- The Pulse Newsletter

- Posts

- A Make-or-Break Moment for Champagne’s Budget Vision

A Make-or-Break Moment for Champagne’s Budget Vision

CPI Controversy, G7 Minerals Pact, Jays’ $500M Move

The Week in Review

Weekly Market Recap: U.S. and Canada

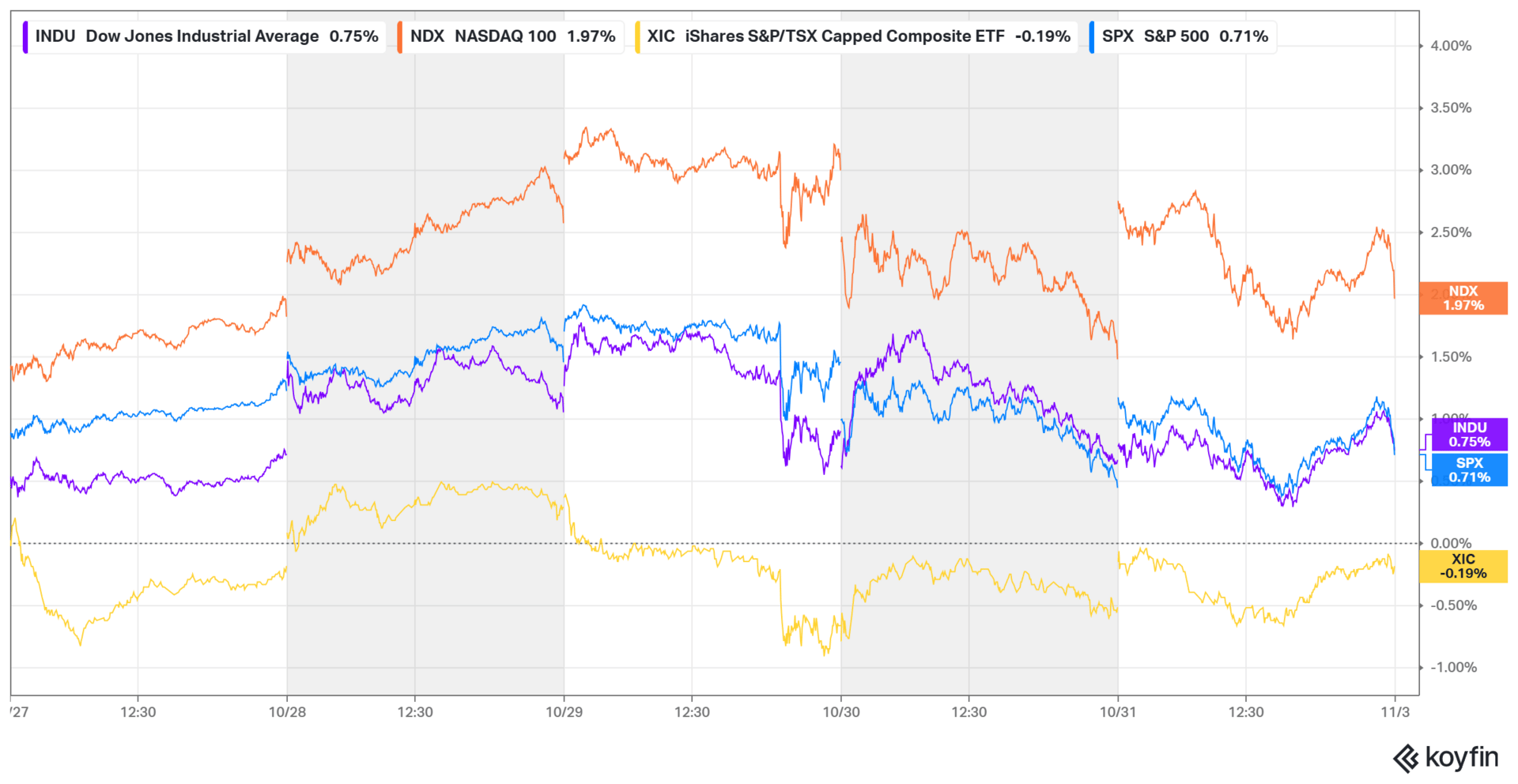

A surprisingly solid week for the U.S. markets, given that from about mid-week on (literally halfway through the Wednesday session) the trend was pretty much down. Here in Canada, the TSX lagged as energy and materials weighed on Canadian equities. It looks like investors welcomed fresh rate cuts from both the Fed and the Bank of Canada.

The Nasdaq 100 led the way, up 1.97%. The S&P 500 and Dow Jones followed with gains of 0.71% and 0.75%, respectively and the TSX slipped 0.19% for the week.

Week ending October 31, 2025

Major Economic Stories

Recap of the Week

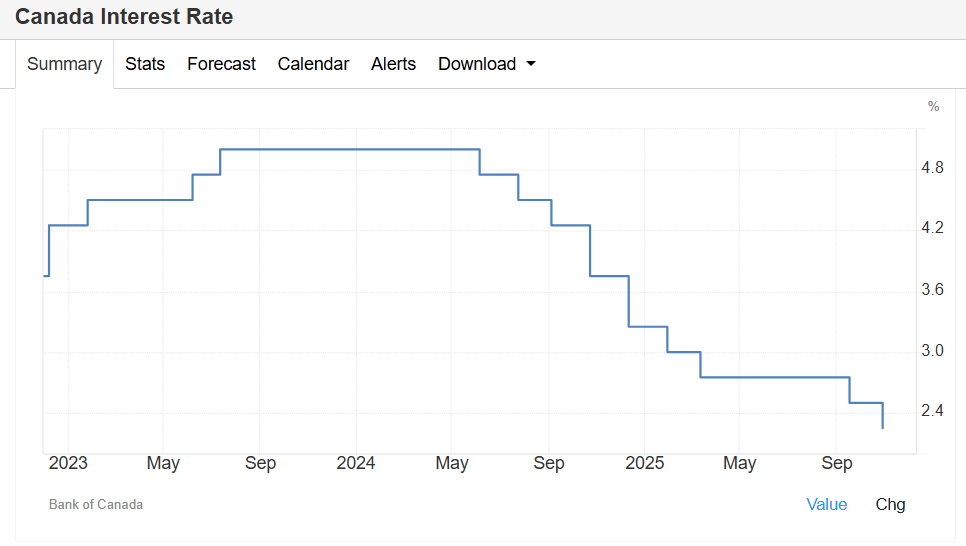

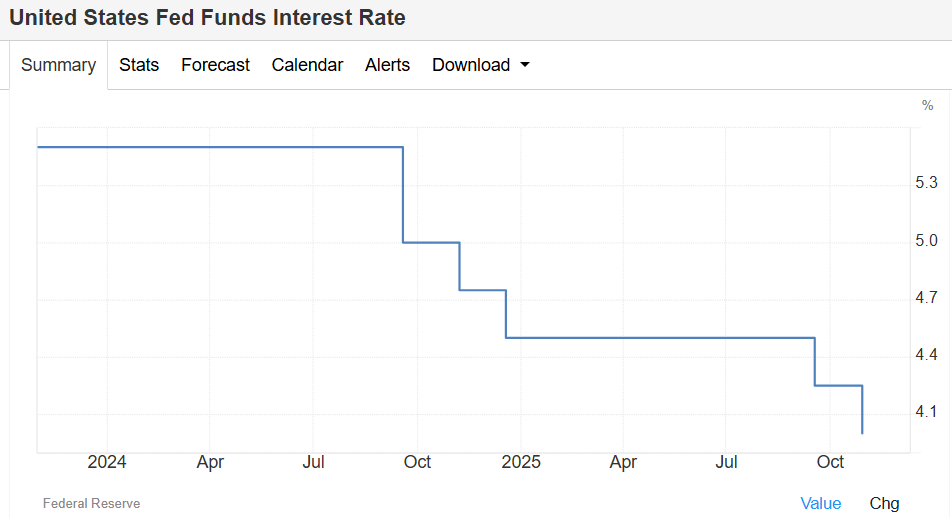

The focus this week was on the Central banks as both the Bank of Canada and the Federal Reserve trimmed rates again and threw in signals that we may be in the final stretch of their easing cycles.

Here’s how the interest rate decisions played out this week.

Bank of Canada Cuts Rates, Signals End of Easing Cycle

As was widely expected, the Bank of Canada trimmed its policy rate by 25bps to 2.25% and hinted it may be done cutting for now.

Policymakers cited soft GDP data and trade headwinds but noted inflation is trending back toward target. Growth is still fragile, and lingering tariffs are complicating the outlook. The overall tone of the statement was cautious and suggested we have moved into a new structural environment.

The BoC delivered a second consecutive 25bps rate cut.

Policymakers see little room for further easing this cycle.

Trade tensions with the U.S. continue to weigh on growth.

Inflation expected to gradually move toward 2% target.

Fed Cuts Rates, Signals Possible Pause Ahead

The Federal Reserve also lowered the funds rate by 25bps on Wednesday, to 3.75–4.00%, a continuation of its cautious easing stance.

The Fed noted a softening in job growth and an elevation in inflation, and that illustrates the delicate balance they’re dealing with. Chair Powell stressed that another December cut isn’t guaranteed, so the markets are left guessing. The decision came with continued internal dissent, with debate over how far to go.

Fed cut rates for the second straight meeting.

Powell hinted December action will depend on data trends.

Inflation remains above target despite slowing jobs data.

End of balance sheet runoff expected to boost market liquidity.

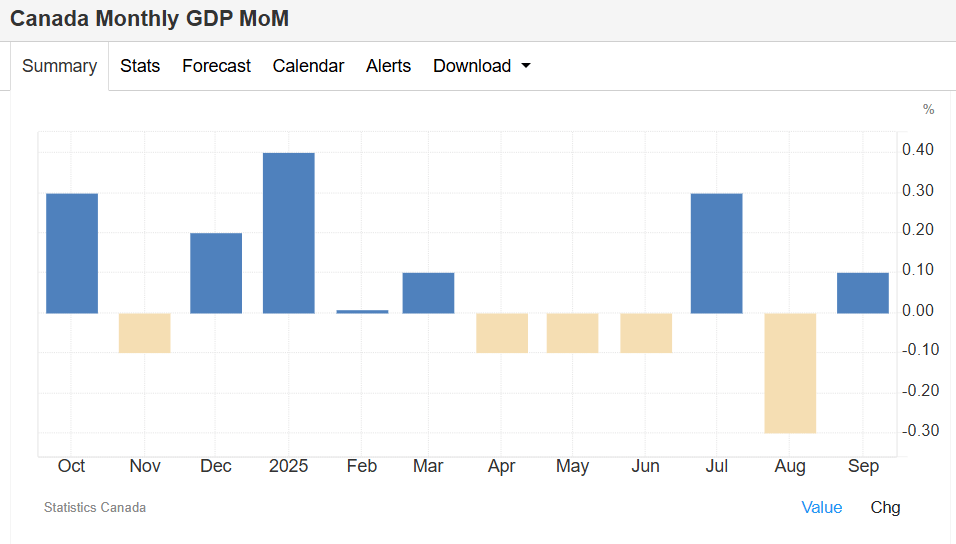

Canada’s GDP Growth Stalls in September

Canada’s economy barely expanded in September, up just 0.1% from August.

The flash estimate suggests Q3 growth of 0.1%, showing limited momentum. Weakness in goods-producing industries weighed heavily, led by sharp declines in utilities and mining output. Services output also slipped as trade and transport contracted, which offset gains in retail. The data reinforced the Bank’s cautious narrative on growth and underlined the drag from the U.S. trade conflict.

GDP rose 0.1% in September, partially offsetting August’s contraction.

Trade conflict and weak energy prices remain key drags.

Goods sector performance remains a major weakness.

Supports BoC’s decision to pause after October rate cut.

Top Insights

The BoC’s “Soft Pause” Is Really a Message

I think the Bank of Canada’s latest move, a 25bps cut paired with language that basically says we’re done for now, is designed to manage expectations. The Bank is clearly nervous about overdoing it, especially with inflation still hovering around 3%. It feels like we’re at a transition point: rates are no longer the main story, confidence is. If growth continues to limp along (Friday’s GDP numbers were disappointing), the BoC may start leaning on fiscal policy and productivity reforms to carry the load instead.

The Fed Is Playing Chess, Not Checkers

In the U.S., the Federal Reserve’s tone this week was interesting. Powell’s decision to trim rates again, while leaving the door open to pause in December, shows how fine the line has become between easing and credibility. Markets heard “cautious optimism,” but the Fed seems more worried about jobs than inflation right now. I think this sets up a tricky few months, and yes I know, ‘what’s new’ you ask? Investors want clarity, but the Fed’s message is data decides everything from here. My translation: volatility is back on the menu.

Canada’s Economy Is Slowing, But Not Stalling

That 0.1% GDP gain in September is weak, but I do think it’s important to keep it in context. We’ve had months of trade tension and sluggish energy output, so even small growth shows at least some resilience. I see this as the early stage of a “slow and low” phase, not a deep downturn, but not much excitement either. What matters now is whether new U.S. tariffs and global supply shifts drag the economy down further, or if domestic demand and retail spending keep the floor under growth. Either way, it’s pretty obvious that Canada’s economic story is shifting from fighting inflation to growth recovery, although no doubt it will be tough sledding.

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

Finance Minister François-Philippe Champagne is stepping into the spotlight next week with what will be the most important budget of his career. Growth is slow and confidence is wavering. He’s promising a smarter, more disciplined approach to Canada’s finances, but can he really pull it off?

Take this week’s quick poll and tell us what you think about Ottawa’s upcoming budget direction.

What tone should Minister Champagne strike with Tuesday's Federal Budget? |

LAST WEEK’S POLL RESULTS

Last week’s results were pretty clear; valuations are keeping investors up at night. A majority (52%) said AI stocks have simply run too far, too fast, while 41% worry that adoption could fall short of lofty expectations. Only 7% think competition will eat into margins. Obviously, most readers see hype and demand as the key driver for now.

Reader Comments

Valuations are Too High

“Love your podcast, keep up the great work.” - doubleoldsam

“The stocks are expensive, and I think the prices will continue to climb. It's early in the AI roll-out and some company are already showing the effects of their AI investments. I'm in for the long haul and will continue to invest in AI.” - thompsond1951

“While there’s potential for truth across all 3 options, the answer comes back to valuation for me. There’s been a free-for-all buying frenzy across many AI related names, which in some cases has driven valuations to irrationally high levels IMO. Some will grow into their valuations, but many won’t. I’d throw Quantum Computing into this bucket as well.” - callawayguy

Competition

“I believe that AI stocks will dominate the stock market. I don't think that it's a bubble. Although the competition is numerous for data and hardware I also believe that it will be a zero-sum game.” - aloquicious

Adoption will fall Short of Expectations

“Ah, the "Bubble Economy" that is AI, a fascinating and cautionary concept! It refers to an economic cycle characterized by a rapid escalation in the market value of assets, often driven by speculative behavior. Here's how it typically unfolds:

Rapid Growth: Asset prices rise significantly above their intrinsic value due to exuberant market behavior or speculative investments.

Overvaluation: The inflated prices are unsustainable, as they don't align with the underlying fundamentals of the assets.

Burst: Eventually, confidence wanes, leading to a sharp decline in prices, a "crash" or "burst" of the bubble.

Historical examples include the Dot-Com Bubble of the late 1990s and the 2008 Housing Bubble. These events often leave lasting economic impacts, such as recessions or financial crises.

A bubble economy is one in which the financial sector crowds out the real economy. Asset prices become severely inflated and detached from their underlying fundamentals. Companies are managed to maximize financial returns rather than market share. As asset prices rise, capital gains replace genuine savings. A bubble economy is sustained by continuously rising debt, which is mostly used for financial purposes rather than investment. Credit growth also boosts corporate profits.

The first of many Bubbles to hit the US economy.” - entender1012

“Considering that up to 40% of all answers from Chatbot are invented and not connected to facts based on a recent study in the EU, I start to question the value of generative AI. It seems the AI bots do not work without humans verify their results.” - jdimigen

“I’m not convinced that, for most, AI will be any more useful than poop bombs dropped from a plane by those in power.” - mjwebstuff

“It's like when the auto industry started. everyone was betting on the several hundred car manufacturers that were going to change the world...now there are a handful left.“ - mrrobpog

THE FEDERAL BUDGET

François-Philippe Champagne’s Make-or-Break Budget

Champagne faces huge pressure to balance spending and credibility.

The fall budget could redefine Ottawa’s entire economic story.

He’s emerging as the Trudeau government’s key economic voice.

Investors want proof Canada can stay disciplined.

At the time I’m writing this, Game 7 of the World Series is still a few hours ahead of us. And just as tonight will be a huge moment for the Blue Jays organization, Financial Minister François-Philippe Champagne is also about to have his biggest moment yet, albeit a political one. As he crafts the 2025 budget, due out next Tuesday, he’s juggling a weak economy, a frustrated business community, and a government that’s running out of fiscal runway. This one’s personal, for both him and the Trudeau team. If he can pull off a plan that supports growth without adding to the deficit, it could reset how people see Ottawa’s economic management.

A Balancing Act in Real Time

Unlike past budgets that leaned on stimulus, word is that Champagne will be betting on discipline and focus; smaller, targeted moves to attract investment and spur productivity. He’s also trying to show that Ottawa can spend smarter, not just more. That’s a tough message to sell, but if it lands, it might just buy the Liberals some much-needed economic credibility. And in today’s political climate, they sure could use some.

What Comes Next?

Top things we’re watching for: clues on housing, innovation funding, and there’s a huge focus on trade diversification. If he nails the balance, it could mark a turning point for Canada’s fiscal story, and cement Champagne as the government’s economic anchor heading into 2026. But it’s a big if.

Read the Full Story Here

IN PARTNERSHIP WITH HARVEST ETFS

Caution in a Time of Greed | A Low Volatility ETF with Monthly Income

The CNN Fear and Greed Index is a composite of sentiment-related variables for the United States stock market. This index considers variables like; stock price strength, market momentum, stock price breadth, put and call options, market volatility, safe haven demand, and junk bond demand. The index reading ranges from 0 to 100, with 100 representing maximum greed and 0 representing maximum fear.

On October 9, 2025, the Fear & Greed Index came in at 53, suggesting a “neutral” rating. However, stock price strength suggested an environment of “greed”. Both the US and Canadian markets posted all-time highs for the fourth straight month in September 2025.

In this potentially frothy market environment, investors may consider a defensive posture. The Harvest Low Volatility Canadian Equity Income ETF (TSX: HVOI), aims to offer a smoother investment experience by reducing market swings. HVOI invests in 100% Canadian equities. It adds a call option overlay to generate monthly cash distributions.

Learn more about the Harvest High Income Shares here.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A units of the Fund. If a Fund earns less than the amounts distributed, the difference is a return of capital.

THE ECONOMY

Fixing Canada’s Broken Inflation Indicator

Canada’s inflation math doesn’t match what homebuyers actually feel.

The CPI’s shelter formula makes affordability look better than it is.

Economists say the system is overdue for an overhaul.

A fix could change how we talk about inflation altogether.

If you’ve ever looked at “official” inflation numbers and thought, that doesn’t feel right, count yourself among many other Canadians. A growing number of experts and economists are saying the way Canada measures inflation, especially housing, is sorely out of date. The shelter component in CPI uses a replacement-cost model tied to mortgage rates, not real housing prices, and that means it often misses what buyers actually pay.

The Problem Behind the Numbers

When rates go up, CPI says inflation rises (because of higher mortgage interest), but when prices jump, CPI says inflation cools, even if affordability actually gets worse. It’s a statistical loop that’s confusing everyone from policymakers to homebuyers and it’s difficult to make sense of the market.

Why This Matters

If this obvious issue with CPI is fixed, it could literally change how the Bank of Canada sets rates and how governments design housing programs. At a time when trust in “official” data is more and more on shaky ground, getting this right and fixing the problem feels more important than ever.

Read More Here

TRADE

Canada Teams Up with G7 on Critical Minerals

Canada’s going big on critical minerals, and it’s not doing it alone.

A new G7 partnership will fund exploration and supply chain projects.

It’s a direct play to counter China’s dominance in EV materials.

The goal: make Canada a global hub for clean-tech resources.

Canada signed onto a major G7 deal this week, designed to boost production of critical minerals, the stuff that powers electric vehicles, batteries, and renewable tech. Ottawa’s pitch is a simple one: if the world wants to go green, it needs secure, sustainable sources of lithium, nickel, and rare earths, and Canada wants to be that source.

A Big Bet on the Future

This partnership could put Canada at the center of global clean-tech supply chains. Also, it’s a strategic move, tying resource policy directly to trade and national security. Private investors will be watching closely, as will environmental groups who’ll be pushing for tight standards.

The Long Game

If done right, this could create jobs, attract investment, and reduce dependence on volatile markets, but execution will be everything. Stickhandling the issues from infrastructure to Indigenous partnerships will be tough and there’s not a lot of room for shortcuts in a sector that’s so highly competitive.

Read the full story here.

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

SPORTS MATH

The $500M Blue Jay: Is It Worth It?

Vladimir Guerrero Jr. signed a $500 million deal with Toronto.

It’s the biggest contract in Canadian sports history, by far.

The move signals a new level of ambition from the Blue Jays’ front office.

Analysts say it could reshape both the team’s brand and business strategy.

Earlier this year, the Toronto Blue Jays made it official: Vladimir Guerrero Jr. is staying put and getting paid like a superstar. A 14-year, $500 million deal shattered every Canadian sports record and sent a message across Major League Baseball that Toronto is done playing small-market ball. For the Jays, this signing is a bold statement of intent; the Jays are serious about winning.

Why It Matters Beyond Baseball

Toronto’s ownership clearly sees Guerrero as more than a big hitter with a contagious smile. He’s now the face of a franchise, he’s a marketing engine, and his brand reaches across borders. In today’s MLB, the biggest stars have to be more than just athletes; they also have to be able to elevate TV rights, sponsorships, and even tourism. By locking him up long-term, the Jays are betting big on stability and identity in a league that’s becoming defined by big-money moves.

The Risks That Come With the Glory

Putting all the positives aside though, $500 million is a massive commitment. A variety of issues, including performance slumps, injuries, or a future shift in payroll priorities could make this deal tricky down the road. In this era, 14 years is an eternity. But for a team looking to build staying power (and to win a World Series title…? You may know by the time you’re reading this) this contract puts Toronto in a whole new league, up with the big boys.

Read the full Story Here

OTHER NEWS FROM THE PAST WEEK

O Canada! Summer Tourism Numbers Hit All-Time High

Canada just had its busiest tourism season ever, with record-breaking visitor numbers flooding major cities and national parks. It’s a sign that post-pandemic travel is fully back — and that Canada’s brand as a summer destination might be stronger than ever.

Tariffs Impacting Halloween Candy: Expert

Turns out your Halloween haul may be feeling the trade war, too. Experts say new tariffs are pushing up candy costs across North America, forcing retailers to either shrink packaging or raise prices.

Budget 2025: Trucker Loophole to Be Addressed, Says Champagne

François-Philippe Champagne says the upcoming federal budget will close a long-standing tax loophole for truckers, aiming to modernize labor policy and level the playing field for logistics companies.

Canada Earnings Average: What Is the 1%?

A new report breaks down what it actually takes to reach the top 1% of earners in Canada, and the numbers show a widening gap between high-income professionals and the middle class.

How Much Google, Meta, Amazon and Microsoft Are Spending on AI

Tech giants are pouring hundreds of billions into artificial intelligence this year, with spending levels that now rival entire national budgets. The arms race for AI dominance is moving faster, and getting more expensive, than anyone expected.

Gold price to retrace before next leg up, warns Canadian miner Agnico Eagle

Agnico Eagle says gold’s rally may take a breather before climbing again, as investors lock in profits and the market digests shifting rate expectations. The miner still sees long-term strength in precious metals.

US Retailers Are Running Out of Pennies

Retailers across the U.S. are reportedly facing a new shortage of pennies, reviving memories of the pandemic-era coin crunch. The issue’s small, literally, but it’s highlighting bigger cracks in supply chain logistics.

Disney Pulls Channels from YouTube TV Over Fee Dispute

Disney has pulled its channels from YouTube TV after contract talks broke down, leaving millions of streamers without ESPN, ABC, and other major networks, just as the holiday sports season ramps up.

Nothing to do with money, but… Timothée Chalamet Look-Alikes, One Year Later

Remember those viral “Timothée Chalamet look-alike” contests? A year later, the story’s taken an unexpected turn, from quirky internet fame to questions about identity, social media burnout, and what online virality really costs.

An espresso shot for your brain

The problem with most business news? It’s too long, too boring, and way too complicated.

Morning Brew fixes all three. In five minutes or less, you’ll catch up on the business, finance, and tech stories that actually matter—written with clarity and just enough humor to keep things interesting.

It’s quick. It’s free. And it’s how over 4 million professionals start their day. Signing up takes less than 15 seconds—and if you’d rather stick with dense, jargon-packed business news, you can always unsubscribe.

Market Movers

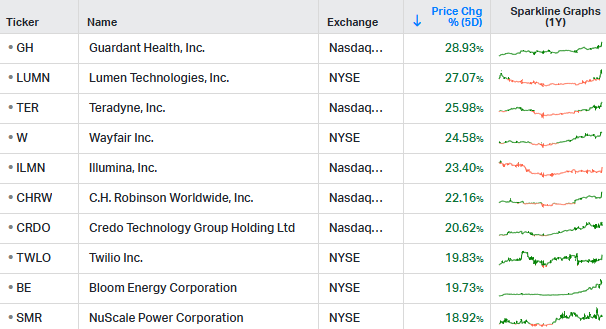

Top 10 Weekly Gainers

Week ending October 31, 2025 | Biggest Gainers

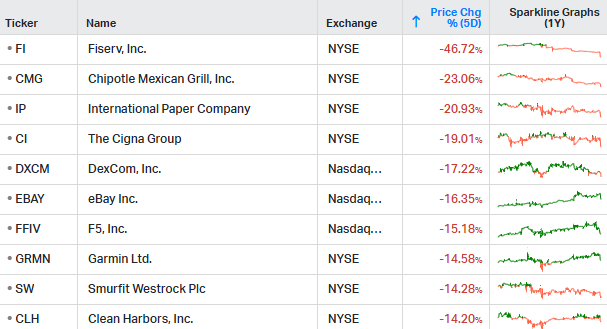

Top 10 Weekly Losers

Week ending October 31, 2025 | Biggest Losers

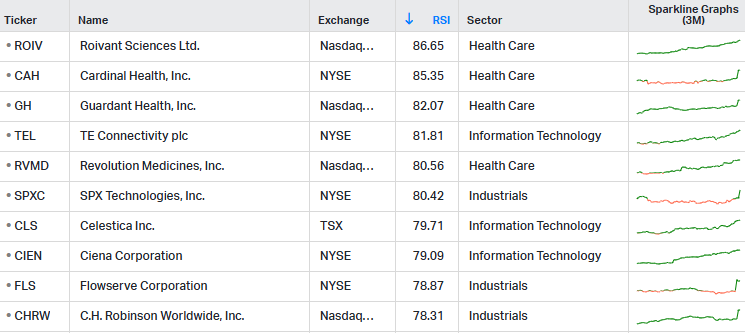

10 Most Overbought Stocks

Week ending October 31, 2025 | Most Overbought Stocks, based on 14-Day RSI

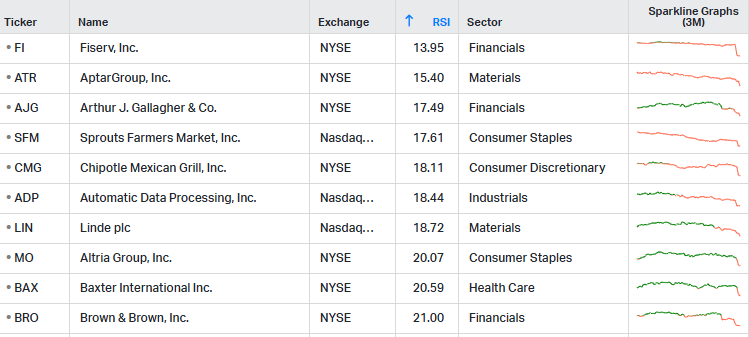

10 Most Oversold Stocks

Week ending October 31, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply