- The Pulse Newsletter

- Posts

- 40,000 Lost Jobs Shatters Bay Street's Illusion

40,000 Lost Jobs Shatters Bay Street's Illusion

Canadian rents fall for 10th month, Canadians rely on homes for retirement

The Week in Review

Weekly Market Recap: U.S. and Canada

Generally speaking, markets were strong this week, with gains across all major indices. It wasn’t all smooth sailing though, and the TSX stood out for its sharp bump mid-week, (check out that pop in the yellow line) benefitting from renewed Fed rate cut optimism, commodity tailwinds and investors buying the dip.

As for actual performance, the Nasdaq 100 was up 3.74%, easily topping the leaderboard. The TSX climbed 2.73%, the S&P 500 added 2.48%, and the Dow Jones gained a more modest 1.35%.

Week ending August 8, 2025

Major Economic Stories

Recap of the Week

Economic signals this week pointed to a cooling Canadian economy, with weak labour market data and a growing trade deficit suggesting slowing demand. U.S. trade figures showed a sharp narrowing in its deficit due to a significant drop in imports.

Here’s how the week played out.

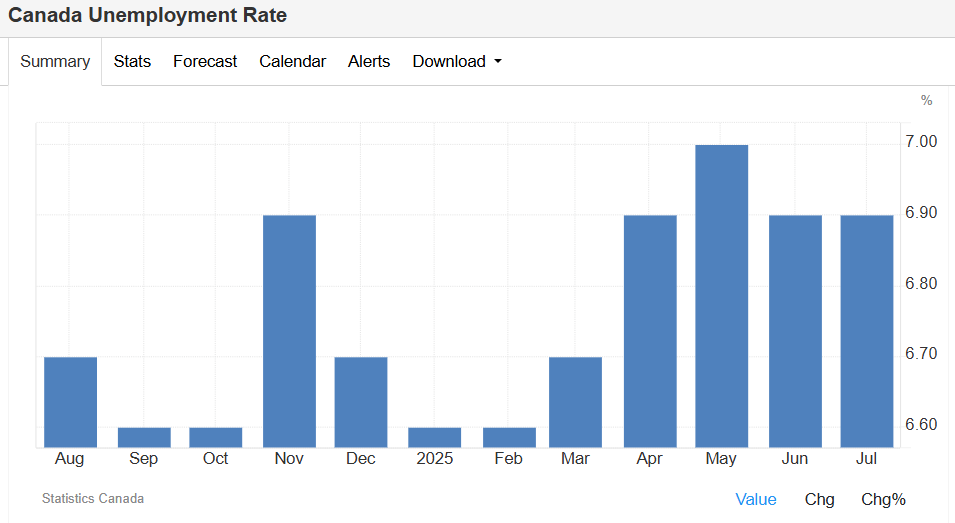

Canada’s Unemployment Holds Steady

Canada’s unemployment rate stayed at 6.9% in July, slightly below forecasts.

Employment fell by 40,800, the sharpest monthly drop since 2022, a reversal of much of June’s gains. The participation rate dipped to 65.2%, and youth unemployment rose to 14.6%, the highest since 2010 outside of the pandemic years. Seasonal hiring weakness and slower labour demand were key drivers.

Falling participation rate masked a larger potential unemployment spike

Job losses concentrated in full-time work, a sign of structural weakness

Youth labour market particularly fragile, hinting at weaker consumer spending

Lower hiring appetite suggests wage growth could slow in coming months

Canada’s Trade Deficit Widens

Canada’s trade deficit expanded to C$5.9B in June up from C$5.5B.

Imports grew 1.4% from a six-month low due to a one-off industrial machinery shipment, and exports rose 0.9%, led by industrial machinery but dragged by weaker motor vehicle sales. Exports to the U.S. increased monthly but are still sharply lower than last year.

Machinery shipment masked broader weakness in underlying import demand

Motor vehicle sector’s export drop points to auto industry slowdown

Persistent annual decline in U.S.-bound exports suggests the tariff impact

Widening gap could add to pressure on CAD and fiscal balances

U.S. Trade Deficit Shrinks to $60.2 Billion

The U.S. trade gap narrowed to $60.2B in June, the smallest gap since September 2023.

We saw imports fall 3.7% to their lowest in over a year, with declines in cars, crude oil, and pharmaceuticals, while exports dipped 0.5%. Deficits with China and the EU shrank significantly, though gaps with Vietnam, Taiwan, and India widened.

Import weakness signals potential cooling in U.S. consumer demand

Trade shifts point to ongoing supply chain diversification away from China/EU

Rising deficits with Vietnam and Taiwan point to manufacturing relocation

Lower U.S. imports could ripple into weaker demand for Canadian goods

Key Takeaways From this Week’s Economic News

Labour Market Weakness Could Accelerate BoC Cuts

There’s no way to sugarcoat it; Canada’s July jobs report was disappointing and possibly a red flag for our policymakers. A loss of over 40,000 jobs, especially in full-time positions, shows that demand for labour is softening faster than expected. The fact that the unemployment rate didn’t tick up is more a result of falling participation than genuine labour strength. On top of that, wage growth will likely cool in the months ahead, and the Bank of Canada may have little choice but to move rate cuts forward. This would ease pressure on borrowers, but at the expense of a weaker Canadian dollar. Pick your poison. For markets, it’s not really a debate of “if” the BoC will cut, but rather “how soon” and “how much.”

Canada’s Trade Gap Signals Structural Challenges

More challenging economic news, the widening of Canada’s trade deficit to C$5.9 billion is a reflection of deeper trade imbalances. Exports had a modest monthly rise, but motor vehicle sales slumped and exports to the U.S. remain down sharply year-over-year and yes, we’re now seeing how tariffs and slower U.S. demand are starting to bite. And although it sort of feels good to have a strong dollar relative to some trading partners, it could also be weighing on export competitiveness. If these deficits persist, they may eventually weigh on GDP growth, and that will add another layer of pressure on fiscal and monetary policy.

U.S. Trade Shift Highlights Changing Global Supply Chains

The U.S. saw a dramatic drop in its trade deficit, with steep declines in imports from major partners like China and the EU. At first this might look like economic strength, but falling imports often signal weaker domestic demand. That said, it also reflects a possible shift in supply chains, as we saw in growing deficits with Vietnam, Taiwan, and India. For Canada, this matters because a U.S. economy sourcing differently could shift demand away from certain Canadian exports. Businesses tied to U.S. supply chains will need to watch these patterns closely.

THIS WEEK’S POLL QUESTION

(Results in Next Week’s Newsletter)

Canada’s labour market just had its worst month in years. One idea floating around: tax perks for firms that hire full-time. Could that actually move the needle? Would you support this strategy, or is it just another government program doomed to fail? Weigh in by voting and leaving a comment.

Would you support targeted tax incentives for companies that hire full-time workers? |

LAST WEEK’S POLL RESULTS

Different poll question, exact same results as the previous poll. The vast majority of those voting last week fell that stocks are the place to be ahead of real estate in the coming decades. I’m confident both asset classes will generate significant wealth, so go with what appeals to you most!

Reader Comments

Stocks

"I've owned property in Canada and abroad. Real Estate is such a drag on finances. With repairs, upgrades, property taxes, etc. It makes no sense to invest in property unless its for a principal home." — skarkez

"Stocks will have much more growth potential over 20 years. Real Estate has reached a level today that is damaging the economy & peoples lives. We have learned that we must somehow control the greed and over expectation that ferments in the real estate market. Future governments will have learned from today that an over exuberant real estate market can have devastating effect on the overall economy." — entender1012

"With rapid real estate price increase in Canada in the past decade I feel that with interest rates coming back to "normal levels" the real estate market will stagnate and not grow much in the next 10-15 years." — tyler.doucet

EMPLOYMENT

Canada Sheds 40,000 Jobs in July

Employment rate falls to eight-month low of 60.7%

Youth unemployment hits highest since 2010 (excluding pandemic)

Job losses concentrated in permanent positions

Construction and recreation sectors see steepest declines

Canada’s labour market stumbled in July as 40,800 jobs vanished, undoing a chunk of June’s strong gains. The unemployment rate stayed at 6.9% ( that’s still elevated) due to the employment rate sliding to its lowest level since the pandemic. Economists had expected modest job growth, so this a significant miss.

Youth Hit Hardest by Employment Decline

As we see so often in these reports, young workers aged 15 to 24 bore the brunt, with their employment rate dropping to 53.6% and joblessness rising to 14.6%. Sectors such as information, culture, and recreation (-29,000 jobs), construction (-22,000), and business support services (-19,000) drove the declines. Transportation and warehousing was the lone bright spot, adding 26,000 jobs.

Signs of a Cooling Economy

Analysts described the report as “unambiguously weak,” noting it follows an unusually strong June. The combination of higher unemployment, soft GDP growth, and sector-specific contractions points to a slowing economy heading into the third quarter. To cap things off, the high youth unemployment numbers are raising concerns about consumer spending momentum later this year.

Read More Here

HOUSING Pt. 1

More Canadians Rely on Homes for Retirement

62% see home ownership as key retirement strategy

44% plan to sell their home to fund retirement

Home equity growth matches long-term stock market returns

Principal residence gains are exempt from capital gains tax

More and more, owning a home is becoming increasingly central to Canadians’ retirement plans, according to a new HOOP survey. More than six in ten respondents said their home is a core part of their retirement strategy, and nearly half expect to sell their property to fund their post-work years. RBC research also shows that home ownership has driven almost half of national wealth accumulation over the past three decades.

Equity Growth and Income Potential

Historically, Canadian home values have grown more than 5% annually over the past 20–30 years. In addition to the price appreciation, a home can generate income through rent-free living or by leasing space to tenants, a benefit that grows in value as rents rise.

Tax Advantages and Portfolio Risks

The sale of a principal residence is tax-free, a rare advantage that compares to a TFSA. However, relying too heavily on one property does expose retirees to concentrated market risk in a single sector and location. To protect against potential downturns in local housing markets, experts suggest balancing home equity with diversified investments.

Read More Here

BLOSSOM SOCIAL

2025 BLOSSOM INVESTOR TOUR

✈️ What is the Blossom Investor Tour?

The Blossom Investor Tour is the traveling edition of Canada’s largest retail investing event, bringing the energy of the Blossom Investor Tour to cities across North America!

With stops in Toronto, Vancouver, Calgary, Montreal, New York, Los Angeles, Chicago, and Las Vegas, the Tour connects hundreds of investors in each city for an intimate and high-impact experience designed to inspire, educate, and empower.

Hosted by Blossom, the investing social network where over 300,000 retail investors are sharing their portfolios, trades, and investing ideas, the Blossom Investor Tour is a live extension of the meaningful conversations we see happening every day in-app.

Whether you're a seasoned DIY investor or just starting out, the Blossom Investor Tour is your chance to plug into the investing community that's changing the game, and meet the people behind the portfolios.

Marc Beavis, Harvest ETF President and CEO Michael Kovacs, and blossom co-Founder Maxwell NIcholson present at the 2024 Blossom Social event in Toronto

What to Expect

🎤 Live panel talks featuring some of your favourite creators and finance pros. Stay tuned as we announce the full lineup!

🤝 Connect IRL with hundreds of fellow DIY investors, creators, and brand partners

🍸 Food, drinks, and light bites served throughout the night, all included with your ticket

🛍️ Blossom t-shirt, tote bag, lanyard, and other exclusive Investor Tour swag drops!

💸 Face time with the largest financial institutions across North America

Take a look at what 2024's Toronto Blossom Investor Social looked like: |

Don’t miss out!

🎟️ Tickets are limited, and last year’s events sold out FAST…

👀Don’t miss your chance to be part of Blossom’s biggest in-person tour yet.

More Information Here

HOUSING Pt. 2

Canadian Rents Drop for 10th Straight Month

National average asking rent falls 3.6% year-over-year to $2,121

All major housing types see price declines, led by houses/townhomes

Nova Scotia posts steepest provincial drop, Saskatchewan sees growth

Calgary, Vancouver, and Toronto record largest city-level rent decreases

I know it’s hard for many to believe this, but Canada’s rental market did continue its downward slide in July, with the national average asking rent falling 3.6% year-over-year to $2,121 , the sharpest annual drop so far in 2025. It was also the 10th consecutive month of annual declines, and a clear sign of a continued cooling phase in the market. Month-over-month, rents stayed mostly flat, dipping just $4 from June.

Softening Market Gains Momentum

The report from Rentals.ca and Urbanation showed weakness across almost all housing types and provinces. Purpose-built apartment rents slipped 1.7% to $2,095, condominium rents dropped 5.7% to $2,202, and houses/townhomes saw the steepest decline at 8.2% to $2,170.

“Canada’s rental market is experiencing a prolonged softening phase, with price declines accelerating across most provinces and unit types.”

The peak summer rental season has now past, and analysts are expecting continued downward pressure heading into the fall.

Regional and City-Level Trends

Nova Scotia led the declines with a 5% drop to $2,275, followed closely by British Columbia (-4.4% to $2,475) and Ontario (-3% to $2,325). Even Alberta saw rents fall 3.9% to $1,738, while Manitoba dipped 0.9% to $1,617. Saskatchewan was the outlier, posting a 4% annual increase to $1,384 , still Canada’s most affordable average. Among major cities, Calgary’s rents fell the most at 7.9% to $1,927, with Vancouver down 7% to $2,830 and Toronto off 4.7% to $2,587. Montreal saw a 2.3% drop to $1,966, while Ottawa (+1%) and Edmonton (+0.6%) managed modest gains. All this said though, even with the latest declines, rents are still 2% higher than two years ago and 11% above levels from three years back.

Read the full story here.

Are you a DIY investor looking for direction? Our online courses will take you from a complete beginner to a confident, knowledgeable investor. Start your journey with The Investing Academy. |

OTHER NEWS FROM THE PAST WEEK

Companies enforcing office attendance at highest rate in 5 years

U.S. firms are ramping up office attendance enforcement, with nearly three-quarters meeting in-person goals. Prime office space demand remains strong despite high vacancy rates, as hybrid work models become more structured.

Tesla touts semi-autonomous driving as safer than humans

Tesla claims its FSD (Supervised) system reduces accidents by avoiding impairment, fatigue, and road rage. Experts acknowledge safety benefits but stress independent verification as autonomous driving technology evolves toward broader adoption.

Crocs sales slump as shoppers pick trainers

Crocs’ U.S. sales 6.5%, sending shares down 30% to a three-year low. Management cites shifting consumer preference toward athletic shoes, high costs, and Trump tariffs as key pressures.

Canadian economy weaker than it appears

Despite surface-level resilience, Canada’s GDP and jobs data reveal stagnation. Weak private-sector hiring, declining per-capita output, and slowing demand are fueling expectations for Bank of Canada rate cuts and a softer dollar.

Trade Desk shares plunge on CFO exit, Amazon threat

The Trade Desk stock sank 39% after CFO Laura Schenkein’s departure and mounting competition from Amazon’s ad platform. Analysts fear Amazon’s growing reach could weaken The Trade Desk’s independent DSP advantage.

Beef prices hit record highs in Canada

Canadian beef prices rose 25% in a year, driven by drought, smaller herds, and strong barbecue-season demand. Analysts expect elevated prices through 2027 as herd rebuilding remains slow and costly.

‘No rally lasts forever’: time to look abroad

Analysts urge diversification beyond U.S. equities as valuations stretch and the dollar remains pricey. Europe and Asia offer better relative value, with improving policies and growth prospects attracting investor interest.

Trump warns of Great Depression if tariffs overturned

Trump cautioned that striking down his emergency tariff powers would cause a 1929-style crash. Economists dispute the claim, arguing reduced tariffs could stimulate growth and ease consumer costs.

Market Movers

Top 10 Weekly Gainers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending August 8, 2025

Top 10 Weekly Losers

TSX, NYSE & Nasdaq Exchanges | Market Cap >$10B | Week ending August 8, 2025

10 Most Overbought Stocks

Week ending August 8, 2025 | Most Overbought Stocks, based on 14-Day RSI

10 Most Oversold Stocks

Week ending August 8, 2025 | Most Oversold Stocks, based on 14-Day RSI

The Relative Strength Indicator (RSI) can provide a signal that suggest a stock is either overbought or oversold.

📈A stock that has an RSI over 70 is considered to be in “overbought” territory. This might suggest that the stock is due for a pullback, however it is not a recommendation to sell.

📉A stock that is trading with an RSI below 30 is considered to be in “oversold” territory. This might suggest that the stock is due for a recovery, however it is not a recommendation to buy. Always perform your own due diligence.

Reply