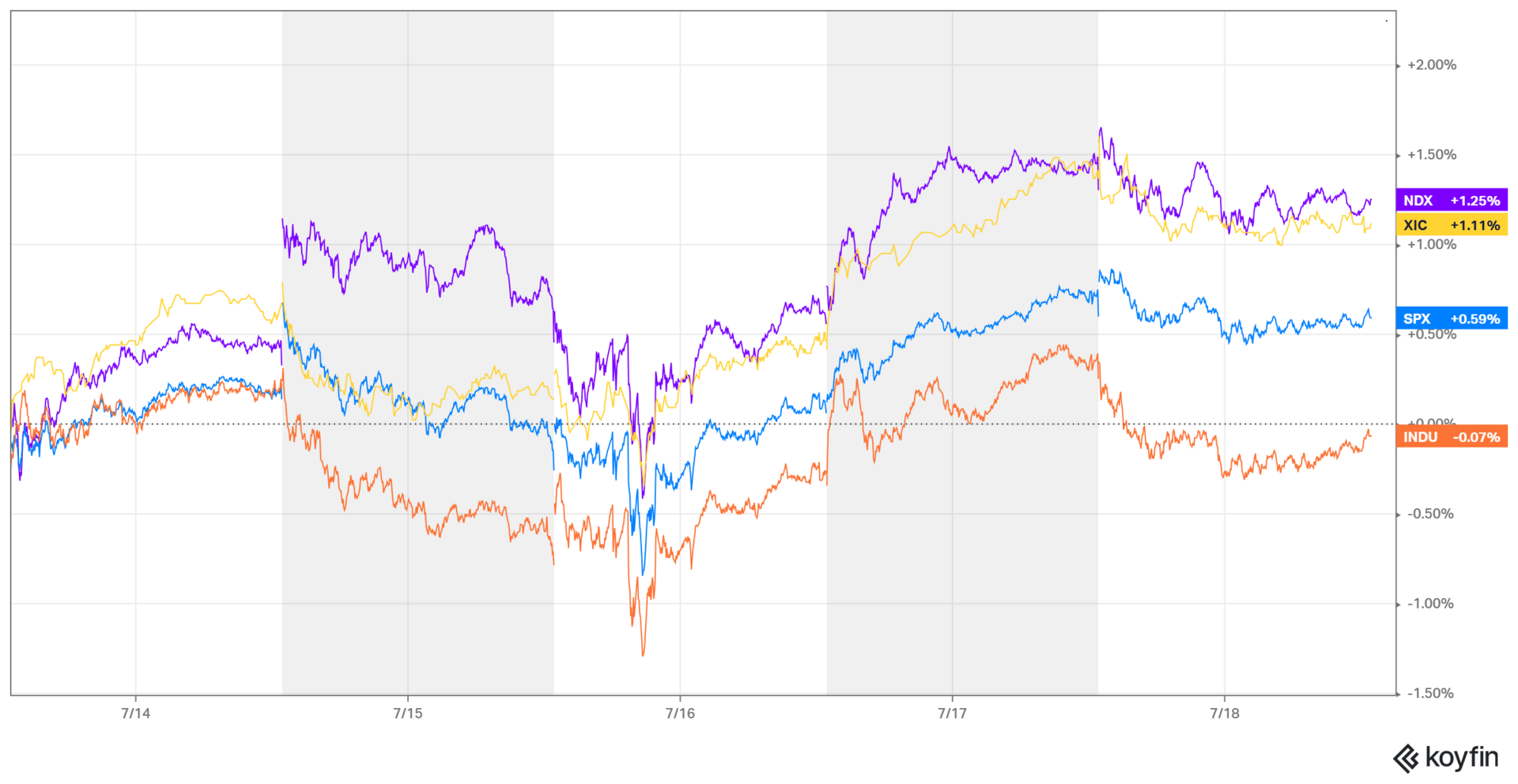

Markets posted mixed results this week, with tech leading the way. The Nasdaq 100 and TSX moved higher as the week progressed, shrugging off a bit of volatility midweek. The S&P 500 eked out a modest gain, and the Dow Jones slipped just a tad into negative territory.

Looking at the numbers, the Nasdaq 100 led the pack with a gain of 1.25%, followed closely by the TSX, which added 1.11%. The S&P 500 finished up 0.59%. Meanwhile, the Dow Jones, the lone laggard, dipped 0.07% over the week.

Week ending July 18, 2025

Major Economic Stories

Recap of the Week

This week was all about inflation, with fresh data from both Canada and the U.S. shaping expectations for rate cuts. We did see a rebound in U.S. retail sales, which adds another layer to the evolving (and somewhat confusing) economic picture.

Here’s how it all played out this week.

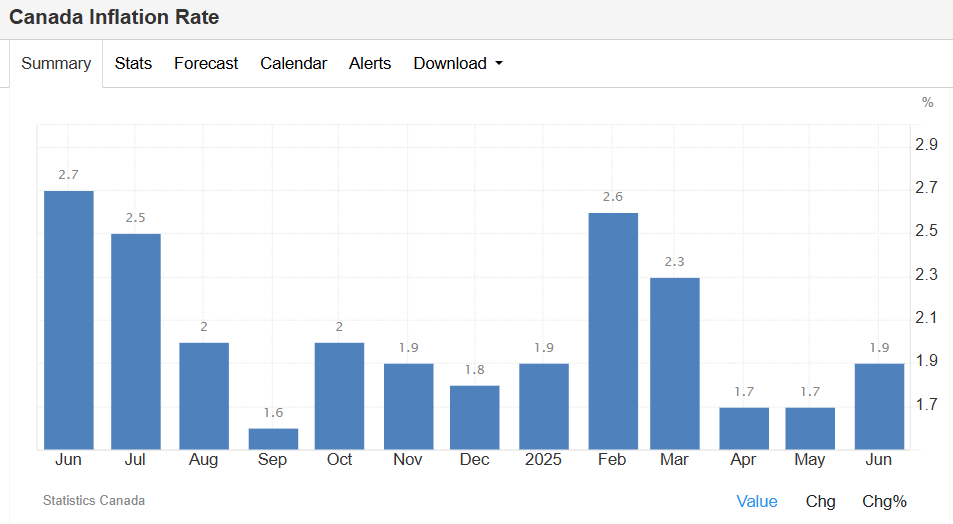

Canada Inflation Rises to 1.9%

Canada’s inflation rate moved up in June, in line with forecasts.

Inflation in Canada edged higher last month, driven by fuel base effects and durable goods. Trimmed-mean core CPI held steady at 3%, showing signs of stability. Slower food and shelter inflation provided some relief.

Furniture prices rose from 0.1% to 3.3%

Passenger vehicle inflation increased to 5.2%

Overall transportation costs shrank at a slower pace

Grocery price growth continued to soften

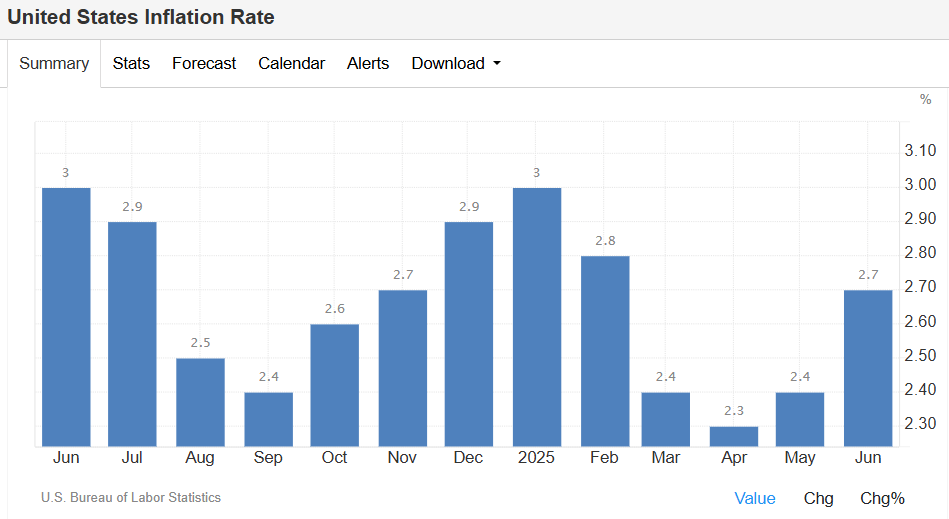

U.S. Inflation Climbs

U.S. inflation rose for a second month in June, topping 2.7%.

Price pressures remained broad, with energy declines softening and core components rising. Monthly inflation rose at the fastest pace in five months, but still within expectations.

Natural gas prices remained elevated at 14.2%

Gasoline deflation eased but stayed negative

Used car prices climbed a full percentage point

Energy costs dragged less on overall inflation

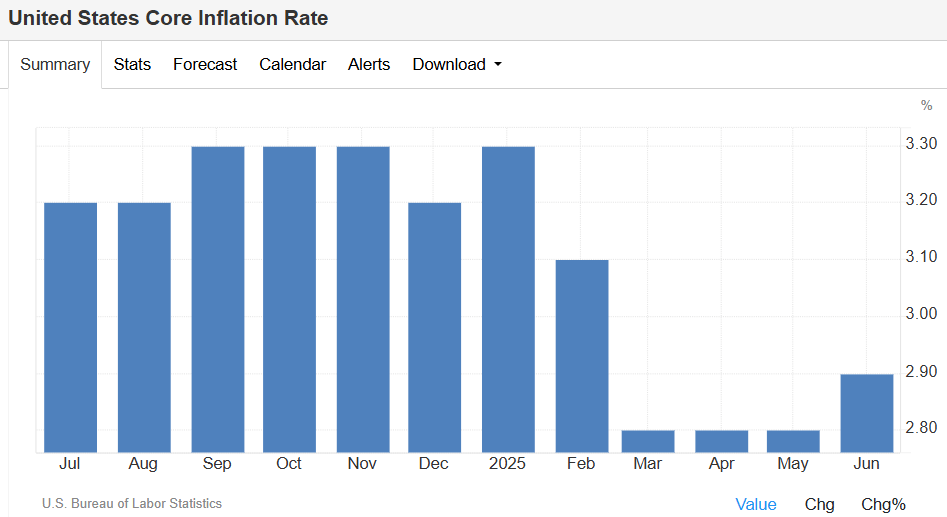

U.S. Core Inflation Holds at 2.9%

Core consumer prices rose modestly, but remained under control in June.

Even though we saw monthly gains, inflation pressures remain mixed and below expectations. Some components like shelter and insurance continued upward trends, but nothing overly dramatic this time around.

Household furnishings rose 3.3% year over year

Medical care services saw steady upward pressure

Monthly increase still under analyst forecasts

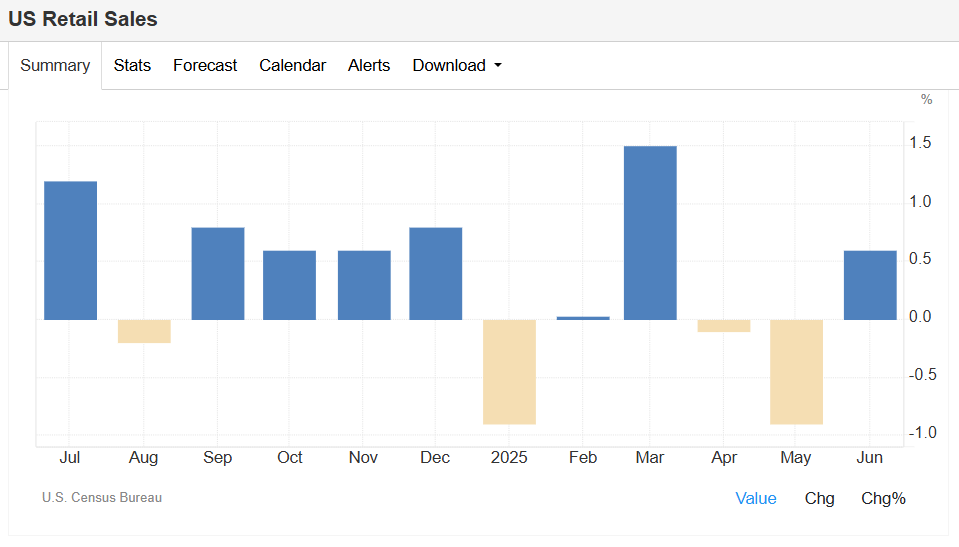

U.S. Retail Sales Rebound in June

Retail sales bounced back stronger than expected last month.

A broad range of categories posted gains, especially auto and building materials. It’s a sign that consumer demand still has legs.

Clothing stores posted a 0.9% monthly gain

Furniture and electronics dipped slightly

Sales in personal care and food stores rose together

Gasoline station sales remained flat

Key Takeaways From this Week’s Economic News

Canada’s Inflation Rise Looks Controlled—for Now

Canada’s inflation inching up to 1.9% might sound like a yellow flag, something we didn’t want to see, but I see it more as a rebalancing. Fuel deflation eased and durable goods drove price gains, but the rise was expected and remains below the Bank of Canada’s 2% midpoint target. It’s also notable that food and shelter inflation continued to soften, which is easing pressure on household budgets.

From a monetary policy perspective, I don’t think this print forces the Bank of Canada’s hand at all. The trimmed-mean core CPI is still sitting at 3%, where it’s been for months, and that gives the central bank space to stay patient should it choose to do so. The bigger story may be how inflation components are rotating, with transportation and autos taking over as drivers while essentials like food fade.

U.S. Core Inflation Stays Sticky, but Manageable

U.S. core inflation ticked up slightly in June, hitting 2.9%, and although that’s below market expectations, it’s still uncomfortably high for the Fed. What stands out is that key categories like motor vehicle insurance and household furnishings are still climbing at a strong pace. I note that shelter costs are easing, but they do remain a major contributor.

This kind of inflation isn't spiking, but it’s not going away either, and that keeps the Fed in a tricky spot. On one hand, they’re making progress, especially on volatile components like energy and gas. On the other, core prices are proving harder to tame. I wouldn’t be surprised if this reinforces the Fed’s cautious tone going into the fall, delaying any aggressive rate cuts even though the political pressure to move is mounting. (More on this in the full story below.)

Consumer Strength Could Complicate Rate Plans

Retail sales jumping 0.6% in June was a big surprise, and an important one. Surprisingly, at least to me, U.S. consumers are still spending across a wide range of categories, from cars to garden tools to eating out. It’s hard to argue the economy is stalling when retail demand looks this broad-based.

But that strength might actually become a headwind for rate cuts. The Fed is walking a tightrope: they want to ease, but not if demand stays hot enough to reheat inflation. Strong consumer data keeps them in a wait-and-see position, especially if core inflation holds near 3%. Take this as a reminder that good news on growth can be bad news for policy expectations.

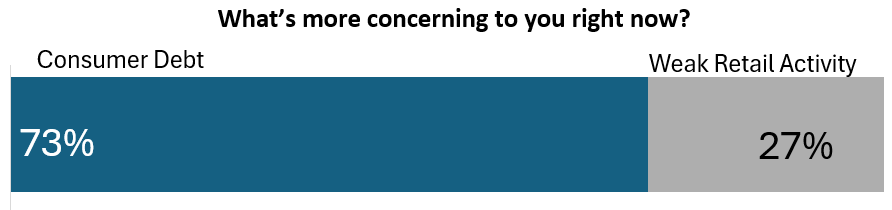

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

In my lead story this week, we look at one of the most debated topics in personal finance: the value of dividend investing. For decades, dividends were seen as a steady, almost foolproof way to generate income and build wealth. But that view is being challenged in today’s higher-rate environment. With dividend stocks underperforming and new research questioning their actual benefits, many investors are rethinking their loyalty to yield. So this week we’re asking:

Are dividends overrated as an investment strategy? |

LAST WEEK’S POLL RESULTS

In our last poll, I asked readers to share their bigger concern right now, the rising consumer debt problem, or weak retail activity. The answer was overwhelming. I do agree that in the longer term, personal debt is a huge issue. As an immediate concern, I might lean to weak retail activity. Both though, are important.

Reader Comments

Consumer Debt

"Consumer debt in and of itself it concerning, but it's high interest debt that rising the most right now and that's extremely concerning... While retail activity is weak, a rise in consumer debt almost assures retail activity will get even worse. Delinquency rates are already rising and a huge red flag considering they're already close to or possibly even surpassed what was experienced during 2008. Bad bad bad... None of this has a happy ending IMO.” — callawayguy

“I have always thought of Consumer Debt as being our consumers wanting another car, a nicer watch, things they do not need. But it is not that way today, consumer debt is incurred trying to pay your rent, put a proper meal on the table, take care of your health. It is criminal that consumer debt is growing due to people needing the basics of life. What has happened in Canada - I feel that one thing that has changed is the level of greed amongst the “ Have Gots “ Take a look at property values , gone way up but most of the property has been owned for say 10 years, so if you own a second apartment that you bought 8 years ago, why are you trying to rent it at a price that reflects the cost tomorrow not the cost from 10 years ago. Its the same with groceries in most cases the shelf price does not reflect true cost. The people need help & they are not getting it. Look at Alberta & Premi Dani , oh you want to get a shot of vaccine oh just have to pay $100 + dollars, look at Ebby in BC really not doing much of anything to help with the high cost of rents. Rent controls anybody, New York has had controls for a very long time. Our people need help. Please folks open your eyes and look to see what can be done. We all have ideas.” — entender1012

Weak Retail Activity

“Without retail activity every economic factor just stagnates. Low sales/low demand hurts manufacturing and retail job market. Growth/GDP goes to zero. This can lead to lower job growth, increases in unemployment. Just all around bad.” — ddamude"

INVESTING STRATEGIES

Dividend Investing’s Identity Crisis

Interest rates have undercut the income appeal of dividends

Studies show dividend performance is linked to value, not yield

Many dividend stocks carry high debt loads, increasing risk

Dow Jones Canada Dividend Index has underperformed since 2022

I made a last-minute decision to include a story I read this morning, and because so many of us have dividend stocks in our portfolios, I thought this would take the lead this week.

Dividend investing seems to be undergoing a reset and is losing some status and long-standing reputation as a “safe” strategy. Dividend stocks have long been the cornerstone of conservative portfolios but have not been delivering the same outperformance that defined them in past decades. I’m not saying the appeal has disappeared entirely, but the assumptions behind the strategy are now being challenged more openly and frequently.

The Performance Myth

Research increasingly confirms that dividends aren’t the reason dividend-paying stocks outperformed, rather it’s that those stocks often reflect value or defensive factors. In other words, it wasn’t the payouts that mattered, but the traits of the businesses. This has long been the underlying reason I hold a significant amount of dividend paying companies in my portfolio.

By the way, if you’d like to see which dividend stocks I have in my personal portfolio, you can see them on my blossom social profile.

A New Reality

Higher rates have changed the math. Companies that pay consistent dividends are often leveraged, making them more vulnerable in today’s costlier borrowing environment. Investors also now have compelling alternatives—GICs, T-bills, and high-yield savings—that offer income without the risk, although the attainable returns in these areas has faded since their recent highs. Still, the psychological comfort of dividends remains strong, especially for income-focused investors. All that said, blindly chasing yield is proving riskier than it once seemed. As is always the case, understand why you may want to included dividend stocks in your portfolio, and manage your decisions accordingly.

Read More Here

IN PARTNERSHIP WITH HARVEST ETFS

Harvest Global Utilities ETFs | Income, Stability, and Growth Potential

Markets have rebounded in the summer season after the bout of volatility in the spring, but uncertainties remain. Harvest global utilities ETFs – HUTL & HUTE – provide a mix of stability, monthly income, and growth opportunities through exposure to a diversified portfolio overlayed with an active covered call strategy.

Why Utilities?

Utilities produce and deliver basic essential services that we take for granted everyday:

Water

Natural Gas

Electricity

Pipelines

Etc.

Global Utilities Advantage | Stability from Diversification

HUTL & HUTE’s global utilities portfolio provides added benefits:

Reduces geographic risk

Lower regulatory risk

Diversified exposure

AI Power Demand | Growth Potential for Utilities

ChatGPT and AI-powered searches consume many times more energy than a traditional google search. Utilities must work to meet the demand of rising generative AI usage. MIT estimates that data centers could account for 21% of global energy demand by 2030.

Large-cap global utility stocks with long-term sustainable cash flows

Defensive position with monthly income

Covered calls generate cashflow and lower volatility

Access to global utilities portfolio

Employs modest leverage to HUTL to enhance cashflow and growth potential

Learn more about HUTL and HUTE here.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A units of the Fund. If a Fund earns less than the amounts distributed, the difference is a return of capital.

HOUSING

Canadian Home Sales Rebound, But Outlook Still Dim

June sales rose 3.5% YoY and 2.8% MoM

CREA cut 2025 sales forecast by 3%

National average price expected to fall 1.7% this year

Recovery led by GTA, but regional gaps remain wide

Canadian housing data surprised to the upside in June, with sales up 3.5% year-over-year and 2.8% month-over-month. But even with this rebound, the Canadian Real Estate Association (CREA) downgraded its full-year forecast, pointing to ongoing trade tensions and interest rate headwinds. Optimism is rising cautiously, but expectations are still subdued for 2025.

Short-Term Lift, Long-Term Uncertainty

The increase in June was mostly driven by the Greater Toronto Area, CREA says, noting that the broader market is still struggling. The number of newly listed properties fell 2.9% from May, and average national prices are down 1.3% from last year. CREA’s senior economist Shaun Cathcart said that while recent data is promising, the real recovery “may have only been delayed” rather than derailed altogether.

Tariffs, Rates, and Delayed Demand

The U.S.-Canada tariff threats and broader economic uncertainty held back buyers earlier this year, especially in B.C., Alberta, and Ontario. The national average price is now forecast to fall 1.7% this year—roughly $10,000 below previous estimates. CREA does expect a 6.3% recovery in 2026, however, led by pent-up demand and easing rates. Cathcart says “We’re not out of the woods yet,” but notes that momentum is slowly returning.

Read More Here

BLOSSOM SOCIAL

2025 BLOSSOM INVESTOR TOUR

✈️ What is the Blossom Investor Tour?

The Blossom Investor Tour is the traveling edition of Canada’s largest retail investing event, bringing the energy of the Blossom Investor Tour to cities across North America!

With stops in Toronto, Vancouver, Calgary, Montreal, New York, Los Angeles, Chicago, and Las Vegas, the Tour connects hundreds of investors in each city for an intimate and high-impact experience designed to inspire, educate, and empower.

Hosted by Blossom, the investing social network where over 300,000 retail investors are sharing their portfolios, trades, and investing ideas, the Blossom Investor Tour is a live extension of the meaningful conversations we see happening every day in-app.

Whether you're a seasoned DIY investor or just starting out, the Blossom Investor Tour is your chance to plug into the investing community that's changing the game, and meet the people behind the portfolios.

Marc Beavis, Harvest ETF President and CEO Michael Kovacs, and blossom co-Founder Maxwell NIcholson present at the 2024 Blossom Social event in Toronto

What to Expect

🎤 Live panel talks featuring some of your favourite creators and finance pros. Stay tuned as we announce the full lineup!

🤝 Connect IRL with hundreds of fellow DIY investors, creators, and brand partners

🍸 Food, drinks, and light bites served throughout the night, all included with your ticket

🛍️ Blossom t-shirt, tote bag, lanyard, and other exclusive Investor Tour swag drops!

💸 Face time with the largest financial institutions across North America

Take a look at what 2024's Toronto Blossom Investor Social looked like: |  |

Don’t miss out!

🎟️ Tickets are limited, and last year’s events sold out FAST…

👀Don’t miss your chance to be part of Blossom’s biggest in-person tour yet.

More Information Here

POLITICS AND THE FEDERAL RESERVE

Trump vs. Powell: Political Firestorm Meets Monetary Policy

Trump questioned GOP support for firing Powell

Legal experts say removal requires “cause,” unlikely to succeed

Markets fear damage to Fed credibility and independence

Rate cut pressure risks undermining inflation-fighting stance

A political standoff is brewing between President Trump and Fed Chair Jerome Powell, and speculation continues to mount that Trump wants to fire him. Even though the president’s ability to carry out a firing is legally shaky, the threat alone is generating serious concern about Fed independence and the stability of U.S. monetary policy. The fight could define not just Powell’s term, but along with it, global market confidence in the Fed itself.

No Precedent, No Clarity

Trump has publicly and repeatedly asked Republican lawmakers whether he should remove Powell and has accused him of “choking out the housing market” with high rates. Legal experts agree that firing the Fed Chair would require cause, a high bar that courts are likely to uphold. But Trump’s complaints, centered on the Fed’s building expansion project, may be a pretext. As I mentioned, the uncertainty alone could erode market faith in central bank autonomy.

Risk of Institutional Damage

Even if Trump fails to remove Powell, the episode risks long-term damage. Jonas Goltermann of Capital Economics notes that it’s not necessarily the actual firing that is causing concern, but the spin-off effects could be long lasting.

“The reputational costs from firing Powell would be harder to undo.”

Also, any rate cut now may be interpreted as a political surrender, and that would damage the Fed’s credibility. As J.P. Morgan’s Michael Feroli warned, history shows that political interference in monetary policy leads to bad inflation outcomes. Whether Powell stays or goes, this conflict has already raised the stakes.

Read the full story here.

CRYPTO

Trump Signs Stablecoin Law in Crypto Milestone

New law requires reserves and monthly disclosures for issuers

Could drive $2T stablecoin market by 2028

Critics warn of AML gaps and tech company dominance

Trump calls it a win for U.S. dollar and crypto leadership

President Trump signed a landmark stablecoin bill into law this week, the first major U.S. regulation tailored to dollar-pegged cryptocurrencies. Known as the GENIUS Act, the new legislation sets capital and disclosure requirements for stablecoin issuers and brings legitimacy to a market that has long been seen as speculative and underregulated.

A Win for the Industry

At the signing event, Trump praised the law as “good for the dollar and good for the country.” Treasury Secretary Scott Bessent echoed that sentiment, calling it a move that could strengthen the dollar’s role globally while boosting demand for short-term Treasuries. The law requires stablecoins to be backed by liquid assets and disclosed monthly, as two key conditions that crypto advocates believe will draw in banks, retailers, and mainstream users.

Critics Warn of Loopholes

Still, some Democrats and transparency advocates argue the law doesn’t go far enough. It doesn’t restrict big tech firms from issuing stablecoins or address all anti-money laundering concerns. Critics warn it could make the U.S. “a haven for criminals,” if oversight lags behind. Meanwhile, major crypto players like Circle and Ripple are already seeking banking licenses, and analysts estimate the stablecoin market could surge to $2 trillion by 2028. One thing is clear: crypto just took a huge step toward the mainstream.

Read the full Story Here

OTHER NEWS FROM THE PAST WEEK

Bank of Canada could be done cutting its policy rate for now

With inflation still sticky and consumer spending holding up, the Bank of Canada may pause its rate-cutting cycle. Policymakers are weighing risks of overtightening versus prematurely declaring victory.

Canned cocktail hitting you hard?

Many canned cocktails contain higher alcohol content than consumers expect, raising health concerns. Regulators are looking at clearer labeling as sales surge in the ready-to-drink beverage market.

Couche-Tard exits 7-Eleven parent deal

Laval-based Couche-Tard has dropped its bid to acquire 7-Eleven’s parent company, citing valuation concerns. The move ends months of speculation about consolidation in the global convenience store sector.

Canada Post workers urged to reject deal

The CUPW union is encouraging postal workers to vote down a tentative contract, arguing it fails to address key wage and workload issues. A strike vote could follow this month.

Hidden mutual fund fees persist

Despite regulatory efforts, many Canadians are still paying hidden advisor fees in mutual funds. Advocates call for more transparency as embedded commissions quietly erode long-term returns.

Mail scams still targeting Canadians

Fraudulent mail schemes continue to deceive Canadians, with fake prize notices and government cheques among the most common. Officials urge consumers to report suspicious letters immediately.

McDonald's Snack Wrap frenzy causes lettuce shortage

The viral return of McDonald’s Snack Wrap has created an unexpected supply crunch for lettuce, leaving some locations short. Restaurant chains are scrambling to adjust sourcing strategies.

Trump’s lawsuit against Bob Woodward dismissed

A judge has tossed out Donald Trump’s copyright case against journalist Bob Woodward over audiobook recordings, citing fair use. The ruling is seen as a win for press freedom.

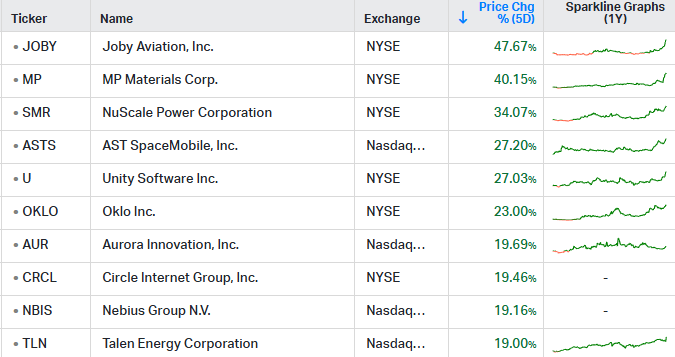

Market Movers

Top 10 Weekly Gainers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending July 18, 2025

Top 10 Weekly Losers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending July 18, 2025

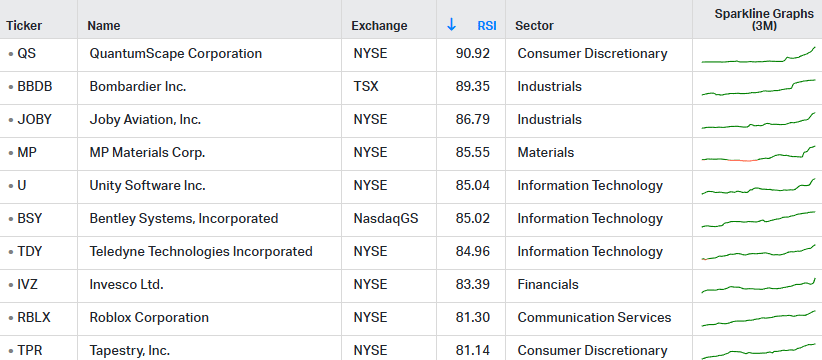

10 Most Overbought Stocks

Week ending July 18, 2025 | Most Overbought Stocks, based on 14-Day RSI

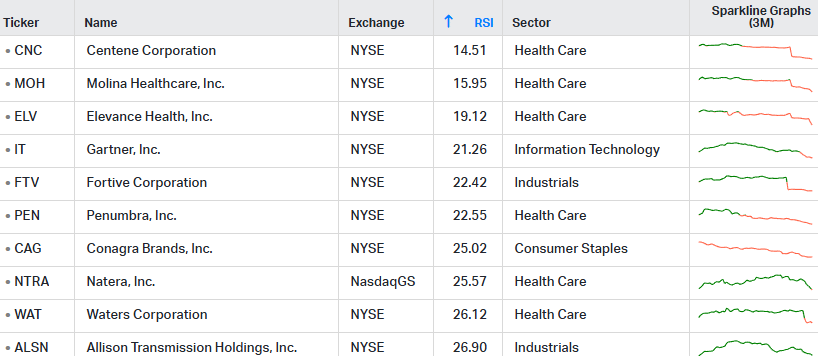

10 Most Oversold Stocks

Week ending July 18, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply