- The Pulse Newsletter

- Posts

- A Risky Reset at the Federal Reserve

A Risky Reset at the Federal Reserve

K-shaped economy, space-based AI

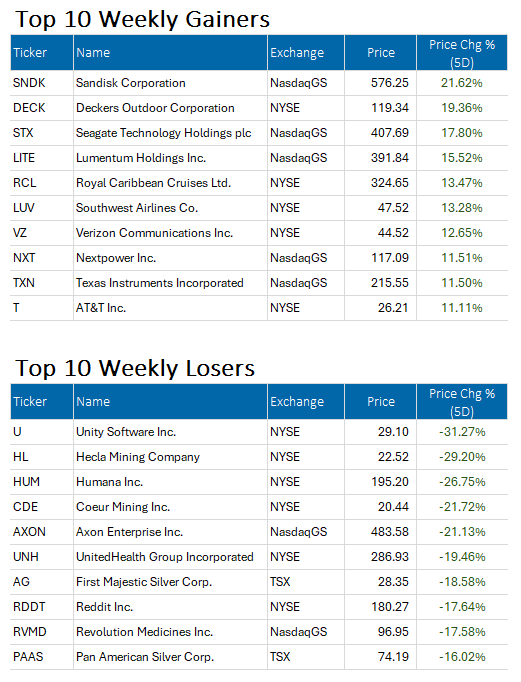

Market Recap: U.S. and Canada

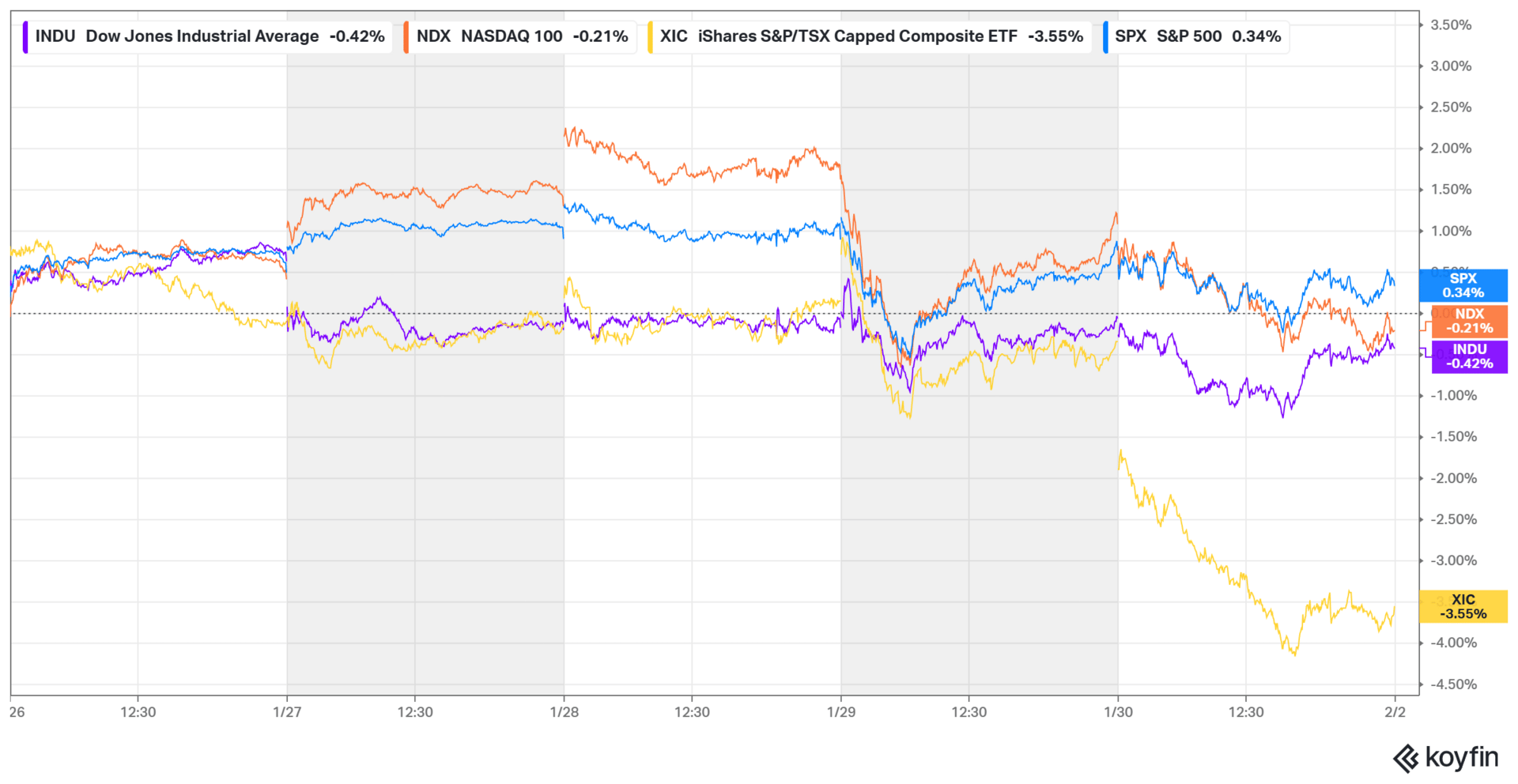

The markets ground it out this week, as investors digested our two central banks holding rates steady. But man, was it a tough day for the TSX on Friday. Canada’s main index fell hard as precious metals sold off, and that dragged miners lower and knocked the wind out of risk appetite into the close of the week.

From a returns perspective, like I say, it was a rough week for Canada as the TSX fell 3.6% over the five trading days. U.S. markets were more resilient though, with the S&P 500 finishing up 0.34%, the Dow Jones falling 0.42 %, and the Nasdaq 100 down 0.21%.

Week ending January 30, 2026

Major Economic Stories

Economic Recap

The biggest economic news of the week was both the Bank of Canada and the Federal Reserve staying patient with rates, but fresh inflation signals in the U.S., coupled with a new round of political risk, kept uncertainty right up front.

Here’s how things played out this week.

Bank Of Canada Holds As Trade Risks Resurface

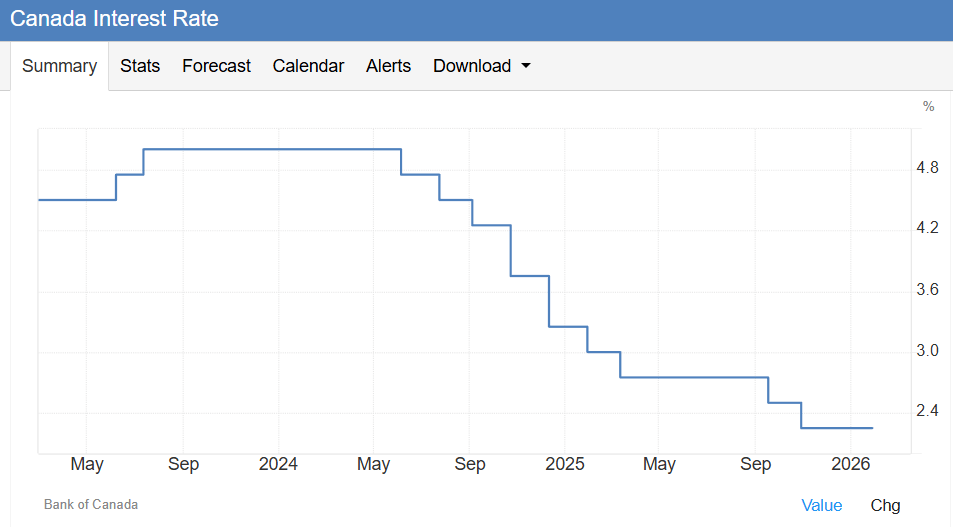

The Bank of Canada kept its overnight rate unchanged at 2.25%, sticking closely to its prior guidance while flagging rising uncertainty tied to US trade policy.

BoC Governor Tiff Macklem said the current stance remains appropriate given their baseline outlook, but he did warn that tariff threats could push policy in either direction. Growth expectations were largely unchanged, with GDP projected to rise just over 1% this year and 1.5% in 2027. Inflation is expected to hover near the 2% target as trade-related cost pressures are offset by excess supply. As has been the case for the past while, the overall message leaned cautious rather than confident.

Policy flexibility clearly remains on the table

Trade uncertainty re-enters the monetary policy conversation

Growth outlook remains modest but stable

Inflation risks seen as broadly balanced

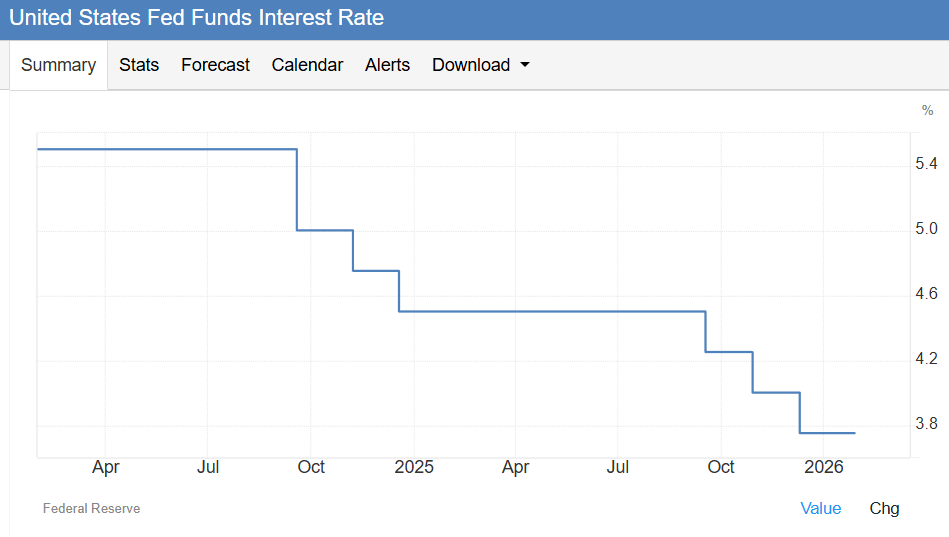

Federal Reserve Stays On Hold, Internal Split Persists

The Federal Reserve held its policy rate steady at 3.5 to 3.75% after three cuts last year, and that reinforces the view that rates are now in a wait-and-see phase. Two governors dissented in favour of another 25 basis point cut, confirming the ongoing debate inside the committee. Policymakers described economic activity as solid, with job gains cooling and unemployment showing signs of stabilization. Inflation was still characterized as somewhat elevated, keeping the bar high for further easing. Chair Powell stressed that current policy is appropriate to support both growth and price stability.

Dissent signals rising debate over next rate move

Fed emphasizes patience and incoming data

Labour market cooling but not cracking

Inflation remains an obstacle to faster cuts

US Producer Inflation Surprises To The Upside

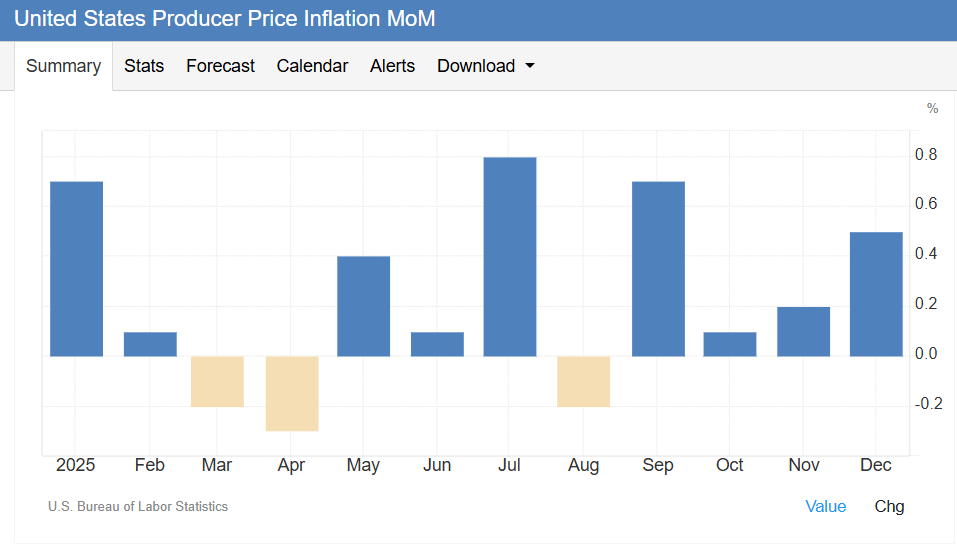

US producer prices jumped 0.5% month over month in December, the strongest gain in three months and well above expectations.

Services drove most of the increase, led by a sharp rise in wholesaling margins, while goods prices were flat overall. Core producer inflation surged 0.7%, its largest increase since July, pointing to persistent underlying pressure. On an annual basis, headline PPI held at 3%, while core accelerated to 3.3%.

Services inflation shows renewed momentum

Core pressures remain stubbornly strong

Energy price declines offered limited relief

Inflation path looks bumpier than hoped

TOP INSIGHTS

Central Banks Are Comfortable Waiting, But Aren’t Relaxing

This week reinforced just how comfortable central banks are sitting still right now. Both the Bank of Canada and the Federal Reserve signaled patience, but not complacency, and that distinction matters. Rates may be on hold, but it’s clear that policymakers are unwilling to declare victory on inflation.

It feels like the markets may be leaning a bit too far into the idea that we’ll see rapid easing later this year. Policymakers in both Canada and the US are clearly keeping their options open, and inflation data will still be calling the shots for a while longer.

Inflation Risks Are Shifting, Not Fading

The U.S. Producer price data stood out for me as a strong reminder that inflation pressures haven’t disappeared; they’ve simply changed shape. Services inflation and margins are doing more of the heavy lifting now, which makes the problem harder to solve with simple rate cuts.

Here’s what I’m watching next. If producer costs keep firming up, consumer inflation could follow with a lag. That would be a typical sequence. That would complicate the soft-landing narrative just as markets grow more confident about easier policy.

Politics Is Becoming A Bigger Monetary Variable

Between trade threats, tariff risks, and leadership questions at the Federal Reserve, political influence on monetary policy feels more prominent again. Central banks are clearly factoring uncertainty into their outlooks, even if they are not acting on it yet.

This probably means higher volatility ahead. Markets tend to downplay political risk until it shows up suddenly in pricing, and I think that risk is percolating as 2026 gets underway.

TOP STORY

A Defining Moment for the Federal Reserve

Kevin Warsh nominated to replace Jerome Powell

Markets cautiously optimistic about Fed independence

Warsh seen as hawkish but institutionally minded

Political pressure on monetary policy resurfaces

The big news of the week was President Trump’s decision to nominate Kevin Warsh as the next Federal Reserve chair. This has reopened the debate over how independent the US central bank can remain under political pressure. Warsh, a former Fed governor with deep Wall Street and academic ties, has long been associated with higher-rate, hawkish thinking, even as Trump has openly pushed for lower borrowing costs. The nomination came as a surprise to many, but markets initially took comfort in Warsh’s institutional background and reputation for independence.

Independence Versus Alignment

Interestingly, Warsh has publicly warned against the Fed bending to political demands, and has argued that credibility is easily lost and hard to regain. Supporters see him as a stabilizing choice who understands the risks of politicizing monetary policy. Critics, however, point to his shifting public tone on rates and his family’s political ties as reasons for concern.

What Comes Next?

While most analysts expect near-term rate policy to stay on its current path, Warsh’s views on regulation and balance sheet management could reshape the Fed’s longer-term approach. It will be interesting when we get to the confirmation hearings, and we’ll all be watching for clues on how firmly he intends to defend central bank independence.

Read the full story here.

Donald Trump has never been shy about sharing his views on interest rates or the Federal Reserve. And yes, that’s putting it mildly. With a new chair nominee in the spotlight, his pick has many people wondering what’s really behind the decision.

So on that note, I’m asking for your opinion this week. Please vote and weigh in to the discussion:

Do you think Trump’s choice for Fed chair is really about lower rates, or about influence? |

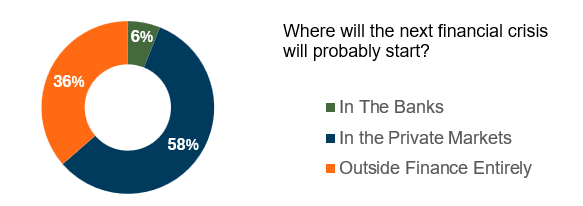

LAST WEEK’S POLL RESULTS

In last week’s poll, I asked where the next financial crisis will probably start. A clear majority pointed to private markets at 58%, while 36% thought it would emerge outside finance entirely, and just 6% saw banks as the main risk. Thanks to everyone who voted.

READER’S COMMENTS

The Private Markets

"Commercial Real Estate is in big trouble. Defaults in this space will cause trouble with mid tier banks." — mrzarowny

"Default on private investment vehicles will initially take the brunt. Business failures will be going up leading to selloffs in bad debts across this sector." — jotham.manley

"I chose the Private Markets, primarily because it's even less regulated than the banking sector whose regulation have also been loosened of late.

If history has shown anything, less regulation in the financial markets often leads to poor decisions if not outright fraud.

At this point of the economic cycle, most of the easy lending money has likely been made, so higher risk is needed to squeeze the last remaining bits and the last bits are usually garbage.

What private credit is doing today is akin to what the banks did with mortgage loans in 2006-2008, IMHO, and we know how that story played out. Kaboom!!! The difference with the private markets, bailouts far less likely, but plenty of damage will ensue anyway.

As I often end my commentary; I honestly hope I'm wrong on this..." — callawayguy

"Their the end users of the loans " — b.r.morris54

Outside Finance Entirely

"I suspect the next financial crisis will be triggered by geopolitical action... such as a surprise invasion or war, surprise coup, or sadly the use of nuclear weapons in a conflict. The threat is higher now that it has ever been in my lifetime." — philip.swan

"Inflation due to currency devaluation" — karen.egan.2013

"It will be caused by Trump interference and his insatiable greed. The good thing is it will effect the US a great deal but elsewhere not so much, just like the sub prime. Add this together with, gold reserves being pulled from US banks, investment outflows leaving US markets and the general market manipulation by trump. This will be a major crisis that this USA will not be able to save itself. The new world order." — entender1012"

THE ECONOMY

Wealth Gaps Define The US Economy

Top earners drive growth and spending

Lower-income households fall further behind

K-shaped recovery looks increasingly permanent

Political pressure around affordability intensifies

A new batch of data shows the divide between wealthy and lower-income Americans has widened into a defining feature of the US economy. Measures of wealth concentration are sitting near multi-decade highs, with the top 1 percent controlling nearly a third of total net worth while the bottom half holds a fraction. Consumer spending patterns now clearly reflect this split, with higher earners driving travel, luxury, and services growth as lower-income households pull back.

We’re Seeing A Structural Shift

More and more, economists are describing the K-shaped economy as structural rather than cyclical, rooted in decades of policy shifts, declining unionization, and asset-driven wealth gains. Stock market performance and housing appreciation have disproportionately benefited those already well positioned, while real purchasing power for most households has barely improved since the pandemic.

Looking Ahead

Many economists expect inequality to worsen as social supports shrink and AI-driven efficiency pressures employment. For the record, I fall into that camp, sadly. The concern isn’t just fairness, it’s also sustainability, as growth relies on a narrow slice of consumers. That fragility could become even more visible if labour markets weaken further.

Learn more here.

BIG TECH AND AEROSPACE

SpaceX Plans Orbital AI Network

SpaceX applies for one million satellites

Orbital data centres pitched as AI solution

Space congestion and debris concerns grow

Regulators face unprecedented scale questions

Elon Musk’s SpaceX has applied to launch up to one million satellites into low-Earth orbit, proposing orbital data centres as a way to meet surging AI computing demand. I’ll admit that when I saw that number, it shocked me. One million satellites seems like a lot! The company says that space-based processing could be more energy-efficient than traditional data centres, and claims terrestrial infrastructure is already struggling to keep up. The plan would dwarf SpaceX’s existing Starlink network and push satellite deployment into entirely new territory.

Big Vision, Big Risks

Musk’s concept promises global computing capacity, but experts warn about cost, technical complexity, as well as the growing risk of space debris. Not be be outdone, astronomers have also raised concerns about interference from existing satellites, and scaling up by this magnitude intensifies those fears.

Regulatory And Market Implications

The FCC hasn’t signaled yet how it will evaluate an application of this scale. If approved, the move could reshape both the AI infrastructure race and space regulation, and at the same time raise tough questions about congestion, safety, and long-term sustainability. I like the idea, but seriously wonder about whether it can safely be pulled off.

Read the full story here.

I got my letter this week saying the hackers got my personal information, and I tell my story in this video. If the bad guys got you too, leave a comment and share your experience! Watch the video here. |

Trump’s Threat To Decertify Canadian-Made Jets Could Hamper US: Trump’s threat to decertify Canadian-made jets could disrupt cross-border supply chains, raise costs for US airlines, and inject new uncertainty into aerospace manufacturing just as the sector faces slowing orders and margins.

Trump Sues IRS For $10 Billion: Donald Trump’s $10 billion lawsuit against the IRS escalates his long-running feud with US tax authorities, raising legal and political stakes while adding uncertainty around enforcement practices and presidential accountability.

Canada’s Most Livable Cities Ranking: Canada’s most livable cities ranking highlights shifting affordability, housing pressures, and quality-of-life trade-offs, offering a snapshot of where Canadians are thriving and where rising costs are starting to erode livability.

How Much Money You Should Save Before Quitting Your Job: With job markets cooling, experts outline how much savings Canadians should have before quitting, stressing runway length, benefit coverage, and realistic timelines as essential buffers against income gaps.

How Lego Got Swept Up In US-Mexico Trade Frictions: Lego’s exposure to US-Mexico trade frictions shows how global brands are being pulled into tariff disputes, supply chain reshuffles, and political risk well beyond their core consumer markets.

Meta Faces Trial Over Social Media Harms: Meta faces a high-stakes trial in New Mexico over alleged harms tied to Facebook and Instagram, testing how far states can go in holding social platforms accountable for youth safety.

Trump, Jobs Data, And Political Pressure: Questions around US jobs data integrity surface after political pressure allegations, putting the Bureau of Labor Statistics in the spotlight and testing trust in one of Washington’s most critical datasets.

Starbucks Feels The Heat As Competition Rises: Starbucks is feeling pressure as rivals compete aggressively for value-conscious coffee drinkers, forcing the chain to balance pricing, promotions, and brand identity in a slowing consumer environment overall.

Anyone else Remember the $1 Vegas Buffets?: Las Vegas buffets are making a costly comeback, with higher prices reflecting labour shortages, food inflation, and changing tourist expectations around variety, quality, and experience across the Strip.

ESPN Strikes Deal With NFL Network: ESPN’s deal to acquire NFL Network rights and RedZone gives the league an ownership stake, reshaping sports media economics and tightening the bond between live football and streaming platforms.

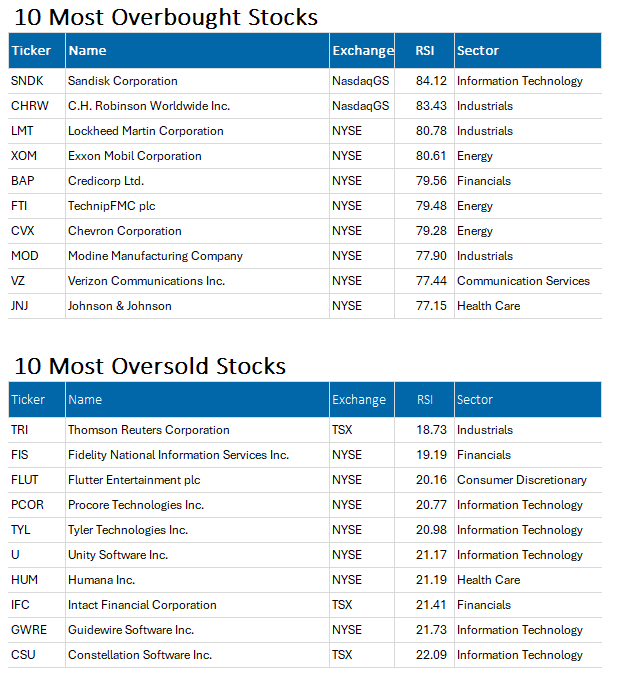

Week ending January 30, 2026 | Market Cap > $10 Billion USD

Week ending January 30, 2026 | based on 14-Day RSI | Market Cap > $10 Billion USD

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply